2023 is a Ripe Environment for Central Bank Failure

The history of the Bank of Amsterdam underscores the vital role trust plays within the monetary system today. As more individuals choose Bitcoin over traditional fiat currencies, its adoption and significance will grow.

Swan Private Insight Update #27

This report was originally sent to Swan Private clients on September 11th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

In 2022, Agustín Carstens, the General Manager of the Bank of International Settlements gave a speech titled “Digital Currencies and the Soul of Money.” In the speech, Carstens argues how important central banks are to money, why the “soul of money” is trust, and why decentralized alternatives are doomed to fail.

He stated,

“At its core, trust in the currency holds the monetary system together. Like the legal system, this trust is a public good. Maintaining it is crucial for the effective functioning of societies.

Trust requires sound institutions that can stand the test of time. Institutions that ensure the stability of the currency as the economy’s key unit of account, store of value and medium of exchange, and that guarantee the safety and integrity of payments.

Throughout a history measured not in years but in centuries, independent central banks have emerged as the key institutions that underpin this trust in money. Alternatives have often ended badly. It is for good reason that most countries have established central banks with a clear mandate to serve society. As public policy institutions, central banks have proven successful in upholding trust while adapting to societal and economic change.”

For the purpose of this piece, I would like to focus on two of his assertions in the excerpt above:

1.) “Central banks have proven successful in upholding trust, ”

2.) “Alternatives have often ended badly.”

Carstens definitively states that central banks have succeeded in upholding trust, but this doesn’t appear to be based on any fact or reality. The truth is, one can argue that the credibility of central banks around the world has never been lower after they were blindsided by high levels of inflation after their aggressive monetary policies during the pandemic.

Over the past several decades, people had more faith in central banks and the currencies they issue. But there was one major difference from then compared to today — inflation remained low. Since the pandemic began, trust in central banks has been eroding rapidly as inflation eats away peoples’ savings and purchasing power.

Since 2020, we have seen the public discourse around central banks shift, and suddenly, headlines began to emerge questioning the credibility of these institutions. It was rare to see headlines like the ones below before 2020.

A recent poll by Gallup showed that confidence in the Federal Reserve has its lowest level in 20 years. Americans do not trust its central bank.

It leads to the question… Are Americans justified to feel this way?

The Federal Reserve’s main job is to maintain price stability. Americans have seen inflation explode to levels not seen in four decades, and a big contributor to the recent bout of inflation is the Federal Reserve’s own policies. One can argue that the Fed has failed at its mandate since 2020.

Even the BIS’s own 2023 annual report admits that the highly accommodative Central bank policies have contributed to the high levels of inflation people are suffering from today.

“With the benefit of hindsight, the extraordinary monetary and fiscal stimulus deployed during the pandemic, while justified at the time as an insurance policy, appears too large, too broad and too long-lasting. It contributed to the inflation surge and to the current financial vulnerabilities.”

– BIS, 2023 Annual Report

The BIS goes on further to say,

“The privileged powers of fiscal and monetary policy ultimately depend on an implicit social contract underpinned by trust in the state. People consent to paying taxes because they trust the government to use the proceeds for the public good. Similarly, people accept the use of money as a means of payment because they trust the central bank to preserve its value.”

What the BIS is getting at here is that fiat currencies are backed by nothing but trust in the central bank that issues them. If that trust fails, so does the value of the money, and so does the issuer of that money (i.e., the central bank) with it.

In another speech titled “Trust and Public Policies, ” given at a central banking seminar in Brazil in May 2023, Agustín Carstens stated,

“Fiat money is an asset with no intrinsic value… Thus, its value clearly comes from trust… This is why the issuer of money is so powerful. However, this power carries with it great responsibility: those who abuse their ability to issue currency, deprive money of its value and will be rejected from society.

The trust gained can be lost if society doubts the central bank’s commitment to the objective of maintaining price stability. This is one of the reasons why the recent rise in inflation in virtually every country is cause for concern.”

As I already mentioned, trust in the Federal Reserve is at two-decade lows as the cost of living soars. One dollar today can buy much less food, fuel, transportation, and shelter than it could three years ago. It leads to the question, where is the breaking point?

When does trust get eroded so much due to mismanagement of the currency that Americans reject the Federal Reserve altogether?

What conditions need to exist that increase the likelihood that a central bank like the Federal Reserve fails?

It’s clear that the BIS is concerned about the erosion of trust in central banks today, given the sheer number of speeches and various papers written on the topic. But what’s interesting is the BIS itself published a paper earlier this year that aimed to answer some of the questions above.

In a recent BIS paper titled “The Bank of Amersterdam: The Limits of Fiat Money, ” researchers examined what it takes for an issuer of fiat money to fail. To better answer this question, BIS researchers looked to the lessons of history; specifically, they analyzed the fall of the Bank of Amsterdam.

They chose the collapse of the Bank of Amsterdam because its money was used as the global reserve currency for nearly two centuries. It mimicked a modern central bank in that it issued fiat money, the Bank guilder, without any gold backing and attempted to use monetary policy to stabilize its value. The Bank of Amsterdam performed liquidity operations akin to today’s asset purchase programs by the Federal Reserve, to stabilize the exchange rate around a predetermined target, such as the Federal Reserve’s 2% inflation target.

BIS researchers wrote,

“The monetary policy objective of the Bank of Amsterdam is to maintain a stable premium of Bank money relative to coins (the agio). This objective is attained by adjusting the money stock through asset purchases or sales so that Bank money supply is set equal to Bank money demand at the target agio.”

These policies were similar to what the Federal Reserve does today with its Quantitative Easing (QE) and Quantitative Tightening (QT) programs.

What BIS researchers found by analyzing the Bank of Amsterdam was that the central bank collapsed when these three factors were present:

The central bank had negative equity.

Deteriorating economic conditions were present with external shocks.

A monetary alternative was widely available to the public to escape to.

In the case of the Bank of Amsterdam, the combination of war, poor economic conditions, and bad loans led to their downfall.

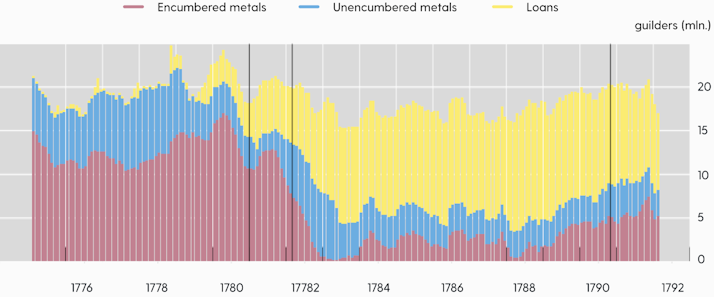

One can see in the chart below how the shock of the Fourth Anglo-Dutch War from 1780-1784 led to an increase in the amount of loans on the Bank’s balance sheet. Loans ballooned to make up a greater and greater percentage of the assets backing the bank by 1790.

Most of these loans became “non-performing” as the borrowers failed to pay the loans. On top of that, the Bank of Amsterdam lacked fiscal support, and individuals could escape from the fiat money with metal coins widely available.

The result was the Bank eventually had to come clean to the public about the low level of metals backing it, and the Bank guilder was then devalued 30% on this revelation. Over the coming years, the Bank withered away as individuals continuously chose metal coins over the Bank-issued fiat. Finally, in 1820, the Bank of Amsterdam closed its doors for good.

With these factors in mind, let’s look at the Federal Reserve today and the current environment it finds itself in to determine whether or not it’s at an increased risk of failing, just like the Bank of Amsterdam did over 200 years ago.

In response to the pandemic, the Federal Reserve did what it has done whenever turmoil hit the market; it came in as the “buyer of last resort.” In this case, the Federal Reserve cut interest rates to zero and then went on a buying spree. It bought not only massive amounts of U.S. Treasuries and Mortgage-backed securities as part of its QE program, but it even ventured into the corporate debt market for the first time.

What resulted was the Federal Reserve’s balance sheet exploded, adding over $4.5 trillion in debt in a two-year timespan.

Soon after, inflation surged. After months of denying that this was a problem, the Federal Reserve pivoted its monetary policy hard and began raising interest rates at one of the fastest rates in its history in an attempt to bring inflation down.

Ironically, one of the consequences of the Fed’s interest rate hikes is that it caused the value of its own assets, its massive bond portfolio, to fall significantly. To make matters worse, the increase in interest rates hurt the Federal Reserve on the liability side as well.

The liabilities of the Federal Reserve consist mainly of commercial bank deposits known as bank reserve, which the Federal Reserve must pay interest to. It also has to pay interest on the Reverse Repo facility. As the Federal Reserve raised interest rates, it also raised the interest expense on itself that it has to pay to these institutions.

Back when the Federal Reserve bought all those bonds during the pandemic as part of its QE program, the Treasuries and MBS paid a higher interest rate than the interest on bank reserves and in the Reverse Repo facility. But now, that dynamic has been flipped on its head. The Fed now has to pay interest expenses on those liabilities at a rate of north of 5%, as its bond portfolio continues to pay out at pandemic-era low rates.

The Fed has to pay more in interest than it is bringing in on its bond portfolio.

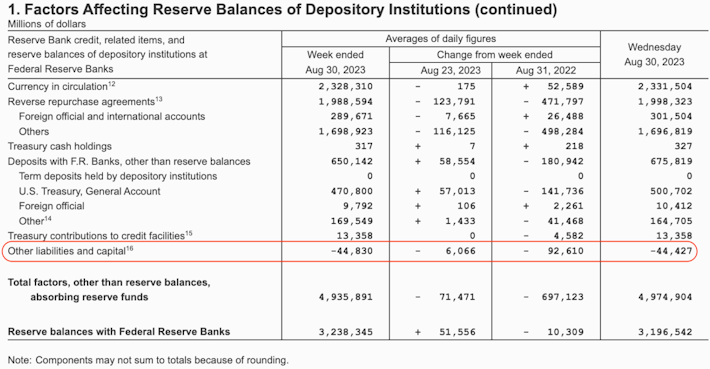

The result? For the first time in its history, the Federal Reserve is now losing money. It has suffered operating losses of about $95 billion since September 2022.

This all came to ahead in April when the Fed’s net equity went negative. This means that the liabilities on its balance sheets exceed its assets. If the Federal Reserve was a commercial bank, it would be called insolvent.

The Fed’s equity position sits at negative $44.4 billion.

Like the Bank of Amsterdam, the Federal Reserve currently has negative equity due to many underwater loans on its balance sheet. Ironically, it’s the loans they acquired through their own QE programs, and then they jacked up their own interest expense with their rate hikes. How rich.

So why isn’t everyone running around talking about the Fed being insolvent?

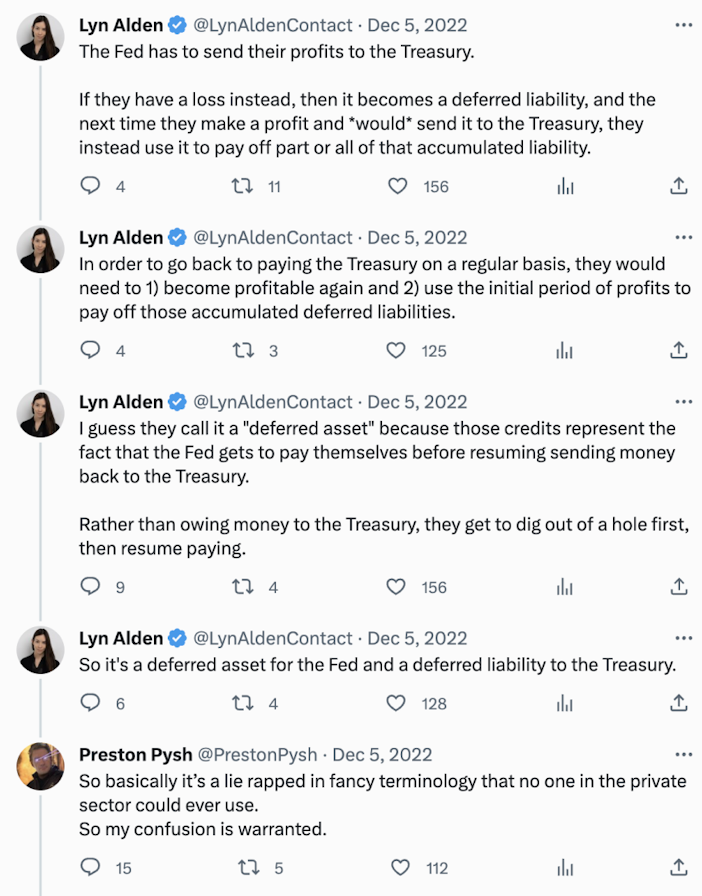

Simple — accounting tricks. The Fed can mark the losses as “deferred assets” on its balance sheet. This is essentially voodoo accounting that ultimately benefits the Fed and deprives the government and taxpayers of revenues.

Investment Researcher John P. Hussman summarizes it well,

“The Fed recently indicated that it will create a new line called a ‘deferred asset’ on its balance sheet. This ‘deferred asset’ is a phantom accounting entry that represents the anticipation of future interest on the Treasury securities held by the Fed. This interest will not be paid back to the Treasury for the benefit of the public, as the Fed has historically done. Instead, the interest will be retained by the Fed.

As Former Fed Chairman Ben Bernake indicated… “It is an asset in the sense it embodies a future economic benefit that will be realized by reducing future cash flows.”

Let’s be clear about what Bernake is saying: “It is an asset in the sense that it embodies a future economic benefit [to the Fed] that will be realized as a reduction of future cash outflowed [to the public].”

So, instead of paying out profits to the Treasury once the Fed becomes profitable again, it will instead pay off its own losses first.

If you’re still confused — don’t worry — you’re not alone. The Fed made up this new “deferred asset.” Here is another exchange between Lyn Alden and Preston Pysh that may clear things up more…

All in all, it seems that the Federal Reserve expects to one day be profitable again soon, meaning that it, too is anticipating rate cuts down the line which will increase the value of its assets and drop its interest expense.

When that happens, the Fed can pay down its losses.

Make no mistake, if it wasn’t for accounting tricks, the Federal Reserve would be formally insolvent and working with negative equity, just like the Bank of Amsterdam years ago. The Fed could always try to print more money to get out of this hole and have the government backstop them if push comes to shove, but at that point, faith in the currency may erode to a level where it breaks entirely. In that scenario, the public may reach a point where they begin to lose all trust in the dollar, which would be the beginning of the end of the Federal Reserve.

One aspect of the Bank of Amsterdam’s downfall was war, which caused them to expand their balance sheet greatly and make unproductive and riskier loans. This occurs when central banks use their balance sheet to pursue public policy objectives and incur financial losses as a result. This war was a large external shock that altered the central bank’s policy and economic conditions.

Fast forward to 2023, and we had a similar external shock in the form of a global pandemic.

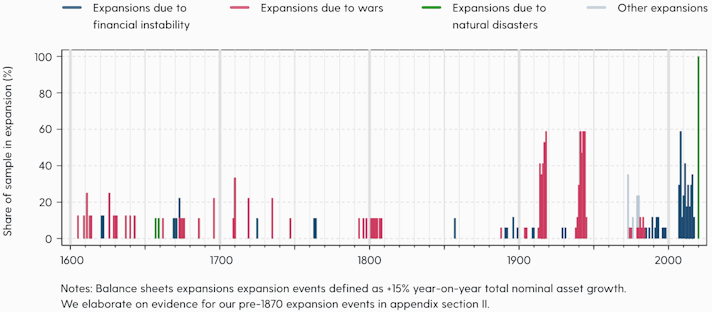

The pandemic and economic lockdowns caused central banks to expand their balance sheets to truly historic levels. The chart below shows how balance sheet expansions typically occur in times of financial instability, war, and natural disaster.

One can see how the pandemic response dwarves all the other expansions dating back to 1600 (in green).

This is a prime example of the Federal Reserve prioritizing public policy over other factors, such as price stability or the long-term health of its balance sheet.

Now, the Federal Reserve is grappling with the fallout from its extreme pandemic-era policies, facing high inflation and negative equity.

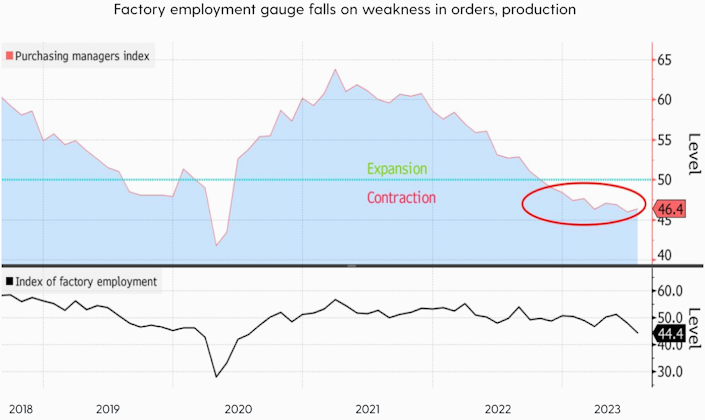

In addition, economic conditions continue to show signs of deterioration. U.S. Manufacturing PMI has been contracting for nine straight months.

When we analyze the labor market, though the unemployment rate remains low at 3.8%, there are signs of strain.

The first sign is that pay for new hires has decreased in 2023. The first thing companies reduce pay for new hires at the beginning of a labor cycle.

The first issue is that pay for new hires has decreased in 2023.

Another sign is the observed reduction in average working hours. Average weekly hours of private-sector employees have been in steady decline. Before employers lay off workers, they will try to keep them on by reducing their hours.

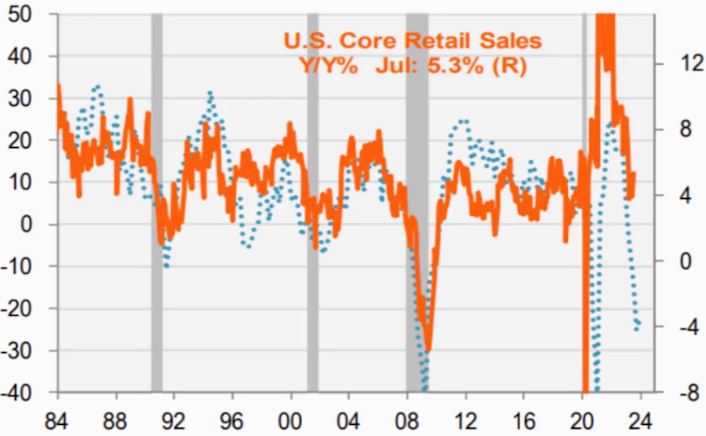

Lastly, we are seeing tightening lending standards. Analyst Michael Kantro notes that this typically precedes a drop in retail sales by two quarters. We have already been experiencing a steady decline in retail sales since the pandemic-highs when we zoom out.

The consumer has been resilient up to this point, but this strength has, in part, been driven by excess savings from the pandemic policies. These excess savings will be emptied soon.

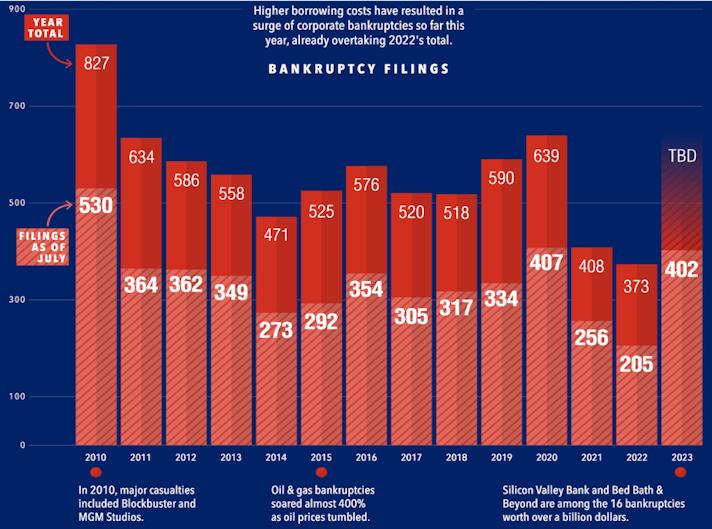

Lastly, U.S. corporate bankruptcies show how businesses have faired in this new environment of high-interest rates. Bankruptcies have already eclipsed all of last year, and it’s only September.

Of course, there are other more optimistic data points in the economy. GDP growth remains elevated, and there is still strength in the service sectors like travel and leisure, but at best, one can say the data is mixed right now.

An important point to mention is the current fiscal predicament the U.S. finds itself in today. Currently, the U.S. is running war-time deficits in a time of peace with debt-to-GDP at levels not seen since World War II. As the Federal Reserve raises interest rates, this exacerbates the fiscal situation by increasing the interest expense on the debt, thereby widening the fiscal deficit further.

The BIS highlights the repercussions when fiscal and monetary policies conflict and become counterproductive to one another:

“In that case, both policies end up narrowing their respective rooms for maneuver, shocks become increasingly damaging and policies increasingly destabilizing. The instability, in turn, threatens or reflects loss of trust in the policies themselves. A common feature is loss of trust in money — as a store of value, means of payment or unit of account — and in the sustainability of public debt.”

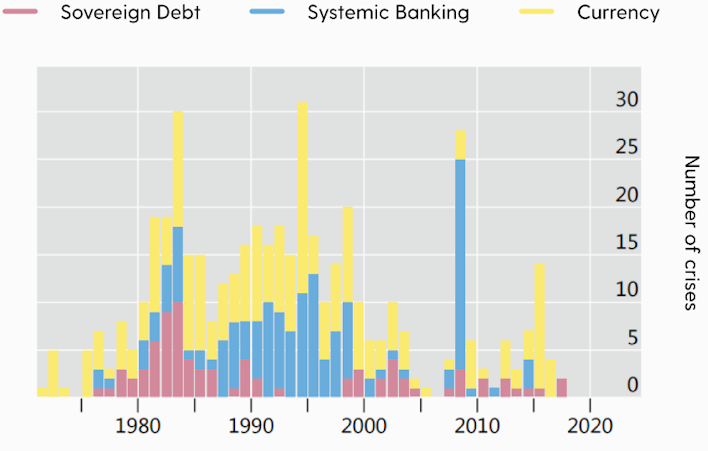

This increasingly fragile environment — with massive amounts of debt, high levels of inflation, and deteriorating economic conditions — increases the likelihood of additional external shocks, such as a systemic banking or currency crisis. And as the BIS shows below, these crises often tend to happen together.

On the whole, it’s safe to say that the Federal Reserve finds itself in an uncertain environment with many economic metrics pointing toward a recession around the corner. These are exactly the kind of deteriorating economic environment that created a ripe environment for the collapse of the Bank of Amsterdam.

One key assumption many central banks make is that there will always be demand for the currency they issue regardless of their policy decisions. However, this may not be the case if trust in the currency is completely lost and alternative forms of money exist that are easily accessible.

The BIS’s research shows that “demand for fiat money may be negatively affected by economic shocks, the availability of alternatives, and network effects.”

This contributed to the fall of the Bank of Amsterdam when individuals increasingly chose to hold and transact with metal coins as the fiat rapidly depreciated.

Today, the Federal Reserve finds itself in an environment where there is more competition for money than there has been in centuries. Central bankers now have to compete with a global form of money that has a fixed monetary supply. A form of money that can’t be debased can be transported anywhere in the world with a click of a button and is accessible to anyone with a smartphone and an internet connection.

ECB President Christine Lagarde said the quiet part out loud in an interview, a couple of years ago…

Bitcoin represents an escape hatch for any citizen of the globe to use when they no longer trust their local currency or the central bank that issues it.

In a paper from the IMF in October 2021, they introduced a new term called “cryptoization” referring to the use of cryptocurrencies as alternative assets in jurisdictions where the local currency is failing.

The paper concluded, “There are several driving forces for cryptoization. Unsound macroeconomic policies combined with inefficient payment systems in some emerging markets and developing economies boost crypto adoption… Weak central bank credibility and a vulnerable banking system can trigger asset substitution as domestic residents seek a safer store of value.”

Whereas metal coins were available to protect people’s savings in the 1800s when the Bank of Amsterdam failed them, today, we have a new form of digital money that can provide the same service for citizens globally. As long as Bitcoin continues to function, it will always be there as alternative money that people can turn to when they feel abused by central bank policies.

Agustín Carstens argued that alternative forms of money have ended badly, but I would argue that all fiat currencies have ended badly. Bitcoin represents an alternative money that has never existed before. A new monetary system based on rules, not rulers that will bring sound monetary policies back to the digital age.

The trust lies in the math underlying the protocol. Carstens and I may agree that trust is the “soul of money, ” but I would rather put my trust in math than in fallible human beings who have shown time and time again that they will succumb to the temptation to debase the currency.

The history of the Bank of Amsterdam underscores the vital role trust plays within the monetary system today. As the Federal Reserve grapples with challenges eerily similar to those that precipitated the Bank of Amsterdam’s historic collapse, trust in it is eroding rapidly, exacerbated by poor policy decisions and surging inflation. With each misstep by central banks that leads to the debasement of fiat currencies, people around the globe are increasingly seeking refuge in alternatives.

Bitcoin presents itself not just as another option but as a beacon of stability and trustworthiness. As more individuals choose Bitcoin over traditional fiat currencies, its adoption and significance will grow. Economist Friedrich Hayek insightfully remarked, “The root source of trouble is precisely that the management of money has been the exclusive right and responsibility of central banks.”

In this pivotal moment, will the Federal Reserve address its faltering course, or will Bitcoin become the standard for a more resilient economic future?

The ensuing chapters of this monetary tale are poised to reshape our financial world.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.