Three Innovations Being Built on Bitcoin Today

The Bitcoin ecosystem is a hotbed of continuous developments, pushing the boundaries of what is possible with this transformative technology.

When Satoshi Nakamoto introduced Bitcoin to the world in 2008, it was presented as a peer-to-peer electronic cash system, simple in its construct and grand in its vision. This groundbreaking invention, based on the principles of decentralization, immutability, and transparency, brought a revolution to money itself. However, many often overlook the profound innovation that continues to evolve within the Bitcoin ecosystem, and a misconception has gained ground that there is a stagnation in Bitcoin’s development process.

Bitcoin’s design, at its inception, was simplistic by design — but this was a deliberate and strategic move. Gall’s Law, a rule of thumb in systems theory and software development that emphasizes simplicity and incremental development, states:

“A complex system that works is invariably found to have evolved from a simple system that worked. A complex system designed from scratch never works and cannot be patched up to make it work. You have to start over with a working, simple system.”

Swan Private Insight Update #24

This report was originally sent to Swan Private clients on June 9th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

The early developers of Bitcoin certainly had Gall’s Law in mind when creating the Bitcoin protocol. It has worked since the Genesis block and has never stopped working since. The simplicity of Bitcoin laid a robust foundation, emphasizing security and resilience, thereby allowing a secure, decentralized network to establish itself without overbearing complexity.

In a way, Bitcoin’s core protocol is akin to the Internet Protocol (IP) — minimalistic yet enabling layers of complexity to be built on top. Much like the suite of protocols built upon IP, such as TCP/IP, HTTP, SMTP, and more.

Contrary to popular belief, Bitcoin’s simple design does not equate to stagnation; instead, it has acted as a springboard for innovative developments and upgrades.

Over time, Bitcoin has evolved and become more complex. We have seen the addition of new features and systems layered on top of the core protocol.

Examples include the introduction of Segregated Witness (SegWit), which led to the creation of the Lightning Network, a second-layer solution that enables fast, low-cost transactions; the Liquid Network, which enhances privacy and enables token issuance; and Taproot, which allows for more smart contract functionality and improves privacy.

With each new upgrade, a wave of developers and entrepreneurs soon follow, bringing about new products and services to the Bitcoin ecosystem. Today, we are seeing the rise of new companies using Bitcoin and its second-layer protocols in exciting ways never seen before, pushing the boundaries of what’s possible with this new technology. In this piece, we will highlight three companies innovating on Bitcoin and Lightning today to show how Bitcoin continues to evolve, adapt, and maintain its place at the forefront of the cryptocurrency world.

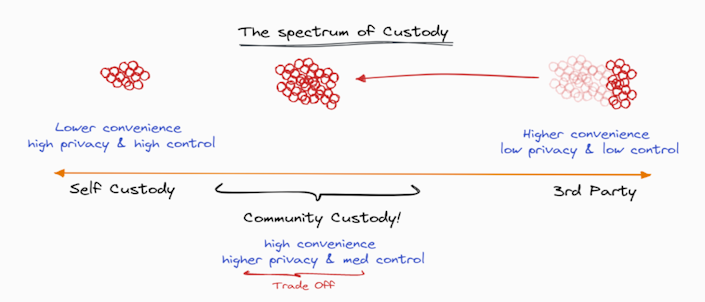

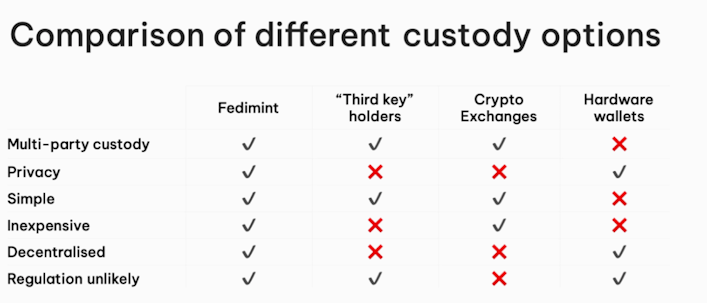

The first company I’d like to explore is Fedi. It is the first Bitcoin wallet being built that’s powered by the Fedimint protocol and taking into account the human experience — mainly that humans trust those closest to them the most. Fedimint is a new protocol that allows individuals to form groups to manage and secure each other’s Bitcoin. Fedi is a groundbreaking innovation in the world of Bitcoin custody, introducing a middle-ground solution between custodial storage with a third party and the autonomy of self-custody.

Fedimint.org

Fedimint represents a form of collaborative custody tailored to individuals who prefer not to relinquish their Bitcoin to large, corporate, custodial services but rather, to entrust their Bitcoin to individuals in their community whom they trust. It removes the technical challenges and risks associated with individuals running their own nodes and holding their own keys while reducing the need to trust a centralized third party in the process. Fedimint offers tradeoffs between costs, privacy, ease of use, and security.

Fedi.xyz

At the heart of Fedimint lies a simple yet brilliant strategy that addresses the custody challenge head-on. It recognizes that within every group, some individuals are more tech-savvy than others. So, these “group guardians” step up to manage the Bitcoin wallets and handle transactions while the rest of the group enjoys a seamless, user-friendly app experience on Fedi. Picture this: Your tech-savvy cousin helping your grandma manage her Bitcoin — that’s Fedimint for you!

Microstrategy World 2023

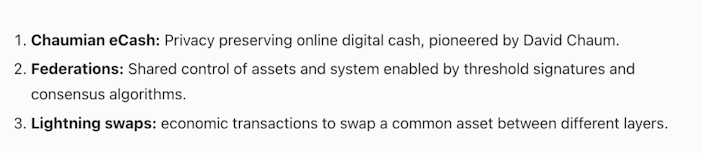

Fedimint combines three technologies to achieve its goals shown below:

Fedimint.org

Federations and chaumian e-cash mints are used to overcome some of the challenges currently facing users regarding custody. A “Federation” is a group of individuals that pool their Bitcoin together and mint Bitcoin-backed tokens (fedimint-Bitcoin) to allow for intra-community transactions that are both private and fast. These fedimint-Bitcoin can then be swapped for bitcoin through its integration with Lightning Network for transactions outside of the federation.

The guardians within the Federation assume the responsibility of maintaining the community’s multi-signature wallet and authorizing the spending of Bitcoin within and outside the Federation. Federations distribute the group’s Bitcoin custody amongst all guardians, ensuring a majority agreement is required for transactions and that the system can handle minor guardian failures.

The chaumian e-cash mints allow guardians to process transactions on behalf of any group member without compromising their privacy. By using chaumian e-cash mints, a guardian will not know the identity or amount that a member of the federation is sending in each transaction, preserving their privacy.

Here is a graphic that highlights how Fedimint transactions work inside a Federation:

Fedimint.org

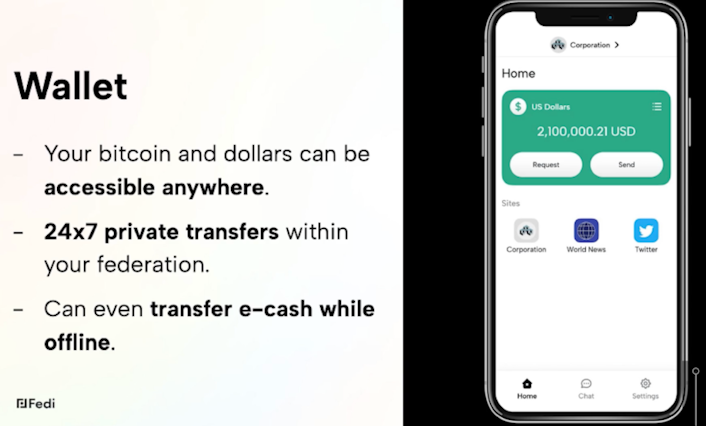

Fedi is a wallet that introduces a new approach to custody, privacy, and transaction scalability rooted in a community’s trust and bond. Fedi increases access to dollars and Bitcoin and allows 24/7 offline private transfers within a federation.

By focusing on community-based custody and the Lightning Network, Fedi offers a unique solution to problems of cost, custody, privacy, and security. Using guardians as custodial entities brings an element of localized trust, making Fedi an appealing product for individuals who may not have access to traditional financial services, such as those in the Global South.

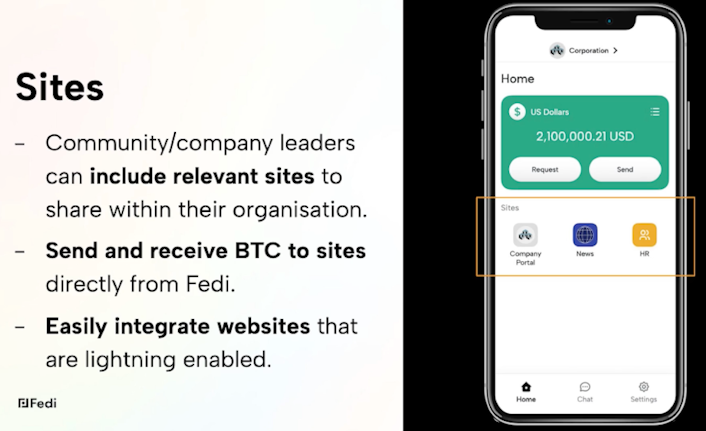

But Fedi has more ambitious goals than just being a wallet. It aims to enable a full-fledged federated operating system where users maintain control over their data and money.

This technology will enable private chat within a federation with seamless in-chat transfers powered by the Lightning Network. This would all be under the power and control of the federation instead of a third-party company that can lose or abuse user data. No longer does one have to trust a company like Apple to protect their data; now, they can trust those in their community that they already trust.

Fedi also has a functional browser that can host any website on the internet. It can host company websites directly in a federation, which, once again, protects the users' data. Also, if the company website supports the Lightning Network, Fedi can integrate with these seamlessly and allow for Bitcoin transfers between Fedi and the company website.

As you can see, Fedi is not just a wallet. It plans to provide a better operating system for users on the Internet that departs from having to trust third-parties to act benevolently with their data and money. It gives power back to the user through Bitcoin and federations.

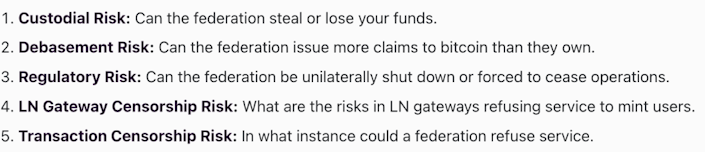

There are some tradeoffs with this model that need to be pointed out. The risks associated with using a federation to manage one’s Bitcoin are five-fold:

Fedimint.org

Despite these tradeoffs, Fedi represents an innovative approach to custody and privacy and appears well-positioned to transform the digital landscape. Fedi has a big vision for what it plans to build using the Fedimint protocol. It aims to scale the Lightning Network while providing a new custody solution to improve access to Bitcoin for individuals worldwide. All in all, it is an exciting, brand-new custodial solution and infrastructure being built that aims to drive Bitcoin adoption to those who need it the most.

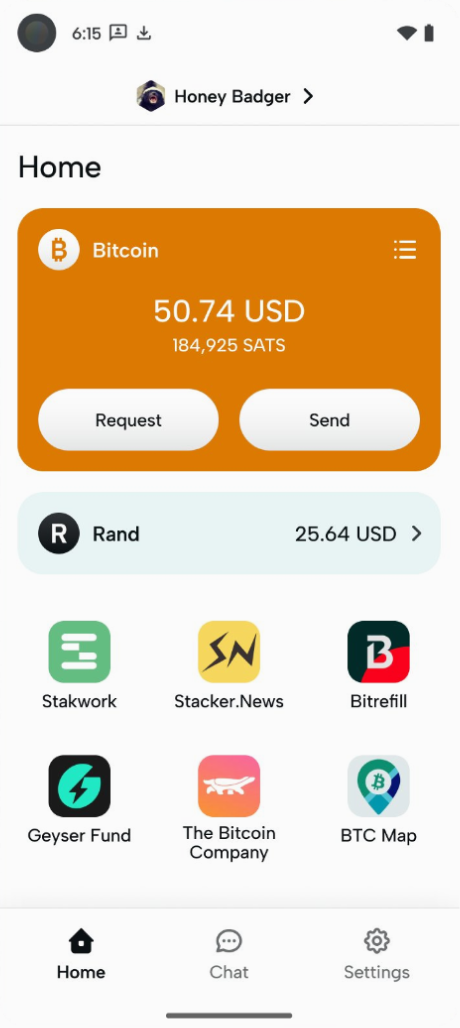

You can test the alpha version of the Fedi wallet here. Below is an image of the home screen.

Amboss is a leading analytics provider for the Bitcoin Lightning Network. Its analytics and data visualizations help users understand what is happening on their Lightning nodes. The firm supports merchants and consumers in identifying optimal peers and payment paths based on cost, reliability, reputation, and enterprise-grade risk management.

Lightning offers several benefits, like cheap, fast payments while still utilizing. Bitcoin’s underlying security and decentralization, but one notable challenge is associated with it. When someone opens a Lightning channel with another party, the balance of the channel is entirely on their side. They can pay the other party as much as they commit to the channel. However, the other party cannot immediately pay them back through that channel because all the liquidity is on their side. This is known as the “inbound liquidity problem.”

Now, suppose you’re a business that primarily receives payments, and you’ve just set up a Lightning node. If you open channels to others, you can send payments but can’t accept them. This means others can only pay you via those channels once you’ve spent some Bitcoin through them, which isn’t helpful for a business looking to receive payments. They have all the outbound liquidity but no inbound liquidity.

To overcome this, a business would need others to open channels, giving them inbound liquidity. Or alternatively, they could use a service that allows them to “buy” inbound liquidity where another user opens a channel to you for a fee.

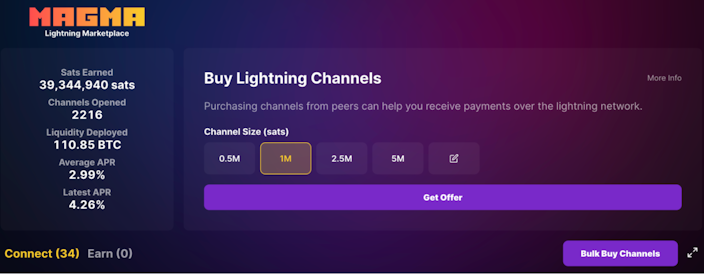

This is where Amboss stepped in and created Magma, a peer-to-peer Lightning Channel marketplace to help businesses and lightning users overcome the inbound liquidity problem.

amboss.space

With Magma, a business or user can see how much another node operator will charge to take their Bitcoin savings and allocate them to open a new channel and provide that inbound liquidity. On top of that, they can review the reputation of that node operator to ensure they are receiving a high-quality channel to their node so they can receive the payments reliability.

amboss.space

Magma essentially matches up people who are saving Bitcoin by running their own lightning infrastructure with people who need Bitcoin to receive payments. Since launching roughly a year ago, the liquidity deployed through Magma has nearly increased fivefold and now stands at 110.85 BTC.

Node operators are incentivized to sell lightning channels to those that need inbound liquidity because they can earn a yield on their Bitcoin by opening Lightning channels to other businesses, corporations, and users. The exciting part is that node operators can take their Bitcoin and earn a return on it by opening up channels without ever giving up custody of their assets. These earnings come without having to trust any other party, only their own node infrastructure. This is a low-risk way to earn a yield on Bitcoin, and node operators can earn it while helping other users by providing them with needed inbound liquidity and increasing the utility of the overall payment network. Win-win-win.

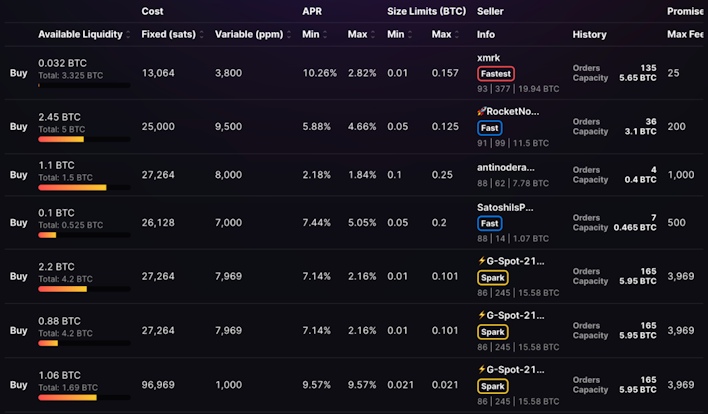

Amboss created a new reference rate recently dubbed LINER (Lightning Network Rate) from this data. In the press release announcing LINER, Amboss stated, “LINER is similar to the LIBOR (London Interbank Offered Rate) in traditional finance, which is a benchmark interest rate for short-term loans between global banks, except LINER is free from credit risk. In other words, LINER is well-positioned to be an alternative to enterprises seeking exposure to Bitcoin without the credit risk that imploded CeFi yield platforms towards the end of 2022.”

Founder of the Bitcoin Layer, Nik Bhatia, has long theorized about the possibility of a Lightning Reference Rate in his writings and had this to say about the announcement of LINER,

“LINER is a first-of-its-kind reference rate derived entirely from the Lightning Network adjacent to Bitcoin. Unlike traditional reference rates that are set by a central bank like the Fed, LINER and other LN-native rates are derived entirely by free market forces — the first step towards money markets unmanipulated by a central authority, much less fragile and prone to the booms and busts of the traditional monetary order. The first step toward building any active capital market is a regularly-published and updated yield curve to attract capital allocators. Amboss is taking the first step toward bringing this concept to reality, and bringing Bitcoin over LN one step closer to denominating the future of our world financial system.”

The way LINER works is it is a dual-index that captures both sides of the market.

On one side, there is LINER Cost which tells you what it costs for someone to get set up with some liquidity.

On the other side of things, LINER Yield asks, what are people demanding to earn in yield for using their Bitcoin savings to open a new payment channel?

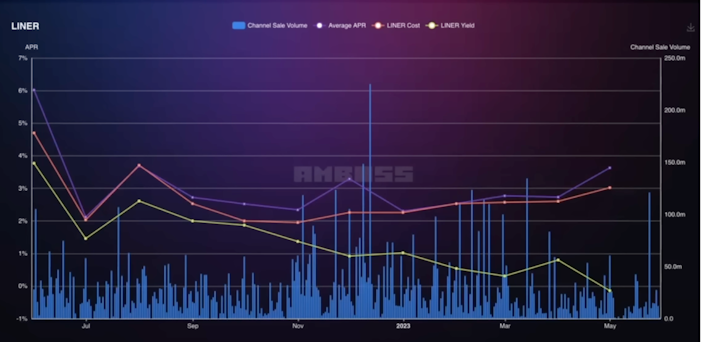

Below is a reference rate for the actual cost of capital beginning to develop on the Lightning Network. The red line shows that it would cost a merchant around 3% APR to get bootstrapped with liquidity. Compared to traditional payment processors, this means that this merchant would save about 1% today and have zero chargeback risk if they used the Lightning network instead.

TIP

The green line shows that node operators earned a range of 0-1% in yield in 2023 without giving up custody of their funds at any point for opening new payment channels with other users, merchants, and institutions.

By having a Lightning benchmark rate available, users can now understand the return on investment for providing liquidity to the network with their savings and the opportunity cost for not doing so. This custodial risk-free reference rate could be the benchmark around which other capital markets, such as Bitcoin lending and investments, begin to evolve. This could lead to new financial innovation in the Bitcoin ecosystem.

It all starts with the hard work of Amboss, which is building the infrastructure to drive Lightning adoption forward. Amboss is providing the data analytics and tools to make it happen and is making it easier for the Lightning Network to grow and for Bitcoin to scale.

The next innovative company in the Bitcoin space aims to take Bitcoin custody and insurance to the next level using miniscript — AnchorWatch.

First, let’s break down what miniscript is. When Satoshi invented Bitcoin, he also created a new programming language called Bitcoin Script. Bitcoin Script can be thought of as a list of instructions that enables someone to transact with their Bitcoin.

These instructions involve providing a digital signature that matches the hashed public key to make it a valid transaction and then broadcasting those instructions to all the nodes in the network to validate that transaction. The simplest forms of Bitcoin Script are verifying single signatures and multi-signatures. However, with miniscript you can take it to another level.

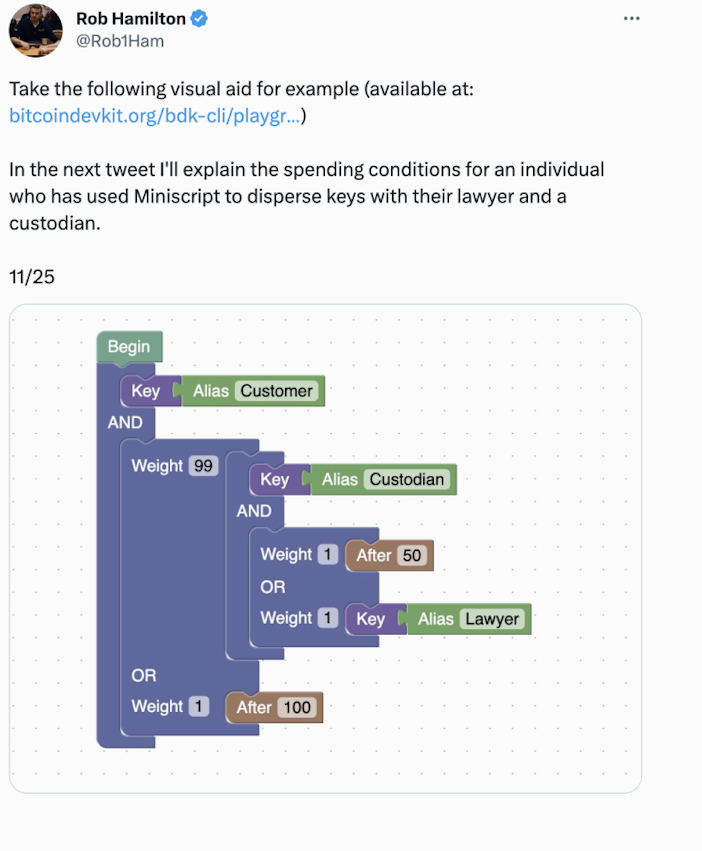

Miniscript is a programming language developed specifically for Bitcoin that makes it easier to create, analyze, and understand Bitcoin scripts. Think of it as a tool that simplifies and makes it safer to write rules or conditions for when and how a Bitcoin transaction can take place.

To put it in even simpler terms, consider the example of a safe. The traditional way to unlock a safe is by using a key or entering a code. But what if you wanted more complex rules for opening it? Let’s say it should open only between 9am to 5pm, or it requires two keys instead of one, or it could be opened by a master key after a specific date.

That’s where Miniscript comes in. It’s like a set of Lego blocks where each block represents a specific rule or condition. You can assemble these blocks in various combinations to define the rules of your “safe” (in this case, a Bitcoin transaction) — and it ensures that you don’t make mistakes while creating the rules. This allows for more flexibility and security in determining how your Bitcoins can be spent, making it a powerful tool for new forms of Bitcoin custody and management.

AnchorWatch sees this as a potential game-changer regarding institutional custody and Bitcoin insurance. Today, insurance on Bitcoin custody is undercapitalized and does not take advantage of Bitcoin’s unique properties as programmable digital money.

If you want insurance on your custodied Bitcoin today, many custodians offer insurance well below the total assets under their management. In other words, it is fractional reserve insurance, where the custodian would only be able to pay out some of its clients if they filed claims.

On top of that, the way the insurance industry treats Bitcoin today is either a lot like gold in a vault, which poses centralization risks, or is custodied using Multi-Party Computation (MPC). MPC is a cryptographic technique where you separate a private key into different shards and store them in various locations with different parties. This way, no single party has full control over the Bitcoin. Instead, a certain number of these parties must come together and combine their shards to authorize a transaction.

But MPC is not ideal because 1.) it’s always connected to the Internet, posing cybersecurity risks, and 2.) It is ultimately dependent on the human processes and policy permissions on top of it, which can be exploited via the collusion of the parties in control.

Miniscript takes custody to the next level and can help distribute the risk of custodying. As a result, Bitcoin could open the door for more institutional adoption. Miniscript allows one to program logic directly into the multi-sig setup itself. No more trusting human processes on top of a secure setup like MPC.

One of the interesting things that Miniscript enables, and how it differs from traditional multi-sig schemes, is that it allows for one key to have priority over others — a master key. In other words, it enables a hierarchy of keys where the Bitcoin cannot move unless a specific key signs. It also allows for spending conditions associated with Bitcoin, such as timelock conditions.

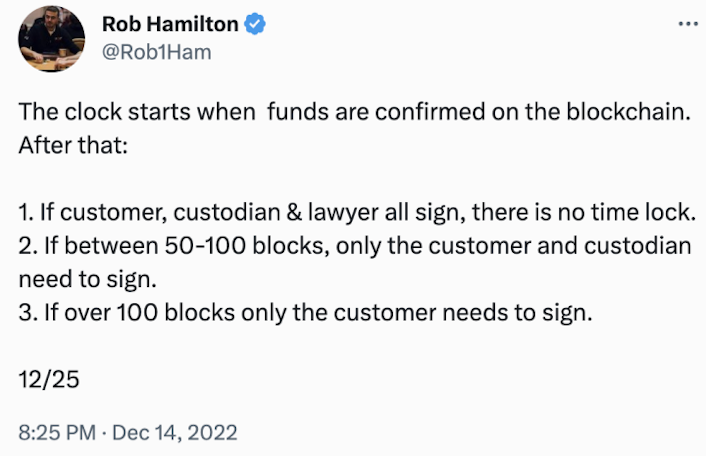

AnchorWatch CEO Rob Hamilton walked through an example in a tweet back in December: closely analyze the visual to the right shows a 2-of-3 miniscript setup between a customer, a custodian, and a lawyer.

Below, Rob explains the spending conditions attached to the keys above and how this distributes risk because, after 100 blocks, the customer can unilaterally take her Bitcoin back if needed without the custodian or lawyer’s signature.

Rob describes this as “layered security” and that the customer has a “sovereign veto,” where they have ultimate control over the private keys after a certain amount of time has passed. The fact that miniscript allows one to distribute risk and then a customer no longer has to even trust the institutions they are working with after a certain period of time is a game-changer when it comes to institutional custody.

Furthermore, it allows institutions to distribute risk amongst each other using Multi-Institutional Custody schemes. With miniscript, this is all possible. One can create sophisticated custody schemes, distribute the risk amongst various parties, and make custody extremely secure. On top of that, it can allow for new ways to think about insuring custodied Bitcoin.

That’s what AnchorWatch is working on. AnchorWatch has built a new wallet, Trident Wallet, that uses miniscript to create unique multi-sig setups for its clients. AnchorWatch plans to combine smart-contract on-chain governance via miniscript schemes, with off-chain compliance and monitoring to further de-risk custody for institutional clients.

Given that Bitcoin is programmable money, Trident Wallet allows for first-of-its-kind insurance policies where AnchorWatch can never unilaterally move the money. Still, at the same time, the client can’t move it without them signing off on it during the duration of the insurance policy. However, when the insurance policy ends, it can be programmed so that the Bitcoin becomes unlocked, and the client can withdraw their funds unilaterally. No longer does the client have to trust the insurance company.

Ultimately, AnchorWatch plans to monetize like any other insurance company by collecting premiums, paying out claims, and netting the profit.

Today, insurance companies are wary of getting involved in Bitcoin, given the various risks and the current state of custody solutions. But with miniscript, AnchorWatch can use it to decrease these risks, opening the door for more institutional adoption. It’s companies like AnchorWatch that are going to make large pools of institutional capital finally comfortable allocating to Bitcoin in the future.

Bitcoin continues to inspire innovation far beyond its initial design. This is clearly evidenced in the work undertaken by companies such as Fedi, Amboss Technologies, and AnchorWatch. Fedi is bringing about a collaborative custody solution empowered by the Fedimint protocol and Lightning Network and aims to provide a new operating system that allows users to regain control of their data and money.

Amboss Technologies is building liquidity marketplaces on the Lightning Network and creating the first Lightning Reference Rate, which could serve as a benchmark for Bitcoin financial products moving forward. And, AnchorWatch is utilizing the power of miniscripts to derisk custody and provide more robust insurance, hopefully attracting more institutional capital to the space.

Far from stagnating, the Bitcoin ecosystem is a hotbed of continuous developments, and companies like these are at the forefront, pushing the boundaries of what is possible with this transformative technology. Their efforts reaffirm Bitcoin’s ever-evolving nature and are prime examples of how new innovations will continue to emerge with time on the stable foundation that is the Bitcoin protocol.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.