Bitcoin: A Digital Benchmark For Tracking Fiat Debasement

As economies around the globe grapple with the fragility of their currencies, the rising adoption of Bitcoin signals a collective move towards the hardest money man has ever known.

Swan Private Insight Update #29

This report was originally sent to Swan Private clients on November 10th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

Since 1971, the world has been forced into one big experiment — the free-floating fiat monetary system. Despite money’s role in purchasing goods and services in the real economy, in this system, we measure the value of fiat currencies against that of other fiat currencies. This is a strange concept.

The value of fiat currencies has been de-coupled from the real world. With their value subject to daily manipulation by central authorities, there is no stable benchmark for individuals to gauge the true value of their money. This is extremely deceptive because it makes it difficult for market participants to recognize when their money is being debased.

Without a way to measure the true value of a fiat currency, it opens the door for it to be manipulated by governments and central banks. Some argue that fiat currencies are inherently immoral because they have been forced upon the public and act as a mechanism for legalized theft through currency debasement. Unanchored to any scarce real-world asset, these currencies are subject to indiscriminate printing by those who command the proverbial money printers, fostering a climate rife with privilege, inequality, cronyism, and corruption.

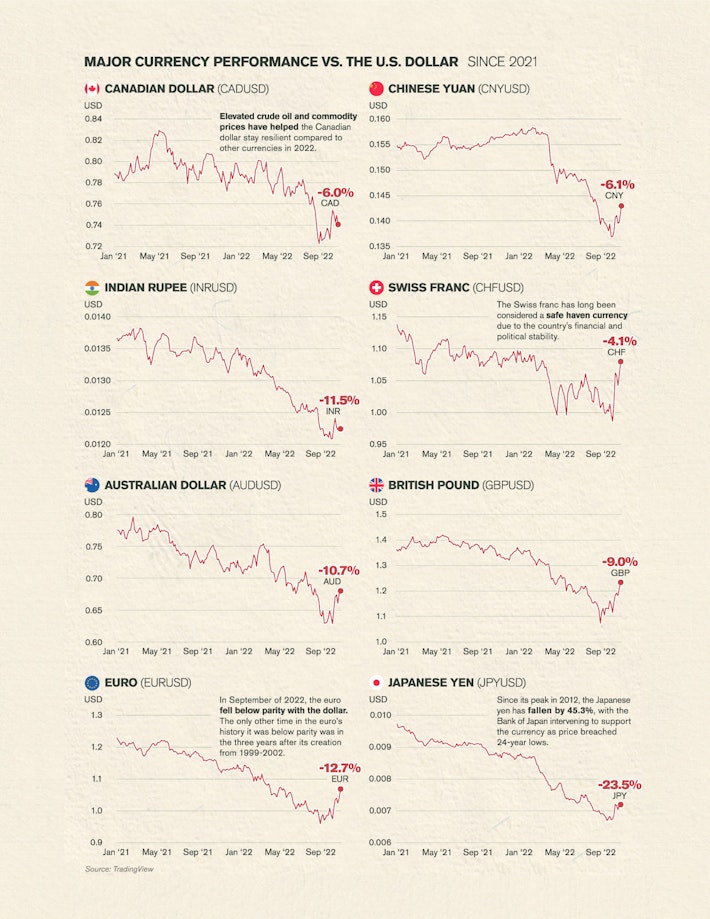

Consider the charts below, which depict how various major fiat currencies have diminished in value relative to the U.S. dollar since 2021.

However, these charts paint a false impression that the dollar itself is growing stronger when, in actuality, the dollar has lost about 12% of its purchasing power since 2021 amid high inflation. This means that, according to the CPI, today’s prices are 1.1x as high as average prices since 2021.

One can observe this trend by comparing the buying power of $100 dollars in 2021 versus today. A dollar today only buys 88% of what it could buy back then.

So even though other fiat currencies are losing value against the dollar, this just means that the dollar is losing its purchasing power at a slower rate than other fiat currencies.

This devaluation trend isn’t new; it’s a consistent pattern since the abandonment of the gold standard in 1971, and the pace of this decline is accelerating.

The true value of fiat currencies becomes apparent only when measured against assets immune to manipulation and inflation and that are inherently scarce — like gold, a historically reliable yardstick for assessing the long-term erosion of fiat currencies.

History has proven that all fiat currencies eventually fail over long periods of time. Since we have gone on this “Great Fiat Experiment, ” the frequency of currency crises has spiked.

When fiat currencies collapse, economies naturally gravitate towards more stable forms of money, such as Bitcoin, gold, or a stronger fiat currency like the dollar.

As Former Fed Chairman Alan Greenspan once said,

“Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.” — Alan Greenspan

We are seeing this dynamic play out in real-time in Argentina. Facing an anticipated inflation rate of 200% YoY by year’s end, Presidential candidate Javier Milei is campaigning to dismantle Argentina’s central bank and transition its economy to the dollar.

This has grabbed a lot of attention, but it’s worth noting that Argentina’s economy has been dollarizing for decades. Over the summer, dollars became so scarce in Argentina that citizens began turning to other fiat currencies that are weaker but still stronger than their local currency, like the yuan.

Argentina’s national statistics agency estimates its citizens hold about $250 billion in foreign currencies, shielding themselves from the crashing Argentine peso.

Yet, Javier Milei is not just advocating for the dollar to be adopted in his country to escape the perils of hyperinflation; he is also advocating for a digital commodity money, Bitcoin.

He stated in a recent interview,

“It has an algorithm and one day it will reach a certain amount and there will be no more. It is a tool that can compete with other currencies. Bitcoin represents the return of money to its original creator, the private sector.”

- Javier Milei

And why shouldn’t Argentines be turning to Bitcoin? When compared against their local currency, Bitcoin represents a flight to safety, even with its inherent price volatility. And unlike the dollar, Bitcoin’s scarcity allows it to hold its value over long periods of time.

One local Argentine noted in a Bloomberg article, “People don’t trust the peso…Between the volatility of the peso and the volatility of Bitcoin, I prefer Bitcoin.”

For the last several decades, gold has been the go-to measuring stick to clearly visualize the ongoing devaluation of all fiat currencies. But now, there is a digital gold that can accomplish the same task, Bitcoin.

For the people of Argentina, if they had held Bitcoin over the last 5 years, it would be evident to them that their currency was failing because the purchasing power of their Bitcoin had increased significantly. The accompanying chart illustrates the five-year average return for Bitcoin holders in various foreign currencies, highlighting the benefits realized by individuals in Turkey and Argentina amidst rampant inflation.

Bitcoin has often been described as a functioning fire alarm for fiat currencies. Given its scarcity and immutable nature, its price action can be seen as a reflection of the debasement of fiat currencies. Said differently, it’s not that the price of Bitcoin continues to rise; it’s that fiat currencies continue to crash in value against it.

Just last month, Bitcoin’s price in Turkey, Nigeria, and Argentina hit record highs despite the asset trading nearly 50% below its all-time high in dollar terms. This coincided with 61%, 26%, and 138% YoY inflation rates, respectively, and economic instability within these nations.

It’s no surprise that we see that the highest cryptocurrency adoption rates are occurring in countries with high rates of inflation. Turkey, Argentina, and Nigeria all rank in the top 15 in crypto adoption globally, according to the 2023 Global Cryptocurrency Adoption Index.

Some might argue that Bitcoin’s volatility makes it a difficult measuring stick to use, but this misses the point. Bitcoin’s volatility is a function of its fixed supply and ongoing adoption. The fact that there will only ever be 21 million Bitcoin is precisely what makes it valuable in the first place. It is also a result of the fact that Bitcoin can’t be manipulated by central planners. Central banks and governments have intervened with their currencies for decades to maintain some arbitrary levels of price stability. They have enacted policies to suppress volatility, but where has that gotten us? All we have seen is steady devaluation with periods of heightened volatility in the forms of manias, bubbles, and crashes. Over the long term, Bitcoin’s natural price discovery and the volatility that comes with it is preferable to the artificial stability brought on by central planners.

Today, we appear to be reaching an inflection point in this free-floating fiat experiment. Around the world, fiat currencies have been manipulated and debased consistently for decades, and we are now seeing hyperinflationary events become more frequent.

The unraveling of fiat currencies emphasizes the critical need for an incorruptible benchmark, one not susceptible to the whims of policy or economic tides. Emerging in response to the free-floating fiat system, Bitcoin represents a contrasting monetary experiment. At just 15 years old, it is considerably younger than the fiat system, yet in this short time, it has appreciated in value — a stark contrast to fiat’s depreciation. Bitcoin can be thought of as a compass guiding us through the monetary tumult. It’s fixed supply and decentralized nature offer a consistent frame of reference for everyone to see the devaluation of fiat currencies in real-time.

As economies around the globe grapple with the fragility of their currencies, the rising adoption of Bitcoin signals a collective move towards a money that stands firm in the face of inflationary pressures and is free of manipulation. It is in this digital revolution of money that we will find a return to the fundamental principles of scarcity and value, principles that fiat currencies have long forsaken, illuminating a path towards enduring monetary stability.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.