Bitcoin: An Endless Chain of Mysteries

There are so many mysteries that draw us into Bitcoin. And there always will be.

There are so many great mysteries. Some are ancient. Some are modern. How did the universe begin? Does it have purpose? How did life arise on Earth? Who built the great pyramids? How did they do it? Why? Are UFOs and UAPs real? Will we ever solve these mysteries? Why do they fascinate us so deeply?

Are we drawn to them because we suspect that their solutions contain answers that will reveal even more — answers to deeper secrets about our nature and origin; answers about our ability to achieve happiness and find meaning? Or are we just such curious beings that we cannot resist the desire to know what lies behind the unexplained?

Whatever the cause, mysteries do draw our attention. They stimulate our problem- solving abilities. They encourage us to think, to talk, to experiment, to research, to hypothesize, and, eventually, to actually discover new knowledge. Moreover, almost every solution to some mystery opens the door to a new mystery that asks a deeper question.

Explaining the mystery of lightning led Benjamin Franklin to discover electricity. Explaining the mystery of the rainbow led Newton to discoveries about the nature of light itself. Almost every such discovery is thus also accompanied by a legend of its discoverer’s journey toward solving that mystery. And often, many aspects of that discoverer’s journey are themselves shrouded in mystery.

It seems we simply cannot resist great mysteries and the stories of those who solved them.

Let us now then focus our attention on a modern mystery — Bitcoin.

Bitcoin is not a single mystery. It is, in fact, a great many mysteries, as we soon shall see.

The first people to be drawn to Bitcoin were not attracted to it because they were confident of its success as global, Internet money. They were mostly computer nerds, not investors, economists, or finance experts. Their attention was tweaked by the curious claims of its mysterious and pseudonymous creator, Satoshi Nakamoto, that he had solved a problem which computer scientists had already proven could not in fact be solved.

The problem went by several names. “The double-spend problem” and the “Byzantine Generals’ Problem” were the two most common.

The gist of the established proof was that it was impossible to maintain consensus over time in distributed systems without imposing a hierarchy in which one participant ultimately had authority over all the others. Thus, by implication, any truly decentralized system would fragment and fall out of consensus. In short, experts had concluded that decentralized consensus was impossible to sustain.

Satoshi Nakamoto’s claim to have solved this problem through Bitcoin was a mystery that demanded examination. Here was this mysterious character making an extraordinary claim. Was it snake oil he was pushing? Was he mistaken? If so, could these first scrutineers of his claims find his mistake?

After all, many claims and proposed proofs or solutions do turn out to be mistaken. If he was not mistaken though, what might be the implications of such a discovery?

Remarkably, what these early investigators of Bitcoin discovered was that Satoshi had indeed found a solution. It wasn’t a perfect solution. His solution actually allowed for discrepancies in consensus to exist, but only briefly. His solution found a way to resolve any discrepancies after relatively short periods of time, allowing for consensus to exist on older data. Under Satoshi’s solution, while there might be some discrepancy between participants’ views about what happened most recently, over time, any such discrepancies would be resolved and the agreed historical consensus would be adopted by all participants.

Satoshi’s solution was practical. And it was elegant. It used a concept called “proof- of-work” (in place of rank) to assign validity to new data and to resolve any discrepancies that occurred as a result of different participants trying to add conflicting data. Proof-of-work was a concept that had been formally documented as far back as 1993. It sat on the shelf mostly, until fifteen years later, Satoshi took it off that shelf and mixed it into Bitcoin. The mysterious Satoshi Nakamoto had indeed solved in practice a problem that was impossible to solve in theory. Instead of “instant consensus” he settled for “eventual consensus” and that turned out to be possible to create in a purely decentralized manner.

The challenge that the “Byzantine Generals’ Problem” posed was “Of all the participants in the system, which one will have the authority to add the next record to the ledger (or, in Bitcoin’s terminology, the next block to the blockchain)?”

In a delicious twist, Satoshi’s solution to the first mystery relies on creating an endless chain of mysteries that need to be solved. Satoshi’s solution essentially stated “Whoever can solve the mystery of what number provides a valid solution to the puzzle for the next record (or block).”

Bitcoin mining is the act of solving a mystery and publishing the solution to that mystery! You’ve probably heard that Bitcoin miners “solve complex mathematical problems.” That’s more accurate than the notion of excavating minerals from the earth that the word mining conjures up in our minds (although it’s still not perfect).

The whole idea of the word “chain” in blockchain refers to the fact that the solution to the prior block — the answer to the last mystery — becomes a part of the problem in solving the next mystery.

Bitcoin’s solution to the Byzantine General’s Problem only works because nobody can start working on the solution to any block greater than the one immediately following the most recent one discovered. It accomplishes this because the solution to the previous block is needed to start working on a block’s solution.

So if the latest block is block 810,000, any miner can start working on solving the problem for block 810,001, but none can begin working block 810,002. Only when the mystery of the solution for block 810,001 is published can anyone begin trying

to solve the great mystery of what will be the solution for block 810,002. Bitcoin is thus a chain of endless mysteries, each of which is hard to solve, and each of which, when solved, creates a unique new mystery to solve. Nobody knows who will solve the next mystery, or exactly how long it will take to solve. While it takes on average, about ten minutes, sometimes it is solved in under a second, sometimes in over an hour.

It is rather beautiful to consider how this endless chain of discoveries, each of which become a part of a new mystery reflects an idealized prototype for how human knowledge advances generally: We solve one mystery and benefit from its solution, yet are presented with more mysteries posed by the answer to the mystery we just solved.

Autonomous means self-governing. Living things are autonomous. But corporations, governments, and other man-made institutions are governed by people. Similarly, very few machines are themselves autonomous. Machines tend to require an operator, or at least a maintainer.

One more mysterious attribute of Bitcoin is that it lacks these external governing bodies and individuals. This feature is a big part of its appeal, of course. As Satoshi himself said, “The root problem with conventional currency is all the trust (in people and institutions) that’s required to make it work.”

He went on, “The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Satoshi didn’t set out to remove some of that trust, or even most of that trust. He developed something that removed “all the trust.” Bitcoin is therefore often referred to as “trustless.” But to be trustless meant that Bitcoin couldn’t rely on trusting people to govern it.

That meant that if Satoshi succeeded in removing all the trust, Bitcoin would have to be an autonomous entity. And by all accounts, it sure looks like it is. There is no CEO.

There is no board of governors. There is no head office. There are no employees. It isn’t incorporated. It just exists and operates. Satoshi somehow also solved the mystery of how to create an autonomous entity!

How does something like Bitcoin work to take care of itself? It’s hard to fully comprehend or explain. There are many moving parts.

First, it isn’t the case that Bitcoin can exist entirely without people. (Not yet, anyway.) Bitcoin does need people. It needs them to run the software, to direct energy towards mining it, and to consider it money. Why do people do these things? Bitcoin doesn’t force them to do this, after all.

For Bitcoin miners, they do the work of solving its never-ending chain of mysteries because Bitcoin pays them to do it. What does it pay them with? Not dollars. Not gold. It pays them in Bitcoins.

In its first four years of its existence, Bitcoin paid out to miners half of the 21 million supply that would ever exist. Why so much? Another mystery?

Well, Bitcoins were worth nothing at the time Bitcoin got going. Why should anyone pay real money to dedicate real energy to obtain money that might not be so real?

There was a big risk premium involved. But Bitcoin promised to handsomely reward these early participants with half of all of the coins it would ever produce in exchange for then joining early. That proved enough incentive that thousands of people were drawn to the prospect of mining Bitcoin.

Not only that — it turned out to be enough incentive to get them to figure out ways to mine as efficiently as they possibly could. Just in its first four years of existence the people engaged in Bitcoin mining went from using CPUs (central processing units) to figuring out how to use much faster GPUs (graphics processing units), to FPGAs (Field Programmable Gate Arrays), and finally to designing custom processors called ASICs (application specific integrated circuits) that could only do one thing, but do that thing very quickly and efficiently — mine Bitcoin.

By the time this first four-year period was complete, Bitcoin’s estimated hashrate skyrocketed unlike any computer development beforehand. The hashrate is the number of attempted solutions per second dedicated to finding the solution to the mystery of the next Bitcoin block. It was originally estimated at about 68,000 attempts per second when Satoshi launched Bitcoin on January 3rd, 2009. It rose to over six million guesses per second within a week and stayed not too far from there for a year. That’s when things started to grow exponentially. By May, 2010 it was at over one-hundred million. And it hit one-hundred billion before 2010 was over. In May, 2011 it was over one trillion, and broke through ten trillion by July of that year. By the time of the first halving in November 2012 — the cutting of mining rewards in half when half of the original coins had been issued — the hashrate was at over 23 trillion attempted solutions per second! (At the time of writing, almost eleven years later, the hashrate is estimated to be roughly 375 quintillion guesses per second — we entered the quadrillions in September of 2013, and blew past them into the quintillions in early 2016.

You might be pondering another mystery: With quintillions of guesses per second aimed at solving Bitcoin’s latest mystery why didn’t the thing blow up? In what is a remarkably visionary solution to the problem of not knowing how much energy might eventually go into solving these sequential puzzles, Satoshi programmed Bitcoin with the ability to adjust itself for any outcome — literally any.

This bit of programming is called Bitcoin’s “Difficulty Adjustment Algorithm.” It is a formula that Bitcoin uses once every 2,016 blocks, which, at ten minutes per block, is once every two weeks. Bitcoin uses this formula to determine how hard to make it to discover each of the next 2,016 blocks. It simply does this by determining how long it took to discover the last 2,016 blocks and it then adjusts the difficulty up or down accordingly so that it should now take ten minutes. If, for example, the blocks came in once every five minutes, the adjustment would make the required solution twice as hard to find. If blocks averaged 20 minutes, it would make finding solutions half as hard. (These examples are used for simplicity of demonstration. In practice, most adjustments are far less than a few percentage points in difficulty.)

This difficulty adjustment is an essential part of how Bitcoin operates autonomously. Bitcoin makes a promise to deliver one block every ten minutes. But it does not create the next block itself. People do. People all over the world compete to do it. These people have invented new technologies to do this better, faster, and cheaper. But they have not been able to make Bitcoin break its promise.

Every 2,016 blocks, Bitcoin looks inward and says “Here’s my objective estimate for how difficult the block-solving mysteries must be for keeping solutions ten minutes apart per block for the next 2,016 blocks.” It then turns outward and says to all people who consider mining, “You must all then solve mysteries of this revised difficulty. I’ll revise this number again after the next 2,016 blocks.”

Bitcoin is a harsh master. But its value comes from it keeping its promises, no matter how strict it must be.

While this is not everything that goes into making Bitcoin autonomous, it does cover a hugely essential feature, and the general template for how Bitcoin interacts with those other autonomous entities we call people, to incentivize them to do what it needs done but cannot do itself, without submitting to their control, and thus, remaining autonomous.

When looking at this, the famed cryptographer, Ralph Merkle, pronounced “Bitcoin is the first example of a new form of life.” He went on to elaborate, saying “It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss. It lives because it is radically transparent: anyone can see its code and see exactly what it does.”

We have covered a few of Bitcoin’s most interesting mysteries here. There remain many more. Perhaps we will explore them in a subsequent article. I’ll leave that as an open mystery.

Studying Bitcoin is often referred to as “tumbling down the rabbit hole, ” since there are so many paths to go down. Some of these mysteries are solved. Some require solutions still. Some will likely never be fully solved.

If you’re ready to explore more of these on your own, Swan has some excellent collections of essays and podcasts it calls “The Bitcoin Canon,” curated by some of the leading voices and intellects in Bitcoin. These collections tackle various topics of Bitcoin, which present their own mysteries, like why Bitcoin uses energy, how it achieves its security, how it relates to time, how it is life-like, and so much more.

There are also two free books Swan offers that go into answering other Bitcoin mysteries in very accessible ways — Yan Pritzker’s “Inventing Bitcoin” and the book I wrote, “Why Bitcoin.” On top of that, there are many Bitcoiners eager to share their discoveries, theories, experiences, and “Eureka!” moments all over the Internet. I wish you happy sleuthing in your exploration of Bitcoin’s many mysteries.

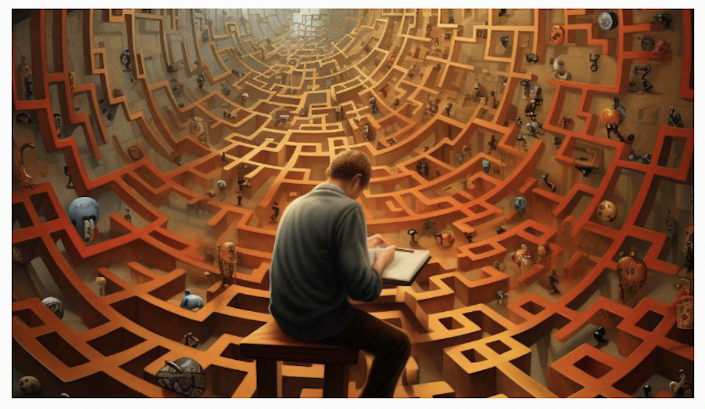

No sooner had I finished writing this article, than out of the blue, I received a message from my friend, the artist FractalEncrypt, asking for my assistance naming a sculpture he had just completed designing. The sculpture’s theme was nothing other than “Bitcoin’s many mysteries!!!!”

I like to joke that there are no COINcidences in Bitcoin, and this was a fascinating example of how he and I had both been inspired, independently, to direct our energies to the topic of mysteries in Bitcoin.

As a result, the above article and his sculpture, pictured here, share the same name.This artwork will be up for auction at scarce.city from August 21st to 26th, and will be on display at the Bit Block Boom conference in Austin, Texas starting on August 24th.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Tomer Strolight is Editor-in-Chief at Swan Bitcoin. He completed bachelors and masters degrees at Toronto’s Schulich School of Business. Tomer spent 25 years operating businesses in digital media and private equity before turning his attention full time to Bitcoin. Tomer wrote the book “Why Bitcoin?” a collection of 27 short articles each explaining a different facet of this revolutionary new monetary system. Tomer also wrote and narrated the short film “Bitcoin Is Generational Wealth”. He has appeared on many Bitcoin podcasts including What Bitcoin Did, The Stephan Livera Podcast, Bitcoin Rapid Fire, Twice Bitten, the Bitcoin Matrix and many more.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.