Bitcoin Awakens from its Summer Slumber

This drawn-out period of low volatility serves as a coiled spring. The only question is in which direction will the price eventually break.

Swan Bitcoin Market Update

This Insight Report was originally sent to Swan Private clients on August 14th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

This summer’s Bitcoin price action can be described as a yawn. After entering the summer with gusto following the excitement around BlackRock’s ETF filing, the price of Bitcoin has crawled sideways. Its 90-day rolling volatility recently hit its lowest level since 2016. Bloomberg described the Bitcoin market as one of “extreme apathy.”

This drawn-out period of low volatility served as a coiled spring; the only question was in which direction the price would eventually break. We got our answer last Thursday when the price of Bitcoin crashed back down towards $25,000 in dramatic fashion.

After this recent drop, Bitcoin remains essentially flat for the summer. This new bout of volatility led to plenty of speculation about what potentially drove this latest price action. Some analysts are speculating that this had something to do with the controversial offshore exchange, Binance.

This has been a rough year for Binance. It has been sued by both the SEC and CFTC on various charges, has had several senior officials recently resign, and is currently under investigation by the DOJ for potential money laundering and sanctions violations all this year. Now, Binance’s token, BNB, is crashing.

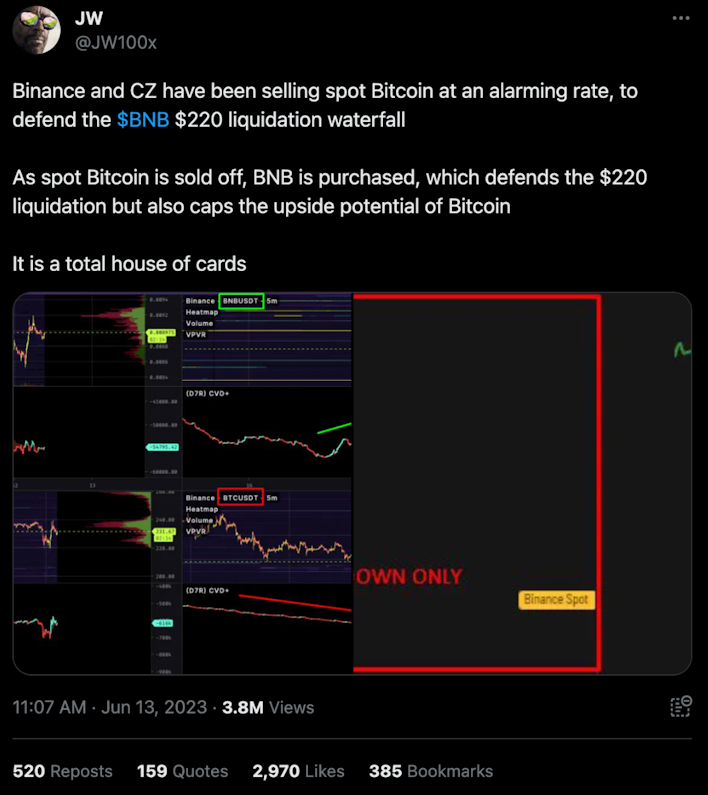

Some are speculating that Binance may be selling the Bitcoin on their balance sheet in a desperate attempt to prop up the token that they printed out of thin air.

There has been an unusual amount of spot Bitcoin selling on Binance compared to other exchanges.

In addition, rumors are spreading on social media that Binance has a large BNB-collateralized loan at risk of getting liquidated at a certain price threshold.

Binance CEO CZ has denied having BNB-collateralized loans in the past, however, the price action of BNB has been abnormal compared to the rest of the broader cryptocurrency ecosystem.

The price of BNB has held up relatively well compared to other altcoins despite its issuer facing challenges from regulators, the shutdown of its fiat onramps, and global macroeconomic headwinds for risk assets.

The question becomes, who is buying massive amounts of BNB in this highly uncertain investing environment?

We know that Binance holds a large amount of BNB on its balance sheet and a significant amount of the supply is Binance-controlled wallets. Earlier in the year, Cryptohippo65 tracked down addresses controlled by Binance and calculated that 67-81% of all BNB — equating to over 131 million BNB tokens — are held in wallets controlled by Binance.

As a result, Binance is incentivized to keep the price of BNB elevated for the success of the business. To be clear, at the moment, all of this is speculation, but the incentives are there.

Time and time again, we’ve witnessed this in the cryptocurrency ecosystem. An exchange issues its own token, it mismanages customer funds, a liquidity crisis ensues, it tries to pump up its token with funds on hand, withdrawals accelerate, liquidity dries up, and the token goes to zero. See — FTX and Celsius.

Outside of Binance rumors, others feel that this recent price drop is more related to macroeconomic headwinds. Fears of contagion spreading from China’s woes are beginning to spook investors.

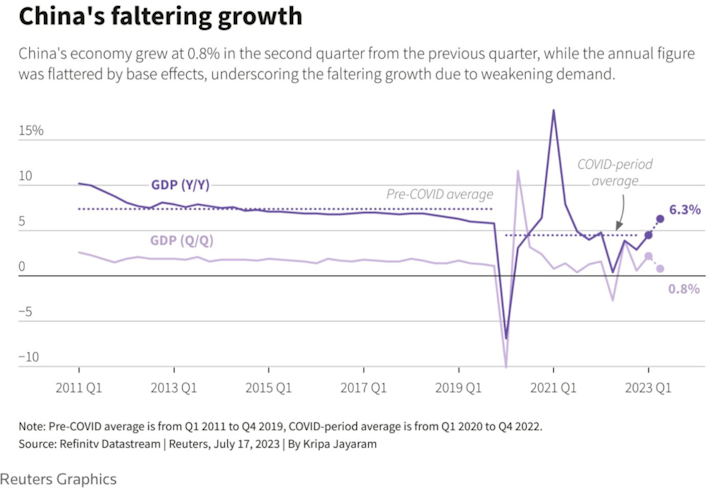

China’s GDP growth has sputtered this year. The rebound in economic activity post-pandemic has not really come to fruition like many market participants anticipated.

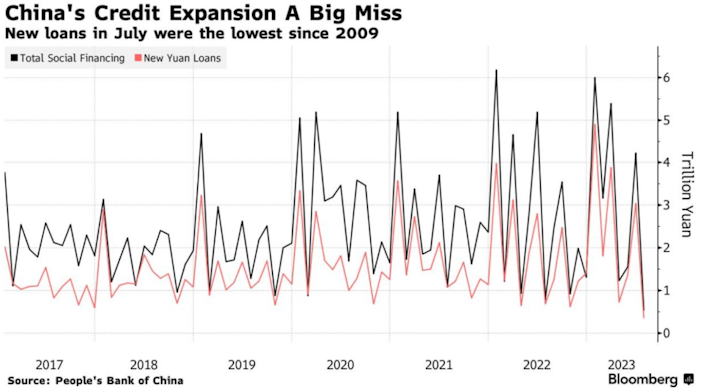

In addition, Chinese banks extended the smallest amount of loans last month since 2009. Credit demand in China has dropped off a cliff, another sign of weak demand.

This comes as China’s prices have slipped into deflation. The Chinese government has instructed journalists that they can’t even mention the “D-word” in publications. One Chinese journalist said, “As the entire market isaware, there is no such thing as deflation in China…We could, however, talk about low inflation,”

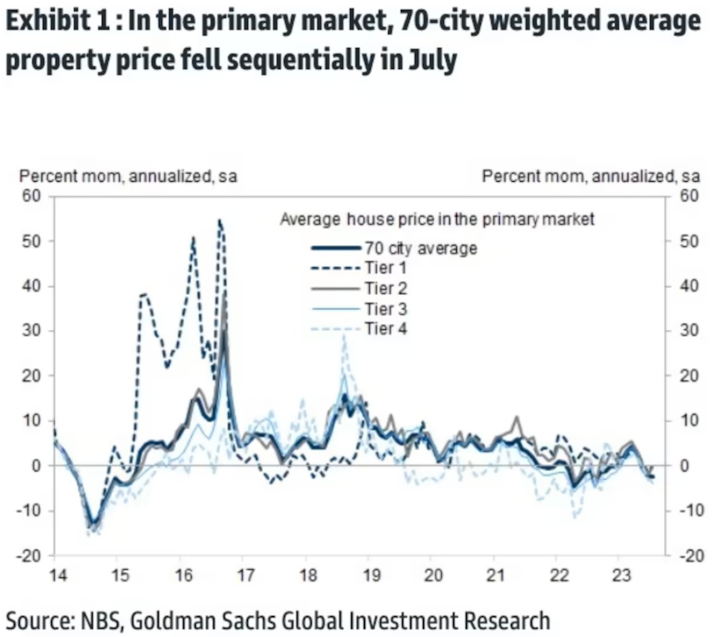

The fall in Chinese prices has never been more evident than in the real estate market. The great Chinese real estate bubble appears to be popping. According to Goldman Sachs, new home price data for July averaged an annualized MoM decline of 2.5% for the 70 cities measured.

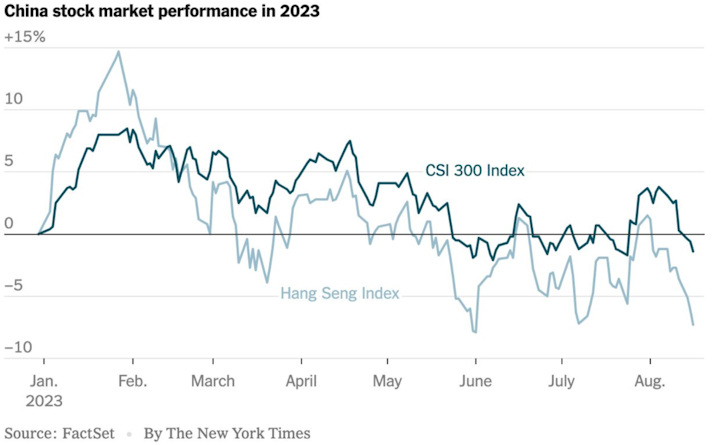

This fall in asset prices can also be observed in the Chinese stock market indices as well. These indices are currently approaching yearly lows, with no signs of letting up in sight.

When taken all together, the data coming out of China is concerning, and investors have taken note.

The news out of China is alarming, but market participants were also concerned with the message coming out of the July FOMC meeting minutes that stated, “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.”

The market took that as a signal that the Fed could be set to hike interest rates higher to combat inflation.

After the meeting minutes were released, yields on 10-year Treasurys rose to the highest levels in 16 years.

Now that investors can earn a decent yield in Treasury bonds or money market funds, they are shifting capital away from riskier assets and into these traditional safe havens. Money market funds saw $40 billion flow in the week of August 16th, and total money market fund assets currently sits at a record $5.57 trillion.

With money market funds and Treasury’s earning attractive yields, and the Fed potentially planning to lift rates even higher, this puts pressure on all other assets, including non-yielding assets like gold and Bitcoin. This too could have contributed to the drop in Bitcoin’s price last week.

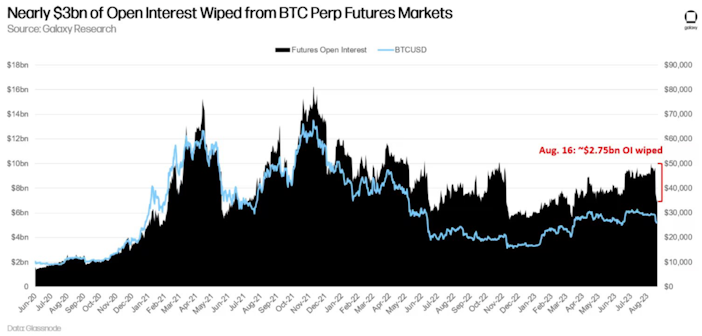

Lastly, leverage always exacerbates price drops like this.

Many traders use leverage to amplify their holdings and place bigger bets with money they don’t have, but it comes with risks. If the price falls below a certain level, they can lose all their money, or get liquidated. This can cause rapid price declines. If the market starts to dip and leveraged positions get liquidated, it adds more selling pressure, causing the price to drop even more. This can lead to a domino effect where one liquidation triggers another, causing a rapid decline in the price.

This is exactly what happened in this recent downward move. For those greedy individuals who levered their Bitcoin long positions — they got wiped out one-by-one.

Galaxy’s Head of Research, Alex Thorn, writes “About $2.75 billion was wiped off bitcoin futures markets in the largest deleveraging event since the collapse of FTX in Nov ‘22….long liquidations accelerated the move lower.”

This just goes to show you that using leverage is a dangerous game with a highly volatile asset like Bitcoin. Successfully trading Bitcoin is extremely hard, but doing it with leverage? Nearly impossible. As Matt Odell likes to say, “Stay humble. Stack sats.”

This price drop in Bitcoin comes as the prices of seemingly everything have been dropping this year. From energy prices, to food prices, to used car prices, they all have been on the decline in 2023.

And yet…people are still feeling like life is more expensive than ever before.

A viral trend is taking over TikTok as millennials and Gen-Zers voice their frustration about the cost of living and their inability to afford basic essentials on their meager incomes.

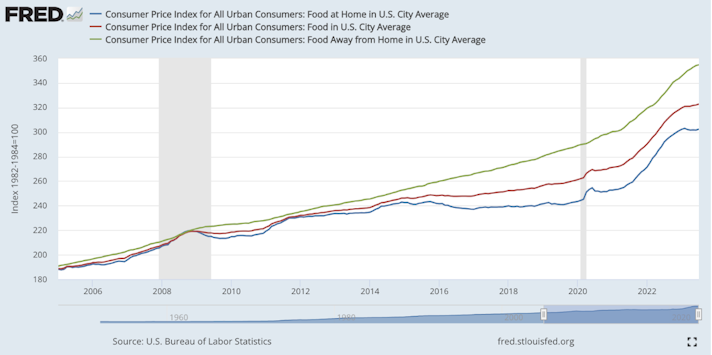

If you’re wondering why everything still feels more expensive despite the CPI steadily falling this year, then you are not alone. The confusion comes from the fact when you hear that the CPI falling, it just means that the RATE of inflation is slowing. It doesn’t mean that the cost of groceries or gas has fallen back down to their previous levels. It just means the prices are still rising, albeit at a slower pace.

For example, food prices both at home and away from home are still up around 20% since 2021.

The same goes for prices at the pump. Although the price of gasoline has dropped in 2023, the average gas price per gallon still remains well above pre-pandemic levels.

Unfortunately, the reality is, prices will never fall back down to pre-pandemic levels.

Despite this, the slowdown in the rate of inflation has been a cause for celebration amongst central bankers and economists. Now, there is even an ongoing debate on whether central banks should just call victory now with inflation at 3% despite it still hovering above their historical target of 2%.

American Economist Jason Furman, who served as the Chairman of the Council of Economic Advisers under President Barack Obama, penned an opinion piece in the Wall Street Journal that called for the Federal Reserve to raise its inflation target to 3% to “better stabilize the economy” and “cushion it against severe recessions.”

This piece was supported by economist Paul Krugman who tweeted,

Furman’s article caused a strong reaction from both Bitcoiners and traditional financial participants alike.

Investment Strategist Lyn Alden tweeted, “Unit anchoring bias means that in inflationary environments, the burden is always on wage earners to keep up with inflation. They have to negotiate a 3% raise per year just to keep up with CPI, let alone raises for experience. Higher inflation = higher hurdle rate to keep up.”

Lyn is touching on the idea that inflation always tends to disproportionately hurt the working class. If their wages aren’t keeping up with inflation, then they are falling behind as the prices of everything they need to survive grows more expensive. For those keeping track, on average, wages have not been keeping up with the rate of inflation over the last several years. Wage earners have been losing out as inflation ran to multi-decade highs.

Casa CTO Jameson Lopp replied, “A 3% theft target means the value of your dollar gets halved every 23 years rather than every 34 years. It’s the miracle of compound theft!“”

Lopp is highlighting that although a difference from 2% to 3% annual inflation may not sound significant, it actually has a major impact on the value of your savings over the long term. What these economists are essentially debating is at what rate central bankers should erode the dollar’s value. This is what makes Bitcoin so special. It is money that can’t be inflated away at some arbitrary rate chosen by central bankers. Because of this, it holds its value over time.

Peter Schmidt responded, “Inflation is the surest way to fertilize the rich man’s field with the sweat of the poor man’s brow. He also wonders where wealth concentration comes from.”

Peter is touching on how inflation hurts the poorest amongst us the most. It’s the people who live paycheck to paycheck, who don’t own stocks and real estate, and who don’t benefit from the rise in asset prices who feel the sting of inflation. A 3% target inflation rate would only serve to cause more wealth concentration at the top, and erode the savings of those that are already being priced out of owning assets.

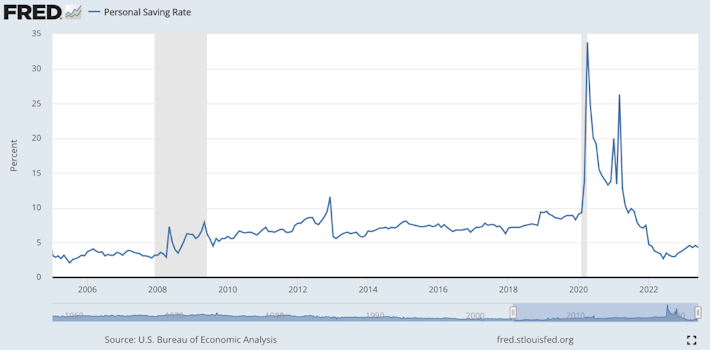

The erosion of peoples’ savings is exactly what we are seeing take place — the US personal savings rate recently hit a 15-year low. The main cause? The higher cost of living.

This is an especially concerning statistic for young people given that they are finding it harder and harder to put away money for retirement. A recent Bankrate survey found that a stunning 31% of Generation Z workers have saved nothing for retirement over the past two years or so. Millennials were only slightly better at 23%.

When you couple this data with the fact that 66% of investors in a survey responded that one needs $3-5 million to retire comfortably, you start to see the problem. Younger generations simply can’t keep up with the rate of inflation, aren’t saving, and are finding it harder to see a path toward retirement.

However, some younger people are seeing Bitcoin as a way to change their circumstances. Recent research from the National Bureau of Economic Research found that age is a very strong predictor of Bitcoin ownership. Those under 40 are 13% more likely to own cryptocurrency than those over 60.

Bitcoin has proven to hold its value over longer time frames and is resistant to inflation. Given younger generations have time on their side to benefit from Bitcoin’s ongoing adoption and subsequent price appreciation, Bitcoin represents one way they can potentially reach their retirement goals as every other asset class is growing more and more expensive and is increasingly becoming out of reach for young people to afford.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Argentina

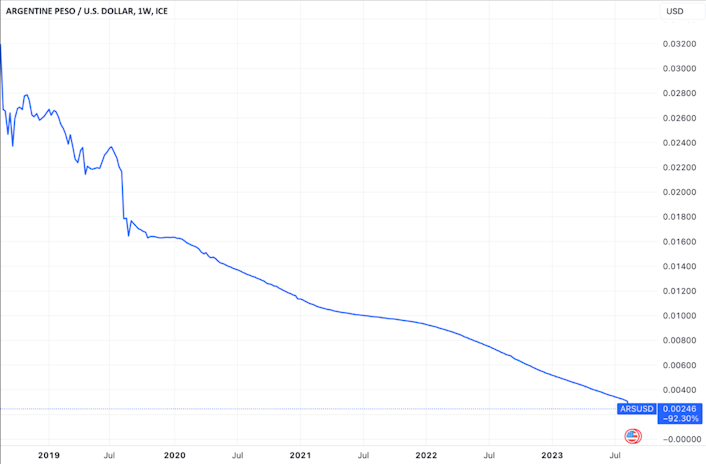

Speaking of inflation — Argentina knows a thing or two about it. Last week, we saw a full-on currency crisis unfolding in the South American country.

The collapse in the Argentine peso comes after its economy has fallen into a steep recession, with now 40% of its population driven into poverty.

As its debt piled up after decades of government and central bank mismanagement of the economy, the peso has collapsed in value against the dollar, down 92% over the last 5 years.

This all came to a head last week when a Libertarian presidential candidate, Javier Milei, unexpectedly won Argentina’s primary election campaigning on the message of ending the Bank of Argentina, dumping the Argentine peso, and adopting the more stable U.S. dollar instead.

After Milei’s election win, Argentine officials only acted to help his cause by choosing to devalue the peso overnight by an additional 18%. Imagine you’re an Argentine citizen and the savings that you accumulated through your hard work and time were just devalued as you slept through no fault of your own. Poof — gone.

With Argentina’s year-over-year inflation now in the triple digits (115% YoY), it’s not difficult to understand why Argentines are resonating with Milei’s message. The Central Bank of Argentina has failed at its mandate to keep its currency stable, and it’s the people of Argentina who have suffered as a result.

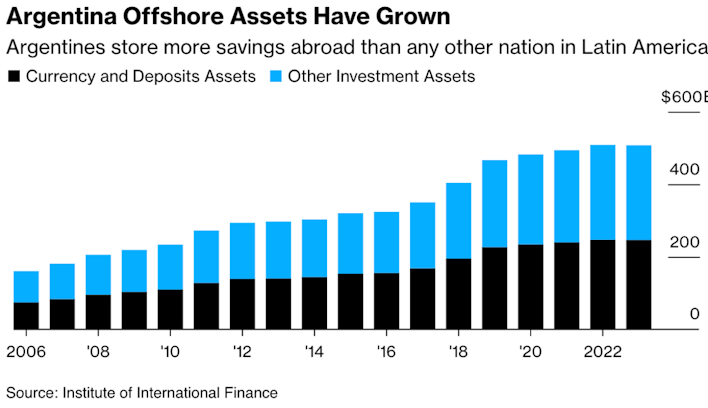

In this time of high inflation, Argentines are looking for solutions. They are turning to alternative ways to store their wealth and protect their savings including dollars, US stablecoins, and Bitcoin. As a result of their currency losing its value, Argentines store more savings abroad than any other nation in Latin America.

Furthermore, Bloomberg reports that today around 200,000 skilled workers in Argentina’s tech sector are already paid in US dollars or euros, citing an Argencon report. This comes as peso-based jobs suffer a turnover rate of over 30%. Argentines are beginning to demand payment in better money for their work.

The problem is, the government has implemented restrictions on the amount of dollars citizens can hold and access, making it difficult for them to obtain. This is where Bitcoin’s accessibility and permissionlessness shines. Anyone can buy, sell, or hold Bitcoin with only a smartphone and an internet connection. This is likely why we have seen increased Bitcoin adoption in Argentina compared to other countries. According to Chainalysis Crypto Adoption Index, Argentina ranks 13th in the world in terms of its adoption rate. Argentines need Bitcoin, today. Javier Milei seems to agree.

When asked in an interview whether or not Bitcoin could be a monetary alternative, Milei responded, “What Bitcoin represents is the return of money to its original creator: the private sector. With legal tender, they scam you with the inflationary tax… Bitcoin is the natural reaction against central bank scammers; to make money private again. In economies with high rates of inflation, the scam problem is bigger…that’s why, as I suggest, we should propose to close the central bank.”

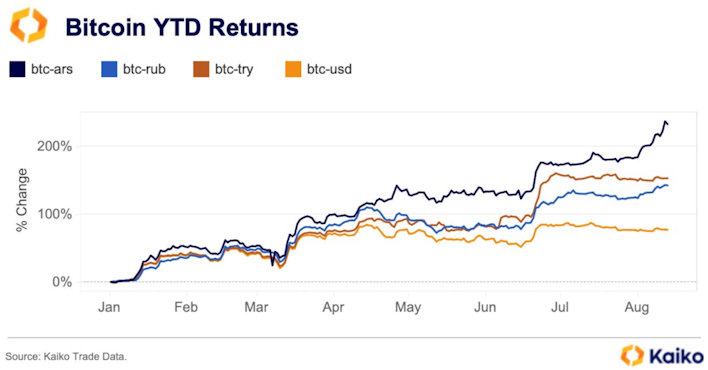

It’s no surprise that Bitcoin is currently making all-time highs against the Argentine peso.

In Argentina, Bitcoin is considered a risk-off asset with the value of their local currency plummeting and the inflation rate soaring. The crisis in Argentina is a reminder of how fiat currencies can fail and how Bitcoin can act as a life raft.

Market Overview

Tradingview, Prices as of 08/25/23

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.