Bitcoin: Solving the Fundamental Problem of Money

Bitcoin’s rate of supply discovery is slowing down, by half, every four years — a first for any commodity! Satoshi solved not just the double-spending problem but also the fiat imalleable supply cap problem!

Swan Private Insight Update #31

This report was originally sent to Swan Private clients on January 15th, 2024. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

What do money and energy have to do with each other?

It seems like a simple question to answer. And indeed, a short answer might simply be that they can be exchanged for each other — you can buy energy with money, and you can sell energy for money. But that’s also true with everything that money can buy and sell.

Take food, for example. You can also buy food with money and sell it for money. Well, hold on. Food is technically energy, right? It’s fuel for your body. You eat food to get energy to power your body’s metabolism. It’s stored energy.

So let’s try a different example, like, say, a house. You can buy a house for money and sell it for money. You could instead, however, build a house. Building is the use of energy to assemble materials into a house (or whatever else you’re building). It also involves transporting the materials to where you’re building the house, which takes energy. And to make those materials in the first place takes energy. And to maintain the house requires energy — keeping it clean, heating and cooling it, operating its appliances, etc… So, a house is very much a product of energy, too.

Which then brings us to another question:

Without belaboring our examples too far, we’ll find that whatever man-made thing we consider, it takes energy to make it. The word “made” in the phrase “man-made” is the giveaway. To make something requires putting effort into making it. Effort is energy.

As it turns out, energy is a very broad concept. Energy is the very ability to do work. And what’s work? Work is the ability to apply energy to things to change them from the way they are — to move them, assemble them, separate them, burn them, and so on. Work is energy.

There are many different types of work, of course. Human beings specialize in the kind of work they each do because no one human can learn how to do all the kinds of work that we find useful.

There are some types of work that all of us have to do. Consider eating. Eating is work. It’s the use of some energy to break down food so our bodies can do the work of digesting it and turning it into more energy, which we can then use to do more work — work that we either need or want to do.

Then there is the work that we do that is incredibly specialized. Performing surgery, for example, is a type of work that only extremely well-trained and highly skilled people can do. It is very high-value work for the reason that it is both valuable and scarce. And to do that, specialized surgical work requires even more work from other highly specialized workers: those who build and maintain operating rooms, who create surgical instruments, who provide assistance in the operating room, who make the chemicals that anesthetize the patient, and so on. And those people need the results of the work of the people who supply them with the materials and knowledge they need to do their work. It’s an endless chain that’s almost impossible to get to the bottom of: A surgeon needs a scalpel. The scalpel maker needs the work of steel producers. The steelmaker needs the work of iron miners. The iron miner needs the work of an excavator manufacturer, who in turn require the effort of factory workers. The factory workers need food. The food growers need fertilizer. And it just keeps going on — endlessly.

Because we rely on so much specialized work stacked together in such a complex manner in our industrialized civilization, we must use money regularly. Money is what allows enterprises to come together. If you are going to get an operation, you don’t need to exchange your specialized work directly for the work of the surgeon, the use of the operating room, the presence of an anesthetist, the anesthetic medicines, the monitoring equipment, the instruments, the stitches, and so on. All of that is taken care of by money. Money is the machinery that coordinates it all.

You exchange your specialized work for money. And because everyone else does, too, enormous chains and webs of adding value can take place without anyone even thinking about what it takes to create that value one or two links down that chain, let alone hundreds of links upstream or downstream of the work we do. If you grow food, you do not need to know (and you never will know) if its energy was used by a surgeon, an iron miner, or a factory worker. And it’s none of your concern either. It’s the “miracle of money” that it orchestrates all of this activity without anybody needing to know any of it. Money performs an organizing function that no organization can. That’s probably why the system that doesn’t try to have an organization to coordinate all economic interactions was named capitalism — capital being another term for money.

Value may look objective because there are many things that we all highly value, like water, food, and energy. However, that is a mistaken categorization. It’s true that water is objectively valuable to all human beings. But the conclusion doesn’t follow that that value itself is objective. This we can see because there are so many things that are valuable to some people and not to others. A word processor is very valuable to me, but not so much to an iron miner.

If your work is more valuable to me than it is to someone else, I’ll probably pay you more for it than they will. This is the simple building block of how a free market works. We all bring our subjective value judgments with us everywhere we go, along with our money and our ability to do the specialized work we know how to do. We exchange our work for the money of others who value our work, and we exchange our money for the work of others that we value. Money for work. Work for money. This simple building block leads to people discovering and creating incredible things of tremendous value.

Behold our present-day civilization with so many everyday, commonplace things that would have seemed miraculous, impossible, or even unimaginable to our ancestors. All of this arose as an emergent consequence of people trading money for work — work being the ever-increasing specialization of the application of energy.

Just by letting people trade their specialized work for money and leaving them to do it, we can now fly. We can do it at over 500 miles per hour, 40,000 feet up in the air, all while watching a moving picture telling a dramatic story and sitting in a reclining chair, sipping on a beer, and snacking on cookies. But we can only perform this miracle if we have enough money. Nobody can build a jet airplane on their own, let alone pilot it, while watching a movie they themselves made, eating cookies they baked, and drinking beer they brewed.

There may indeed be things money can’t buy, but there are also things that only money can buy!

If you’re concerned that I’m leaving the matter of knowledge out of this discussion, let me allay you of those concerns. Knowledge itself is also a product of work. It does not come automatically. Consider, in fact, just how much we are prepared to pay to obtain the knowledge to perform a skill that will earn us money. That is a huge part of what the entire purpose of formal education is.

Moreover, knowledge, if not actually applied through the doing of work, is not actually valuable. If you know how to perform a life-saving operation but don’t do the work of performing it, no value is created — in this case, no life is saved. Knowledge is a value gained by doing work which allows us to perform specialized work.

You may have to pay to obtain the training to learn how to do some kind of specialized work, but, just like you must do the work of eating food yourself to obtain its value, you’ll always have to do the work yourself of learning the knowledge to be able to apply it in your future work. The more specialized our knowledge is, the more specialized our work becomes, and the more valuable it becomes, but only in a world where money exists.

To summarize:

We all do work to obtain things that are valuable to us.

Most of those things that are valuable to us require other people to do specialized work we cannot do because we don’t know how to do it, don’t have the tools to do it, and don’t have the time to do it.

So we use money as the medium to store the value of the work we did (while “at work”) to later exchange that money for the work of others.

We can thus conclude that money is the substance through which we transform one type of specialized work performed at one place and time to other types of specialized work performed at other places and times. Or put more briefly:

Money converts specialized human energy across time and space.

Moreover, money is the only thing that does this. If we didn’t have money, we wouldn’t bother to learn how to do highly specialized work, because we would be able to sell it for the highly specialized work of other people.

Money is the only thing a surgeon can actually use to convert their surgical work into the work required to fly them to a vacation destination.

From this perspective, money is a time machine. It transports and converts energy across time, motivating people in the present to now do work for people who did work in the past, with the expectation of being able to get other people to do work in the future. Money can literally give you the ability to take your energy today and transform it to someone else’s energy in the future.

Although we take this for granted, and it sounds so simple, humans are the only living beings we know of who use money. It’s not so simple or obvious or natural even at all.

In practice, throughout history, this machine we call money has always had one big problem. We might call it the fundamental problem of money.

The problem arises from one of our greatest virtues — ingenuity. We are always figuring out how to make more of something more quickly and with less work (even if sometimes it’s just figuring out how to give that appearance rather than actually achieving it).

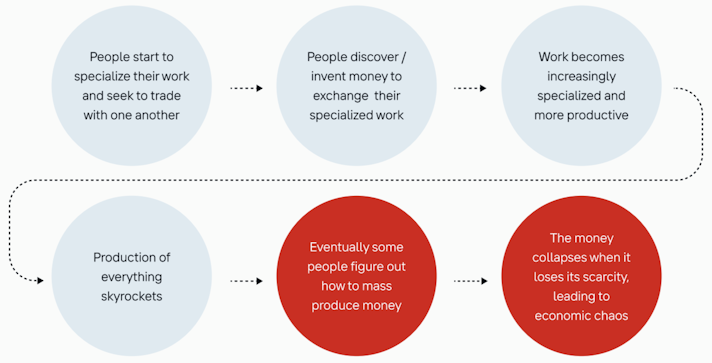

Now, if it takes less work to make money than the money buys, some people will focus on “creating” more money than on doing work that earns them money others worked to earn before. For almost every form of money that ever came before Bitcoin, it went through a process where, over time, some people figured out how to make more of it with less work. And in every instance where it became easy to make lots and lots of it, that form of money ended up “de-monetizing.” Whether it was salt, seashells, beads, spices, physical coins, or paper notes, human ingenuity (or craftiness) eventually destroyed the monetary power of that instrument to enable people to convert their work overtime for the work of others.

Sooner or later, human ingenuity aligned with human incentives to lead to a breakthrough in producing money, which led to the collapse of money. It’s like an ironic, fated tragedy.

This is no small problem. Empires collapsed for this reason.

Maybe it’s actually no wonder that no other animals use money. Nature may view money as a trait that is only a temporary strength for a species but ultimately a weakness.

Over time, increasing knowledge and specialization leads to the mass production and collapse of money, undermining its foundation as the basis of a civilization of specialized knowledge workers.

But now, behold Bitcoin. For the first and only time ever, there is something that no amount of human ingenuity (or craftiness) can make more of. Bitcoin is a money mechanism with numerous verifiable and unalterable measures that forever prevent this problem that ultimately destroyed everything else we ever used for the machinery of money. Bitcoin’s supply cannot ever be accelerated beyond its issuance schedule nor increased beyond its final total supply.

No wonder people get so excited about this. They can see that Bitcoin will be a reliable machine to convert their work today into the future work of others.

The more one understands about Bitcoin, the more they can see that it is in fact built to solve this problem in a way no other money ever before could. Every other money before Bitcoin could be increased in supply by putting more work and ingenuity into creating it. But with Bitcoin, putting more work into creating it does not create anymore. Instead, putting more work into the process that creates Bitcoin (i.e., mining) only means that the existing supply of Bitcoin becomes more secure, more reliable, and thus, more valuable!

In every previous form of money, those who put energy into creating more of it created that money at the expense of those who already had money. Their creation of money grew (i.e., inflated) the money supply, reducing the amount of work a given amount of money could buy.

With Bitcoin, for the first time ever, this is not the case! No matter how ingenious miners get, they can’t increase the supply of Bitcoin beyond the known cap, nor can they accelerate its issuance any faster than its pre-ordained schedule. In fact, unlike all previous monies, the miners work in service of the users rather than at their expense. In Bitcoin, those who put energy into the discovery of more Bitcoin don’t do so at the expense of other users of Bitcoin. Rather, they do it in the service of users of Bitcoin. The service they provide makes the money transferable, reliable, auditable, secure, and more. In performing this service, they don’t change the expected and known supply of the money at any given point in time by even a single satoshi.

As we enter a year with a halving upon us, it’s worth noting that these events lead Bitcoin to deterministically have a declining rate of growth of its supply. This is the exact opposite of what human ingenuity eventually succeeds at doing with all other forms of money. Bitcoin’s rate of supply discovery is slowing down by half every four years. This is also a first for any commodity or good in all history!

In inventing Bitcoin, Satoshi solved not just the double-spending problem. Satoshi solved this Fundamental Problem of Money — that sooner or later, its supply started to grow faster and faster, leading to the collapse of its primary purpose.

The imalleable supply cap is the solution to the Fundamental Problem of Money — and it changes everything.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Tomer Strolight is Editor-in-Chief at Swan Bitcoin. He completed bachelors and masters degrees at Toronto’s Schulich School of Business. Tomer spent 25 years operating businesses in digital media and private equity before turning his attention full time to Bitcoin. Tomer wrote the book “Why Bitcoin?” a collection of 27 short articles each explaining a different facet of this revolutionary new monetary system. Tomer also wrote and narrated the short film “Bitcoin Is Generational Wealth”. He has appeared on many Bitcoin podcasts including What Bitcoin Did, The Stephan Livera Podcast, Bitcoin Rapid Fire, Twice Bitten, the Bitcoin Matrix and many more.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.