GBTC was the Genesis of the Crypto Credit Contagion (Part II)

There are many reasons to criticize DCG and Genesis. Moreover, the drama highlights why holding Bitcoin is a superior option for investors. No fees or if your money benefits a company that doesn’t align with your values.

Over a year ago, I wrote a detailed article highlighting the role that Digital Currency Group (DCG) and its subsidiaries Genesis and Grayscale played in contributing to the contagion that we saw rip through the broader cryptocurrency industry in 2022.

What lay at the heart of it all was Grayscale’s Bitcoin Trust, GBTC. At the time, the structure of GBTC was a closed-end trust without a redemption mechanism. This led to significant market inefficiencies, most notably the fluctuation of GBTC shares' price relative to the Bitcoin price, which consisted of the premium or discount to the Net Asset Value (NAV). For many years, GBTC traded at a premium, which provided lucrative arbitrage opportunities for investors.

Source: Bloomberg

To summarize the “GBTC Premium Trade, ” investors would do the following:

Step 1: Buy or borrow Bitcoin

Step 2: Give that Bitcoin to Grayscale in exchange for GBTC shares

Step 3: Hold the GBTC shares for the 6-month lock-up period

Step 4: Sell the GBTC shares at a premium when the lock-up ended

Step 5: Rinse and Repeat

Investors could optionally also short Bitcoin or use futures to offset their Bitcoin exposure while they were in the trade, thereby ensuring their profit would be in dollar terms rather than Bitcoin terms.

This was effectively “free money” for these firms, and often, they would obtain leverage from lenders like Genesis to put on this trade.

This GBTC Premium Trade was extremely lucrative for both the firms putting on the trade and for DCG, at least while it lasted. Everything changed when the GBTC premium collapsed in 2021, flipping to a steep discount. This shift had far-reaching consequences.

Firms like BlockFi and Three Arrows Capital (3AC), which were heavily invested in this arbitrage trade, went bankrupt. The end of the premium era led to a domino effect of bankruptcies among major crypto lenders and hedge funds, highlighting the precariousness of leveraging such market inefficiencies.

The GBTC Premium Trade quickly became the “Widowmaker Trade,” and in many ways, the impact of GBTC is still being felt today as the market is still dealing with its hangover effects.

As I mentioned in the previous article, there is plenty of blame to go around for why GBTC became such a toxic wrecking ball for the broader cryptocurrency industry. You can blame the crypto lenders for their shockingly poor risk management. You can also blame hedge funds and institutional investors for putting on extremely risky trades with obscene amounts of leverage. You can blame Genesis/DCG for providing the leverage in the first place to pump its revenues. Lastly, you can blame the SEC, which denied Grayscale from converting GBTC into a spot Bitcoin ETF for years, which would have eliminated the market inefficiency and better-protected investors.

When the SEC finally approved the ETFs this January, SEC Commissioner Hester Peirce wrote a letter that applauded the decision and criticized the Commission for the harm it caused by denying these investment vehicles for so many years.

She wrote, “The Commission has driven retail investors to less efficient means of attaining Bitcoin exposure in the securities markets.” Presumably, by “less efficient means of exposure,” Peirce likely meant Bitcoin Futures ETFs and GBTC.

She then goes on to list out five harms caused by the SEC’s consistent denials for spot Bitcoin ETFs:

Source: SEC.gov

These are all reasonable points from Commissioner Peirce, but she fails to include the biggest harm done by the SEC’s failure: the potentially hundreds of thousands of investors who have lost their life savings due to contagion caused by GBTC and the actors behind it. If the SEC had approved a spot Bitcoin ETF, firms wouldn’t have been incentivized to pump obscene amounts of leverage into the GBTC Premium Trade, only for it to explode in their faces, causing a string of bankruptcies that ultimately harmed investors.

But the world looks very different today than when I first wrote the aforementioned article years ago. Multiple lawsuits have been filed against Genesis and DCG since then. Genesis has declared bankruptcy. DCG CEO Barry Silbert has resigned from Grayscale’s board of directors. Plus, the SEC has now approved the conversion of GBTC into a spot Bitcoin ETF. Due to all of these developments, I felt that an update was warranted on this ongoing fiasco.

In this piece, I will dig into what happened to Genesis, how poor management led to its collapse, how DCG actually contributed to its downfall, and where things stand today.

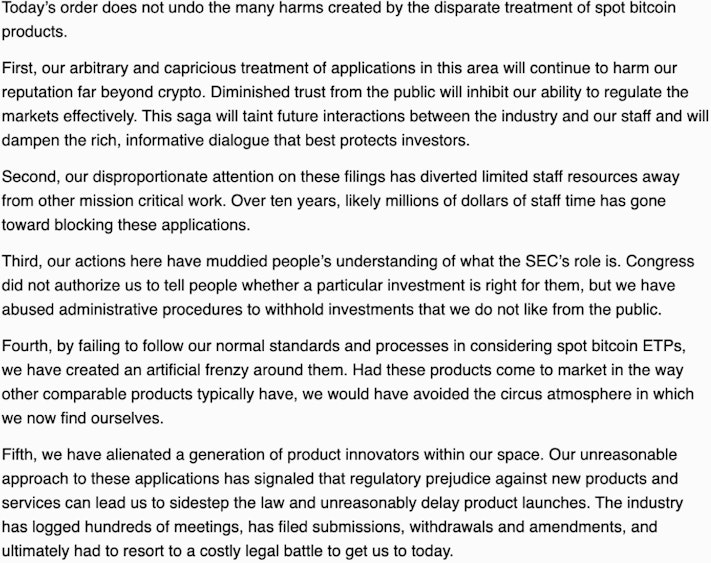

On January 11th, the newly approved spot Bitcoin ETFs went live, but one of them is not like the others.

Source: James Seyffart

When GBTC was converted into a spot Bitcoin ETF, it already had more than $26 billion in Bitcoin, while the other ETFs started essentially from scratch.

Since then, we have seen a massive $6.1 billion in sales out of GBTC. These outflows have occurred for numerous reasons. For one, many traders were putting on another, newer trade, which I’ll call The GBTC Discount Trade. They were betting on Grayscale getting converted to an ETF and the discount going to 0%. They were right. The GBTC discount gradually disappeared leading up to the ETF approval.

Source: Bloomberg

Once GBTC was converted to an ETF, these traders took profit after their successful arbitrage trade.

The second reason for these outflows is that Grayscale maintained its annual fee at 1.5% while the other ETFs were all charging much lower fees. Many investors appear to be rotating from GBTC to those cheaper ETF alternatives. A third factor is that many bankruptcy estates are now selling their GBTC holdings.

The first of these was the FTX Bankruptcy Estate, which sold 22 million GBTC shares worth approximately $1 billion after GBTC was converted.

The next one will likely be Genesis, which is currently looking to sell nearly 36 million shares of GBTC.

This points to the fact that the market is still absorbing the GBTC contagion from years ago.

The firms that went bankrupt after the GBTC premium trade collapsed have now become forced sellers of GBTC, which has put significant sell pressure on the price of Bitcoin itself.

But precisely how Genesis became the holder of so much GBTC is an interesting story in itself.

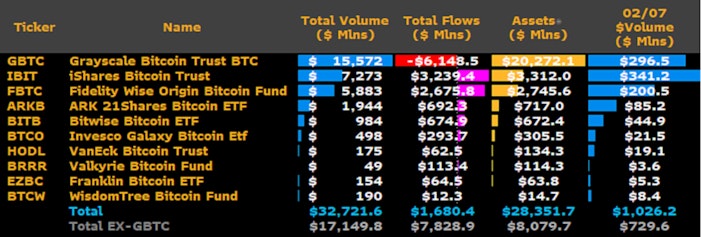

To understand the collapse of Genesis, it’s important first to understand the company’s structure. DCG is the parent company of Genesis, which was a large crypto prime brokerage firm, mainly offering lending and trading services to institutional investors and high-net-worth individuals. Note in the graphic below how DCG is also the parent company of Grayscale.

Genesis didn’t mind providing the leverage to put on the GBTC Premium Trade because, ultimately, it was good business for it to originate more loans. In addition, the Bitcoin it was lending out to put on the trade would end up in its sister company, Grayscale. Due to there being no redemption mechanism in GBTC, once the Bitcoin entered GBTC, it never left. Grayscale would then go on to collect a hefty 2% annual fee on that Bitcoin. The more Bitcoin in the trust, the greater Grayscale’s revenues. And all of that money eventually flowed up to the parent company, DCG.

In the end, it’s all about incentives, and Genesis was incentivized to provide loans to firms to put on the GBTC trade because it was good for Genesis, it was good for Grayscale, and it was good for its parent company, DCG.

Genesis would source its Bitcoin from its customers by offering interest for them to park their Bitcoin on their platform. They would then turn around and lend that Bitcoin out at higher interest rates to borrowers and pocket the difference between the rates.

One of its biggest borrowers was Three Arrows Capital, which was keen on getting as much Bitcoin as possible to put on the GBTC Premium Trade. Genesis was more than happy to provide Three Arrows Capital with the leverage to put on the trade because the Bitcoin would end up in the Grayscale trust.

In late 2021, Three Arrows Capital was the largest shareholder of GBTC, and they were able to acquire that much GBTC by borrowing from Genesis.

Source: Bloomberg

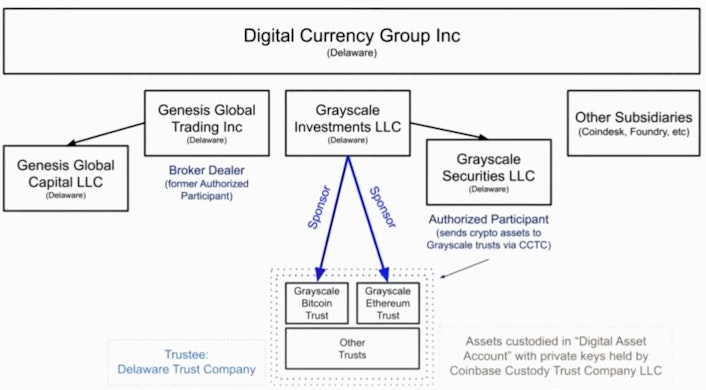

Documents show that even Grayscale was aware that Genesis was providing Three Arrow Capital with the Bitcoin to purchase the GBTC. Below is a document that shows that Grayscale CEO Michael Sonnenshein signed off on the Genesis loan to Three Arrows Capital.

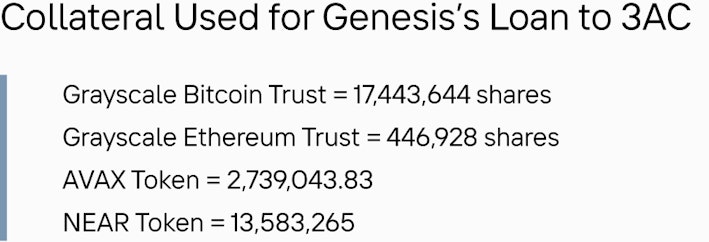

This loan was not small either. From 3AC’s bankruptcy filings, we now know that Genesis loaned Three Arrows Capital a whopping $2.3 billion dollars. To make matters worse, the loan was undercollateralized with GBTC and other illiquid cryptocurrencies.

Source: Grayscale SEC Filings

Ultimately, when Three Arrows Capital went bankrupt in June 2022 after the GBTC premium disappeared, Genesis obtained some of these GBTC shares.

However, since the loan was undercollateralized, Three Arrows Capital still blew a $1.2 billion hole in Genesis’s balance sheet.

Not only did Genesis have a giant hole in their balance sheet, but the collateral they received, the GBTC shares, was illiquid. On June 13th, 2022, Silbert informed the DCG board that some of the collateral Three Arrows Capital provided Genesis was illiquid because GBTC was issued by DCG-subsidiary Grayscale, which Genesis could not liquidate due to restrictions on sales of stock by its issuing company’s affiliates.

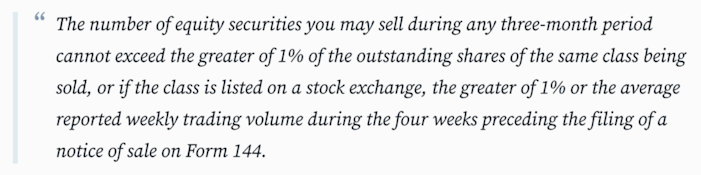

What Silbert was referring to is an SEC restriction called rule 144A. It is explained on the SEC’s website below,

Due to this rule, Genesis would legally only be allowed to sell ~7 million GBTC shares every quarter. This was a problem for Genesis because it needed liquidity immediately to service its withdrawals.

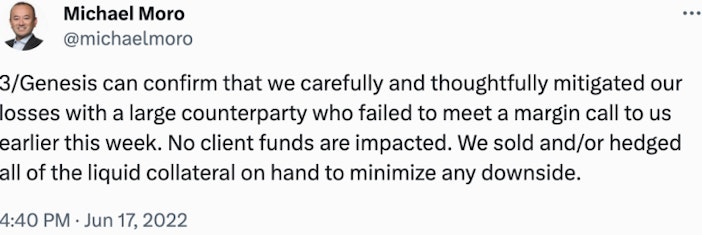

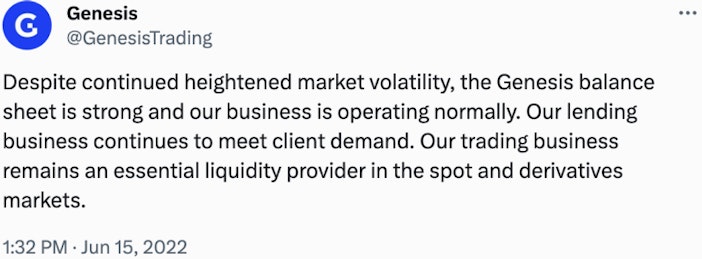

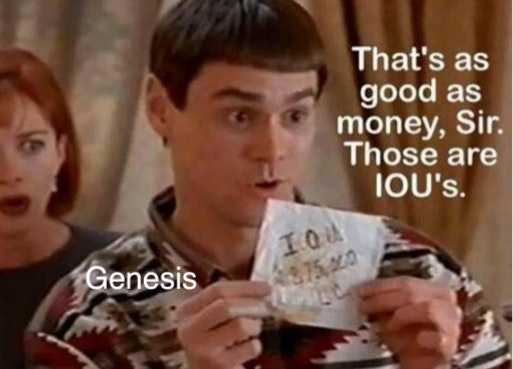

At this point, Genesis was effectively insolvent. If all of its customers tried to withdraw their funds, they would not have been able to service them. But instead of publicly admitting this and declaring bankruptcy, Genesis concocted a plan to avoid doing this with its parent company, DCG. Genesis CEO Michael Moro tweeted reassurances:

Source: Twitter

Around that time, Genesis even tweeted out that its balance sheet was “strong” despite a gaping billion-dollar hole in it.

Source: Twitter

This alleged misrepresentation was highlighted in the NYAG lawsuit against Genesis, Gemini DCG, Barry Silbert, and Michael Moro, which stated, “DCG and Genesis Capital engaged in a communications campaign designed to conceal Genesis Capital’s financial condition and mislead counterparties into believing Genesis Capital was operating ‘business as usual.’

The plan between Barry Silbert and Michael Moro was that DCG would give Genesis a $1.1 billion promissory note to fill the hole in the balance sheet. DCG agreed to pay Genesis a decade later at a 1% interest rate, well below market interest rates. Genesis then categorized this promissory note as a “current asset” on its balance sheet, or the equivalent of cash, when it was far from it.

After the promissory note was signed by Silbert and Moro, Moro tweeted that DCG had assumed the liabilities of its Three Arrows Capital loss with the note and ensured the public that Genesis had the capital to continue long-term.

Source: Twitter

In reality, this promissory note did nothing to fill the hole in Genesis’s balance sheet. Some have argued that this was more of an accounting trick to reassure Genesis users and prevent a bank run from occurring. However, it all unraveled for the lender when FTX blew up in November 2022. Genesis lost $175 million when FTX collapsed. This proved to be the final nail in the coffin. On November 16th, Genesis suspended withdrawals, and on January 19th, it filed for bankruptcy.

So Genesis was sitting on a lot of illiquid GBTC shares that it couldn’t sell because it accepted them as collateral for loans given to hedge funds like Three Arrows Capital to put on the GBTC Premium trade with leverage.

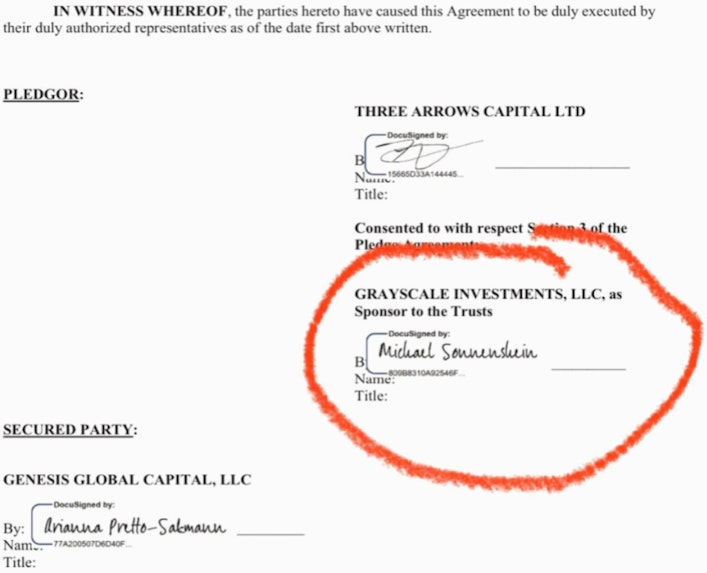

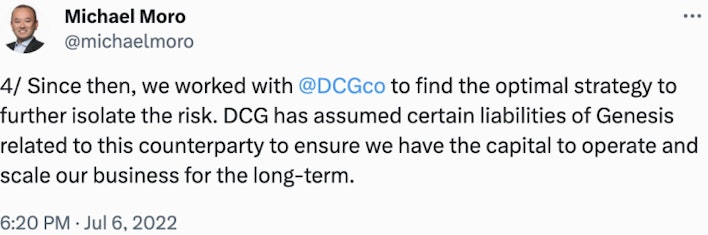

What did Genesis do with these illiquid shares? Well, some of them were used as collateral for the Gemini Earn program. In August 2022, Genesis pledged around 30 million GBTC shares to “secure its obligations to the Gemini lenders.”

Source: Genesis Bankruptcy Files

The Gemini Earn program was a joint venture with the cryptocurrency exchange Gemini, in which Gemini customers could collect interest payments by loaning their digital assets. Genesis served as the program’s only counterparty. The SEC later charged Genesis and Gemini for offering the sale of unregistered securities through this Gemini Earn program.

Genesis later settled with the SEC for $21 million for its role in the Gemini Earn program.

Genesis is now looking to sell all of the GBTC shares that were used as collateral for the Gemini Earn program.

So Genesis is sitting on millions of GBTC shares partly because 1.) It obtained some from the Three Arrows Capital bankruptcy, and 2.) It used GBTC shares as collateral for the Gemini Earn program, which was later deemed illegal by the SEC.

Here’s where things get interesting — it was later discovered that Genesis’ parent, DCG, was actually worsening this whole situation as it unfolded. When Genesis needed liquidity, the most, DCG was actually draining it from them.

From January 2022 through July 2022, DCG borrowed over $800 million from Genesis through multiple loans.

The first loan DCG took out was an unsecured $100 million loan from Genesis that was set to mature in late July 2022. But instead of paying it back when Genesis needed the liquidity the most, DCG informed Genesis that it “[literally] did not have the money right now” and “gave guidance” to Genesis to extend the loan to May 2023.

The Genesis manager initially objected to this but relented, stating, “It sounds like we don’t have much room to push back, so we will do what DCG needs us to do.” On top of that, DCG dictated what the interest rate would be on the loan.

The second loan DCG took out was another unsecured $100 million loan that was set to mature in late August 2022. Similarly, DCG did not pay and had Genesis extend the loan to May 2023.

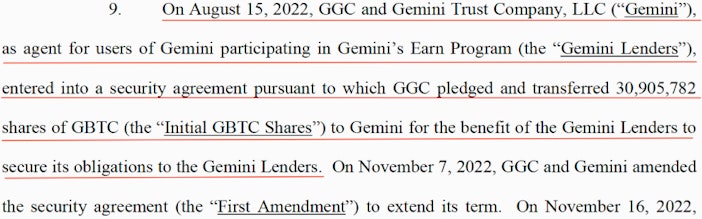

A third loan occurred in early June 2022, right in the middle of the Three Arrows Capital collapse, when Genesis was running around putting out fires, desperate for liquidity. Despite its predicament, Genesis still chose to lend DCG a massive 18,697 Bitcoin worth around $355 million at the time.

Source: Genesis Loan Term Sheet

After the FTX collapse, DCG partially repaid this loan — but not in Bitcoin. On November 10th, 2022, DCG repaid the loan with nearly 26 million GBTC shares worth approximately $250 million. DCG then made Genesis extend the loan on the remaining 4,550 Bitcoin to, once again, May 2023.

So this is how Genesis ended up with another large tranche of GBTC shares. I’ll remind the reader of rule 144A mentioned earlier. Genesis was restricted from selling these GBTC shares, so by consistently forcing Genesis to extend its cash loans and choosing to partially repay its Bitcoin loan in GBTC shares instead of Bitcoin, DCG actually worsened Genesis’s liquidity crunch.

Things didn’t get better for Genesis after it declared bankruptcy. DCG’s loans came due in May 2023, but DCG failed to pay them again.

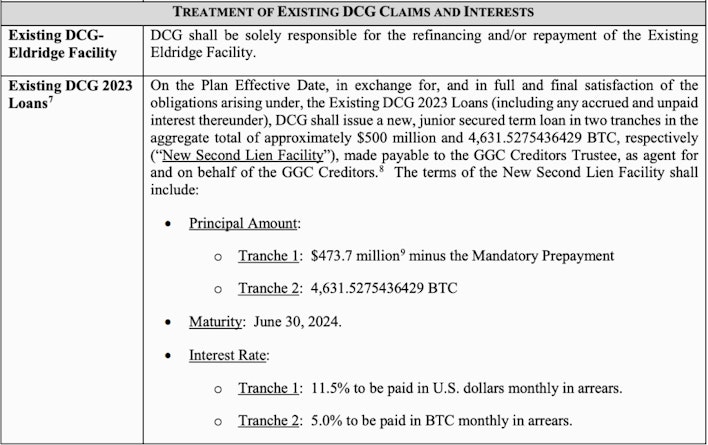

However, the loans were restructured once again to avoid an outright default. This time, the loans were extended to June 2024.

Source: Restructure Term Sheet

So, even in bankruptcy, DCG continued to cause problems for Genesis and its creditors.

Instead of paying off its loans and helping Genesis creditors recoup their funds, DCG put up collateral and promised to repay the loans over time.

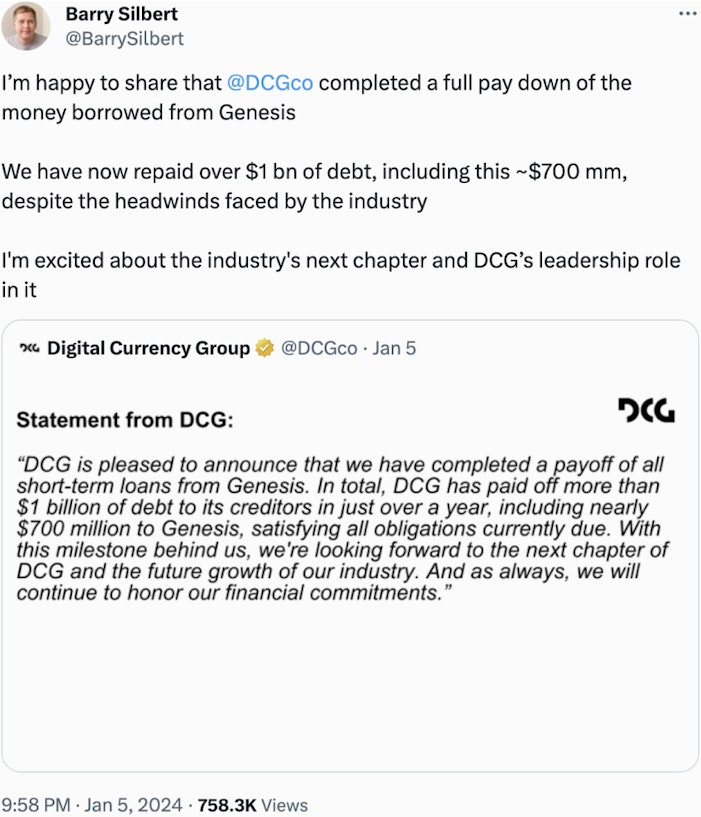

Finally, after Genesis was forced to sue its parent company to recoup the funds, and over seven months after the loans should have been repaid, Silbert took to X to publicly claim that DCG had fully paid off all of the money it borrowed from Genesis.

Source: Twitter

But this claim is being disputed. DCG did not, in fact, pay back the 4,550 Bitcoin that it owed Genesis. Instead, it gave Genesis the collateral it put up when the loans were extended in May 2023.

What was that collateral? Well, it wasn’t Bitcoin. It consisted of shares of Grayscale Ethereum Classic Trust and Grayscale Ethereum Trust. These are highly illiquid securities. This matters because when the Genesis bankruptcy estate goes to sell them, there will likely be significant price slippage, resulting in the face value of these assets falling below what it would have been if they were paid in Bitcoin instead.

According to the partial repayment agreement, DCG was only allowed to settle its USD and BTC obligations in those currencies, not in other assets, but DCG did it anyway. Genesis now claims that DCG still owes them more Bitcoin and about $26 million in interest and late fees.

And the saga continues…

It’s been over a year since Genesis filed for bankruptcy, and its creditors are still awaiting full repayment from DCG. Meanwhile, DCG continues to roll in profits from its cash cow, Grayscale, after it was converted into an ETF.

Despite the significant outflows in GBTC, the Grayscale ETF still holds more than $20 billion in Bitcoin. At a 1.5% annual fee, that means that Grayscale is bringing in roughly $300 million in annual fees.

The only logical explanation for why DCG failed to repay its loans to its subsidiary for so long was that it was also financially in trouble. Evidence of this theory can also be found in the fact that they were selling other valuable assets last year.

In November, DCG sold popular events and media company CoinDesk in an all-cash deal.

I’m speculating, but I think DCG has stalled in these bankruptcy proceedings because it was waiting for Bitcoin’s price to go up and/or for the GBTC discount to disappear when it would eventually be permitted to become an ETF. Perhaps no entity in the world benefited more from Bitcoin’s stellar 2023 than DCG. As the price of Bitcoin soared, DCG’s revenues increased significantly due to its large Bitcoin holdings. This likely put them in a better position to finally, at least partially, pay their loans to Genesis.

I wish to note that I am working only with publicly available information in this piece. There are no doubt details about this story that are not public knowledge and the lawsuit from the NYAG is still ongoing. DCG has called NYAG’s lawsuit “baseless” and said, “DCG has always conducted its business lawfully and with integrity, and DCG and Barry Silbert will be fully vindicated.” However, the evidence paints a picture that there was a whole lot of chicanery here (as my friend Vijay Boyapati likes to say).

In the end, there are many reasons to criticize how DCG and Genesis handled the predicament they found themselves in during the Great Crypto Contagion of 2022.

Instead of being honest with the public and their creditors, it appears they misled them and tried to paper over their losses with accounting tricks that are alleged to be fraudulent. The NYAG lawsuit claims they defrauded more than 230,000 investors of approximately $3 billion.

If you want to hear about the nightmare that some of these Genesis clients have gone through during this whole ordeal, I recommend listening to this podcast with two Genesis creditors. It’s important to remember that there are real victims when situations like this unfold.

This drama highlights why holding native Bitcoin is a superior option for investors. By holding actual Bitcoin, you don’t have to worry about any annual fees or whether your money benefits a company that doesn’t align with your values. Plus, you never have to worry about your Bitcoin getting stuck in bankruptcy proceedings. This is the real way investors can navigate this market and protect themselves.

In the near future, I expect the court to grant Genesis permission to sell the $1.4 billion worth of GBTC shares.

In addition, Genesis has just won another court decision, which found that it was the rightful owner of an additional 31.2 million GBTC shares related to the same Gemini Earn Program mentioned before. This additional tranche of GBTC shares is currently worth more than $1.2 billion.

Eventually, Genesis will likely sell these GBTC shares, too, as it liquidates assets to pay off its creditors. It’s important to note that the Genesis creditors will be paid in-kind (in BTC). So even though around 67 million shares will be sold, the Genesis bankruptcy estate will be buying the spot bitcoin to give to its creditors. The question really becomes, “What percentage of these Genesis creditors will be selling their BTC holdings?”

Regardless of what that percentage is, these developments will likely result in some non-trivial amount of sell pressure on Bitcoin itself. However, eventually, this toxic garbage will be absorbed by the market. These GBTC selling events can only occur once. Once that bullet is shot, it’s done. All in all, it’s good that the toxic remnants from the last cycle are being washed away so that Bitcoin can proceed cleansed and renewed for the next bull run.

Special thanks to Vijay Boyapati for writing two excellent Twitter threads that inspired some of this writing. If you haven’t read them, you can find them here and here.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.