What’s Driving Bitcoin’s Price in the Current Debt & Inflation Predicament

Fulfilling its destiny as a hedge against reckless fiscal and monetary policies, Bitcoin has proven its mettle in its first fourteen years of existence. Let’s look at the current debt and inflation predicament.

Swan Private Insight Update #25

This report was originally sent to Swan Private clients on July 17th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

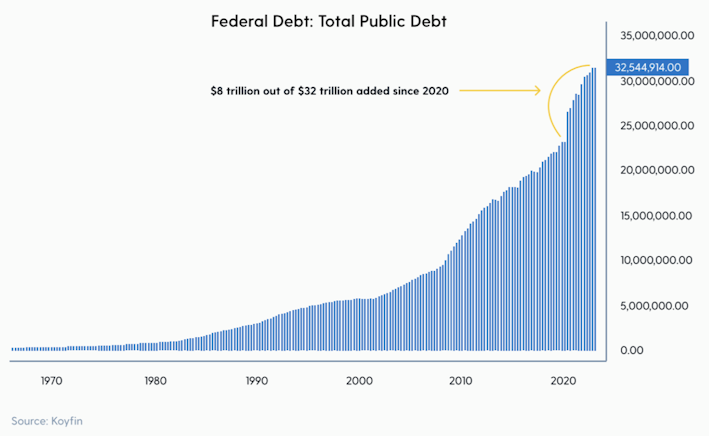

It’s hard to believe that it’s been almost three years since the U.S. government, in collaboration with the Federal Reserve, injected trillions of dollars into the economy in response to the pandemic and economic lockdowns of 2020.

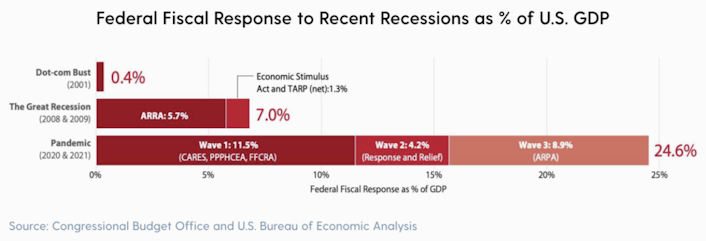

The federal fiscal response to the pandemic dwarfed stimulus packages from the past. In total, the combined stimulus actions totaled 24.6% of debt-to-GDP. To put that into perspective, the fiscal response during the Global Financial Crisis in 2008 totaled only 7.0%.

The fiscal response arrived in three waves:

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Coronavirus Response and Relief Supplemental Appropriations Act, and the American Rescue Plan Act came as a combination of direct stimulus checks to households, boosted and extended unemployment benefits and a plethora of loan facilities, tax breaks, and other corporate subsidies.

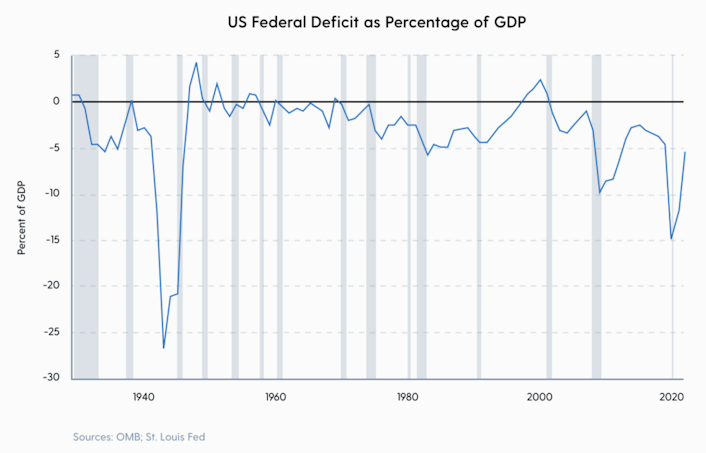

As a result of these fiscal policies, the U.S. federal deficit exploded to nearly 15% of GDP in 2020, levels not seen since World War II.

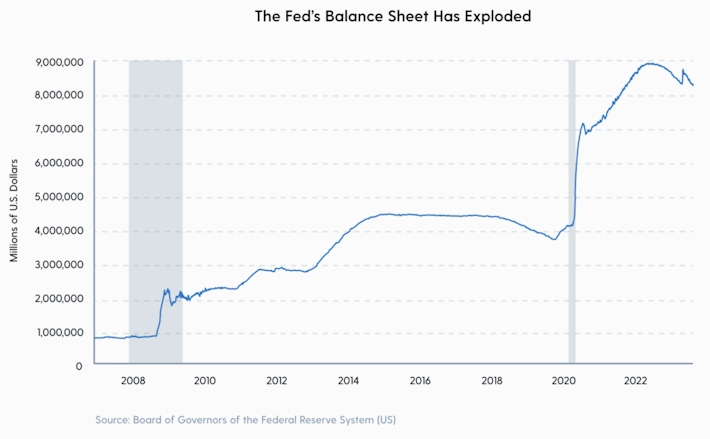

The Federal Reserve primarily monetized this fiscal stimulus, which saw its balance sheet explode during the pandemic. Unlike previous times, the Federal Reserve monetized multi-trillion-dollar fiscal stimulus packages passed by Congress that went directly into the real economy.

In addition, $454 billion was authorized in the CARES Act to fund the Fed’s new large-scale asset purchase program (Quantitative Easing). This $454 billion was leveraged by the Fed to add about $4 trillion dollars worth of assets to its balance sheet, which the Fed did rapidly.

To give you an idea of how large and quick the Fed’s Q.E. program was in 2020, the Fed bought $625 billion worth of bonds in one week, more than its entire Q.E. program during the Global Financial Crisis about a decade earlier.

In Christopher Leonard’s book “The Lords of Easy Money,” he beautifully illustrated the sheer size and speed of the Fed’s Q.E. program when he wrote,

“In roughly ninety days, the Fed would create $3 trillion. That was as much money as the Fed would have printed in approximately three hundred years at its normal pace before the 2008 financial crisis.”

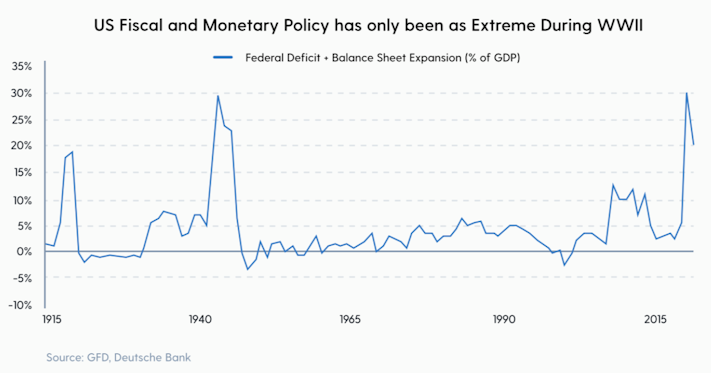

The magnitude of the U.S. fiscal and monetary policy responses to the pandemic and economic lockdowns, when measured as a percentage of GDP, was astonishing. Indeed, the combined effect of the federal deficits and balance sheet expansion was even more extreme than during World War II.

Now we could endlessly debate whether or not these actions from the central bank and government were warranted to fend off a deep recession and help households and businesses in need. Still, there is no debate about how unprecedented the size and speed of these actions were.

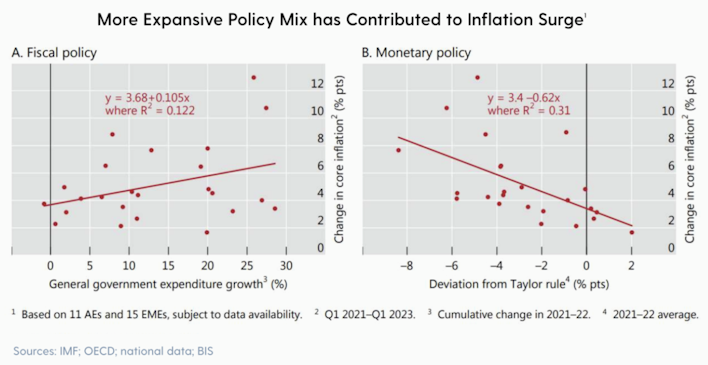

The highest inflation in decades resulted from these ultra-accommodative monetary and loose fiscal policies. The Bank of International Settlements' recent annual report revealed how central bank and government policies in response to the pandemic lockdowns, directly and indirectly, contributed to the surge in inflation.

“With the benefit of hindsight, the extraordinary monetary and fiscal stimulus deployed during the pandemic, while justified at the time as an insurance policy, appears too large, too broad, and too long-lasting. It contributed to the inflation surge and to the current financial vulnerabilities. In the longer term, the challenge is to wean growth away from excessive reliance on macroeconomic policies to set the basis for a robust and sustainable expansion.”

– Bank of International Settlements (BIS)

The charts below highlight how the change in core inflation was correlated with government expenditure and loose monetary policy.

To “deviate from the Taylor rule” means a central bank sets interest rates that don’t correspond with what this guideline recommends when it comes to its inflation targets. For example, if the Taylor rule suggests that the interest rate should be increased due to high inflation, but the central bank decides to maintain or even decrease the interest rate, it can be said that it deviates from the Taylor rule. This deviation was evident when the Fed continued to keep interest rates near zero while CPI inflation rose throughout 2021.

This BIS data provides evidence of what many market participants already knew — the monetary and fiscal policies, which resulted in the Fed’s balance sheet more than doubling, contributed to the high inflation we’ve all experienced since.

The BIS went into further detail on how exactly this occurred,

“The main channels through which monetary and fiscal policies influence economic activity differs considerably. Fiscal policy does so primarily through the direct impact of spending on goods and services and the production of some of those services, as well as through transfers to households and firms. Monetary policy works primarily through the central bank’s operations in financial markets — notably the policy interest rate — which have a pervasive effect on yields, borrowing costs, asset prices, and the exchange rate.”

During this inflation surge resulting from these policy decisions over the last several years, it has been challenging for investors to protect their wealth. Investors no longer live in a world where a traditional 60/40 bond and equities portfolio preserves one’s wealth and helps it grow over time. There are now risks to owning bonds that didn’t exist before in an era of low inflation and low-interest rates. With government and central bank policies stoking inflation, investors need to look outside of bonds to protect their life savings.

Historically, the best-performing investments in previous periods of high inflation were scarce, hard assets. One such asset is Bitcoin. So how has Bitcoin performed since the governments spent trillions and the Federal Reserve’s balance sheet exploded?

Let’s take a look. 👇🏼

On Sunday night, March 15th, 2020, Fed Chairman Jerome Powell announced a sweeping set of actions in response to growing distress in the bond markets and the equity market tanking the week before.

On that fateful night, the Fed:

Slashed its benchmark interest rate by a full percentage point to nearly zero (0-0.25%) and introduced forward guidance that it would keep rates at this level for the foreseeable future.

Announced that it would purchase at least $700 billion in government bonds and mortgage-backed securities in the coming months in a massive round of QE.

Encouraged banks to use their discount window, lowered the discount rate to 0.25%, and lowered reserve requirements to QE.

Enhanced standing U.S. liquidity swap lines by lowering the rates on currency swaps with the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, and the Swiss National Bank.

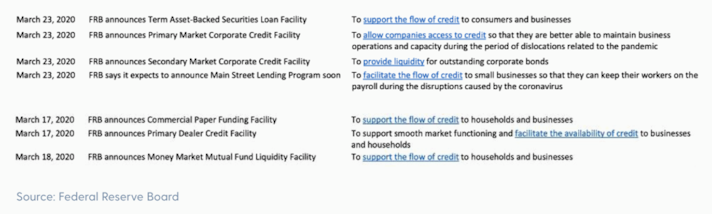

In an unprecedented move, the Fed would launch seven facilities over the next week to support the flow of credit and liquidity. This included the Secondary Market Corporate Credit Facility, which enabled the Federal Reserve to purchase corporate bonds for the first time in history.

In addition, one week after the largest QE action in history, the Fed announced it would continue to purchase Treasury bonds, mortgage-backed securities, and, for the first time, commercial mortgage-backed securities “in the amounts needed.”

The Federal Reserve said, “We will do whatever it takes.”

The Federal Reserve would go on to buy a whopping $120 billion worth of bonds every month from June 2020 until November 2021 — a rate of bond-buying unparalleled in its history.

I am recapping these Fed actions to highlight why March 15th, 2020 is a critical date in financial history. It was the night that the liquidity gates burst open. That Sunday evening, the Federal Reserve went into overdrive to maintain the flow of credit and liquidity in the financial markets and economy. As such, it is a logical starting place to measure how assets have performed since these inflationary policies were set in motion.

When we look at Bitcoin’s nominal returns relative to other major asset classes since that fateful date, we can see how it has clearly performed well in this new high inflationary environment.

This outperformance shows that Bitcoin has protected investors’ purchasing power better than every other asset class since the central bank and government flooded the economy with liquidity, and the inflation rate has soared. Perhaps the best way to recognize this dynamic is to look at the relationship between Bitcoin’s price and the expansion and contraction of the Fed’s balance sheet.

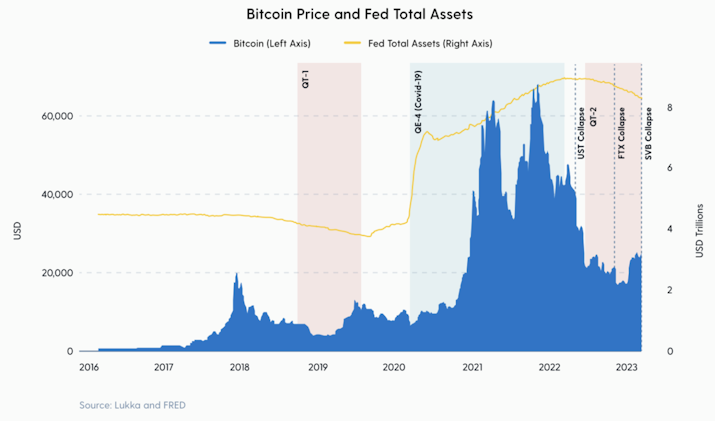

Bitcoin’s rally in 2020 coincided with a QE program that started during COVID-19 and with increased institutional interest in cryptocurrency markets.

In the aftermath of the Global Financial Crisis, multiple quantitative easing and tightening rounds occurred. After many years of giving lip service to the idea of reducing the size of its balance sheet, the Fed finally began doing so in 2018 in a process known as Quantitative Tightening.

This continued until late 2019 when the Fed pivoted and implemented what has been termed “QE-not-QE” in a bid to prevent the overnight repo market from seizing up.

This resulted in the Fed’s balance sheet expanding once again. Soon afterward came the monstrous QE programs in 2020. Since April 2022, the Fed has been reducing its balance sheet. The Fed’s balance sheet peaked at nearly $9 trillion in early 2022 and now sits at $8.3 trillion.

If you look at the history of QE and QT and the consequent rise and fall of the size of the Fed’a balance sheet, you can also observe a noticeable trend in the price of Bitcoin. Mainly, it seems that Bitcoin’s price explodes during periods of balance sheet expansion and falls when the Fed’s balance sheet contracts.

This makes intuitive sense when one understands that QE results in boosted asset prices and increased liquidity in the system. Bitcoin’s price seems to respond favorably to periods when the Fed performs QE and market and liquidity conditions are favorable. One can see that when the Fed attempts to reduce the size of its balance sheet with QT, like in 2018 and 2022, Bitcoin’s price suffers.

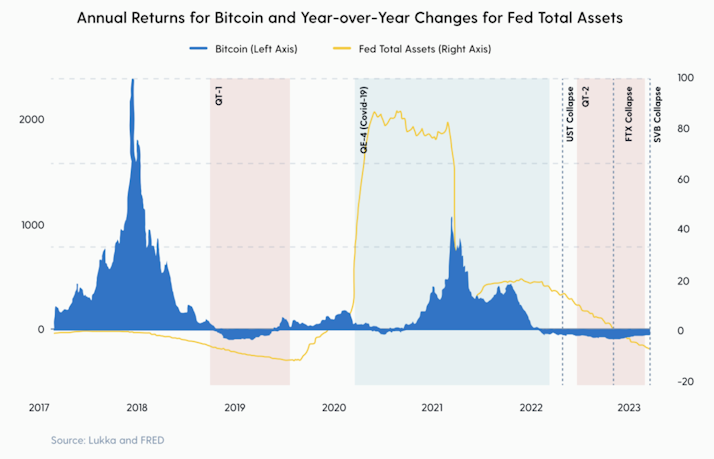

This same trend is observed when looking at the annual returns for Bitcoin and the YoY changes in the Fed’s total assets on its balance sheet. When the YoY change in Fed assets balloons, Bitcoin’s price follows, and vice versa.

This illustrates how Bitcoin’s performance is intimately tied to governments' fiscal profligacy and central banks' accommodative policies. As central banks embrace loose monetary policies and governments open their coffers, liquidity and inflation surge — and with them, so does the price of Bitcoin.

Today, the Federal Reserve persists in its Quantitative Tightening strategy, attempting to shrink its balance sheet while simultaneously hiking interest rates to tighten monetary conditions. Consequently, the price of Bitcoin has languished, remaining suppressed since reaching its peak in late 2021.

This scenario begs the question: when will the Fed again have to resort to expanding its balance sheet?

A common phrase in Bitcoin circles is that Bitcoin acts as a liquidity sponge. It has behaved this way since March 15th, 2020, reflected in its price.

We now have evidence from the central banks themselves (the BIS) that loose monetary policy and fiscal spending can lead to inflationary pressures, specifically asset price inflation. We also know that the price of Bitcoin tracks the size of the Fed’s balance sheet.

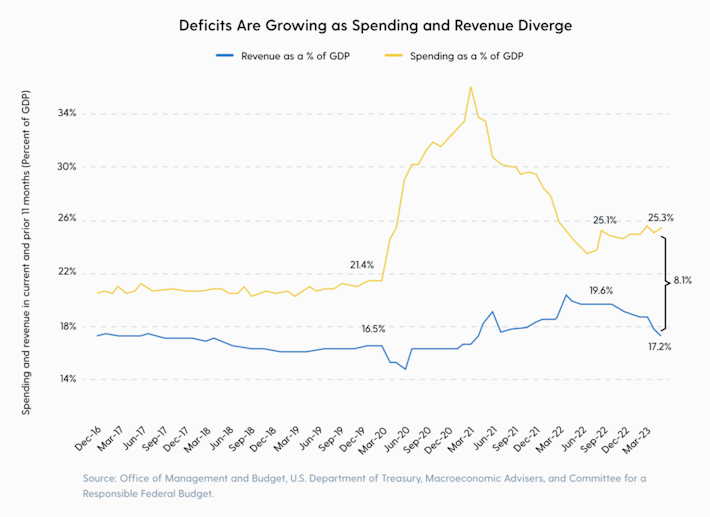

Dive into the U.S.’s current fiscal landscape, and you’ll find a picture rife with challenges. Already, the U.S. is running a federal deficit of over $1.5 trillion over the last 12 months. Worse, tax revenues continue to falter as spending remains elevated.

Tackling this fiscal problem isn’t made any easier by the Federal Reserve’s continued interest rate hikes, designed to combat inflation but paradoxically pumping up the fiscal deficit by increasing the interest expense on federal debt. In other words, the Fed’s policy to fight inflation is worsening the very thing that contributed to it (according to the BIS and other analysts like Lyn Alden) — large bouts of deficit spending.

The graph below illustrates how a significant amount of the federal debt increase has occurred in recent years due to rising debt servicing costs from the Fed’s interest rate hikes.

This underscores the tightrope the Fed must walk: high debt levels, as a percentage of GDP, can severely hamstring its ability to fight inflation with higher interest rates.

In a grim paradox outlined by the BIS, monetary and fiscal policies can end up in a deadly tug of war when these dynamics are at play. “Easy monetary policy can induce the government to build up more debt; expansionary fiscal policy can make it harder for monetary policy to be as tight as necessary, ” warns the BIS.

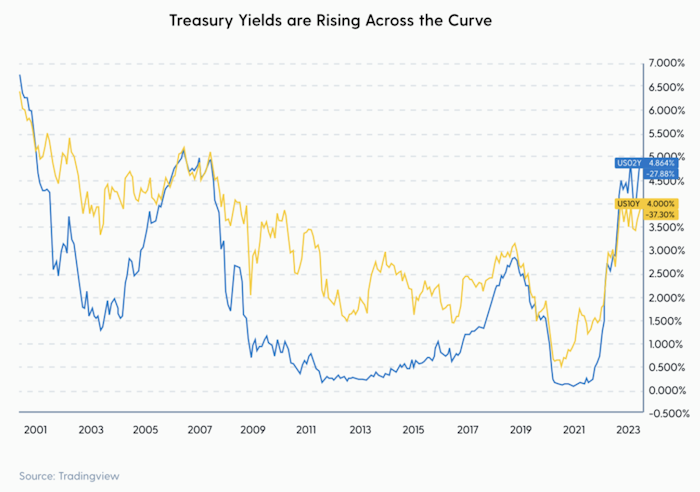

All signs point to Federal Reserve officials continuing to hike interest rates, particularly if inflation proves stubborn. They have already increased rates by 500 bps, and more hikes appear likely from their recent messaging.

If this happens, the debt servicing costs will only rise along with the federal deficit. This could also provoke bond investors to sell their bonds, recognizing that the Fed will need to raise interest rates even higher as inflation lingers. This could send yields soaring even higher, ballooning the debt servicing cost even more. One can see that bond yields continue to creep up, with the 10-year and 2-year Treasury yields recently blasting to their highest levels since 2008.

Just how high will the Fed and Treasury permit interest rates (and thus debt servicing costs) to soar before fiscal worries eclipse their concerns about inflation?

No one can know for sure what the central bank or government will decide to do in that environment. But if yields continue to rise as bond investors sell their holdings and the economy continues to run hot, then historical precedent suggests that inevitably the Fed will step in with bond-buying programs to help “facilitate the flow of liquidity and credit” and decrease the borrowing costs for the government. At this point, it would be more shocking if the Fed didn’t step in.

In that scenario, the Fed’s balance sheet would once again expand, and, at that moment, history suggests that one of the best assets for investors to own during periods of balance sheet expansion is Bitcoin.

Fulfilling its destiny as a hedge against reckless fiscal and monetary policies, Bitcoin has proven its mettle in its first fourteen years of existence. When looking at the current predicament that the government and central bank face, given the debt levels and high levels of inflation, it’s difficult to see how we won’t continue to see the same policies enacted with similar results in the years to come.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

Running the Numbers: How Fiat Pushed the American Dream Away from Millennials

By Sam Callahan

Bitcoin symbolizes hope for a generation who increasingly feel as though their futures have been stolen from them by the traditional fiat system.

Best Bitcoin ETF Fees: Lowest to Highest (May 2024)

By Matt Ruby

In this guide, we analyze and present the top 10 Bitcoin ETFs with the lowest fees for cost-effective investing.

Privacy, Executive Order 6102 & Bitcoin

By Steven Lubka

Let’s keep pushing forward for the future we want to see, one in which both the price of Bitcoin and global freedom can go up together.