GBTC was the Genesis of the Crypto Credit Contagion

Learn how GBTC works, how it’s associated with the recent crypto contagion, and why buying spot Bitcoin and taking self-custody helps you avoid all of these risks today.

This year has been a bloodbath in the broader cryptocurrency space. Leverage has carted off players from the field one after the other. One by one, we’ve seen crypto lenders and hedge funds, bodied and bloodied by the high-interest rate environment after taking on leverage like drunken sailors.

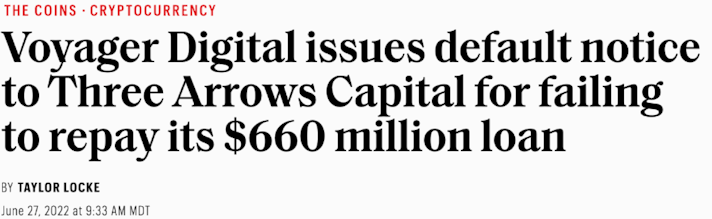

We have seen multiple lenders, hedge funds, and exchanges like Voyager, Celsius, BlockFi, Three Arrows Capital, and FTX all implode as it was discovered that many were woefully mismanaged or nothing more than Ponzi schemes. You can read more about the recent collapse in The FTX Fiasco and the Fallout to Come.

GBTC was the Genesis of the Crypto Credit Contagion

This Running the Numbers report was originally sent to Swan Private clients on December 9th, 2022. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Download this free PDF copy of Sam’s Running the Numbers and share the link with a friend!

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

There were industry insiders out there who were publicly warning about the risks in the system…

In hindsight, it appears these men were working with some inside information because both of their companies have proven to be deeply ingrained in this daisy chain of risk. Genesis, with its poor risk management, and FTX, with its shady shell of a business.

It is well-known by now how Sam Bankman-Fried is tangled up in this credit contagion. His Ponzi scheme, FTX, and Alameda Research is just the latest and largest victim yet of this overleveraged catastrophe.

But now, this contagion has spread to one of the largest crypto prime brokers, Genesis Global Trading, which recently halted customer withdrawals and has hired advisors and lawyers to pursue all options to avoid bankruptcy. There are plenty of rumors about what the consequences of Genesis bankruptcy would be when it comes to DCG, which has its tentacles all over the broader cryptocurrency system.

In a way, this contagion is coming full circle. Here, I will highlight a paper trail that, in my opinion, shows how this entire crypto credit contagion began with Silbert’s DCG conglomerate and the SEC. It appears to be nearing its crescendo right where it started. To begin with, we must go back and look at DCG. These companies comprise it, the investment products it offers, and its contentious relationship with the SEC.

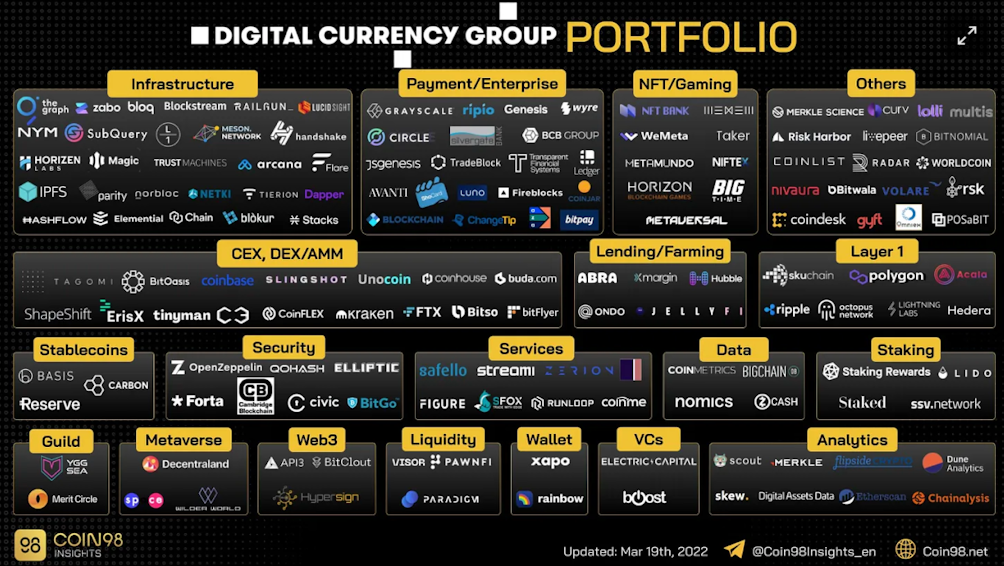

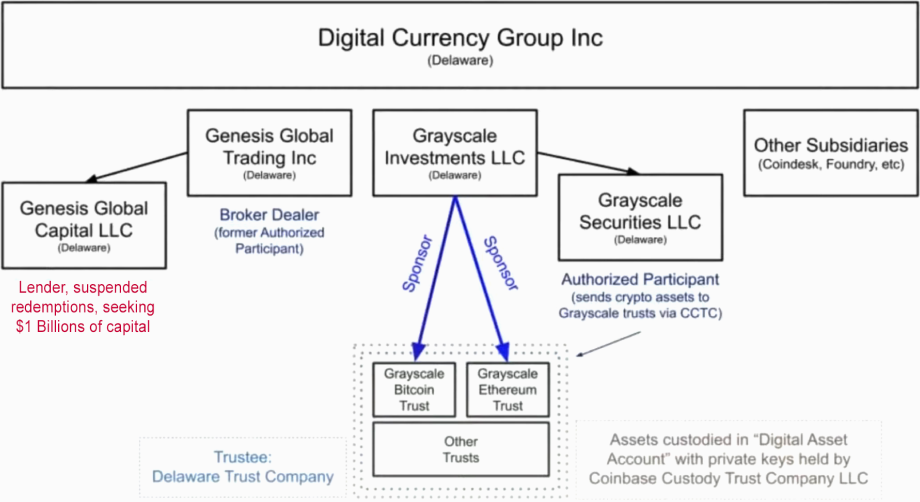

Genesis falls under the umbrella of Barry Silbert’s crypto conglomerate DCG, which has invested in around 200 cryptocurrency companies and projects since its founding in 2015.

Here is a snapshot of only a portion of DCG’s portfolio to give you some scale of the empire Silbert has built.

However, the most important parts of DCG’s business come down to only a handful of its subsidiaries, Grayscale Securities and Genesis Global Trading. Below is a graphic that shows the corporate structure of DCG.

The most important company that DCG owns, by far, is Grayscale Investments, which is an asset manager and the sponsor of the largest Bitcoin trust in the world, GBTC.

At the current price, GBTC holds around $11.4 billion worth of Bitcoin. This equates to 635,235 Bitcoin, or around 3.3% of Bitcoin’s circulating supply.

GBTC is an absolute cash cow for Grayscale and, consequently, DCG. It charges a 2% management fee on the underlying Bitcoin held in the trust.* According to its SEC filings, Grayscale earned $68 million from this fee in Q3 2022, and at its peak, it was bringing in ~$144 million a quarter from this fee alone. At Bitcoin’s current price, Grayscale brings in ~$230 million in revenue annually from the fee. This equates to a substantial portion of the $800 million in revenue Barry Silbert said DCG earns annually in a letter to shareholders on November 22nd.

Taking a step back, let me be crystal clear: DC will continue to be a leading builder of the industry and we are committed to our long-term mission of accelerating the development of a better financial system. We have weathered previous crypto winters and while this one may feel more severe, collectively we will come out of it stronger. DCG has only raised $25M in primary capital and we are pacing to do $800M in revenue this year.

Barry Silbert

CEO of Digital Currency Group

GBTC is a closed-end trust that allows investors to gain exposure to Bitcoin without buying the underlying Bitcoin itself. It is a security and has become extremely popular over the last several years because, for a long time, it was the only way for investors to get exposure to Bitcoin in tax-advantaged accounts like IRAs and 401(k)s.

Understanding how GBTC functions is important to comprehend how this led to all the crypto lender explosions we have witnessed this year. Accredited investors can create shares of GBTC at Net Asset Value (NAV) by giving USD or BTC to Grayscale. After a 6-month lock-up period, the investors can convert the trust shares into GBTC shares, which are then freely tradeable on the open market. Investors can never take the original BTC out of the trust. There is no redemption clause. They can only sell their GBTC shares at the going market price. There is no mechanism by which investors can redeem their Bitcoin.

This is important because it creates a dynamic where the share price of GBTC can trade on the open market above or below the Net Asset Value (NAV) of the Bitcoin that underlies the trust. When GBTC is trading at a premium, that means GBTC shares are trading at a higher price than the value of the underlying Bitcoin. When it is trading at a discount, it means GBTC shares are trading at a lower price than the value of the underlying Bitcoin.

This hurts investors holding GBTC because there can be wild fluctuations between the price of GBTC compared to the underlying asset. This is also why Grayscale has publicly stated that it has structured GBTC legally since its inception to convert into an ETF one day. With an ETF, an authorized participant can create or redeem shares to bring the ETF back to NAV. This would be an optimal investment product for investors because there would be no discounts or premiums, the value of the ETF shares would always track the underlying Bitcoin, and the management fees would be much lower, too.

But, alas, the SEC did not approve Grayscale’s application to convert GBTC into a spot Bitcoin ETF, and this market inefficiency with GBTC persisted, offering an arbitrage opportunity for investors.

This is where things started to get out of control.

For a long time, GBTC was the only game in town for individuals and institutions to gain exposure to Bitcoin in tax-advantaged accounts like IRAs and 401(k)s. Institutions were legally only allowed to buy securities. At the same time, demand for GBTC grew because people could gain exposure to paper Bitcoin conveniently without the challenges and security risks associated with taking self-custody. As the price of Bitcoin increased, investors flooded into the only Bitcoin investment product available to them in their brokerage accounts.

This led to an explosion in assets under management (AUM) for Grayscale, and the fees rolled in. At its peak during the bull market, over $40 billion dollars worth of Bitcoin was held in GBTC.

Due to the lag between shares of GBTC being created in the trust and these shares hitting the open market after the 6-month lockup period, the increased demand created a shortage of GBTC shares available on the open market, driving the price of the shares up to a significant premium to NAV as demand for Bitcoin soared in the bull market.

One can observe below how GBTC traded at a premium for most of its history before 2021.

One of the largest drivers of this GBTC premium was institutional investors, who began putting on an arbitrage trade to take advantage of the market inefficiency between the price of GBTC and the underlying Bitcoin in the trust.

This became known in crypto circles as “The Grayscale Trade.”

Here’s the trade:

Step 1: Short Bitcoin

Step 2: Give Bitcoin to Grayscale, either with their own BTC or borrow it from a lender like Genesis

Step 3: Hold GBTC shares for the 6-month lock-up period

Step 4: Sell the GBTC shares at a premium when the lock-up ends

Step 5: Close the short position

Step 6: Rinse and Repeat

With the GBTC premium breaching 20% at the end of 2020, this trade was basically free money for accredited investors who could do it. It was especially popular among crypto hedge funds and lending institutions, like Three Arrows Capital and BlockFi.

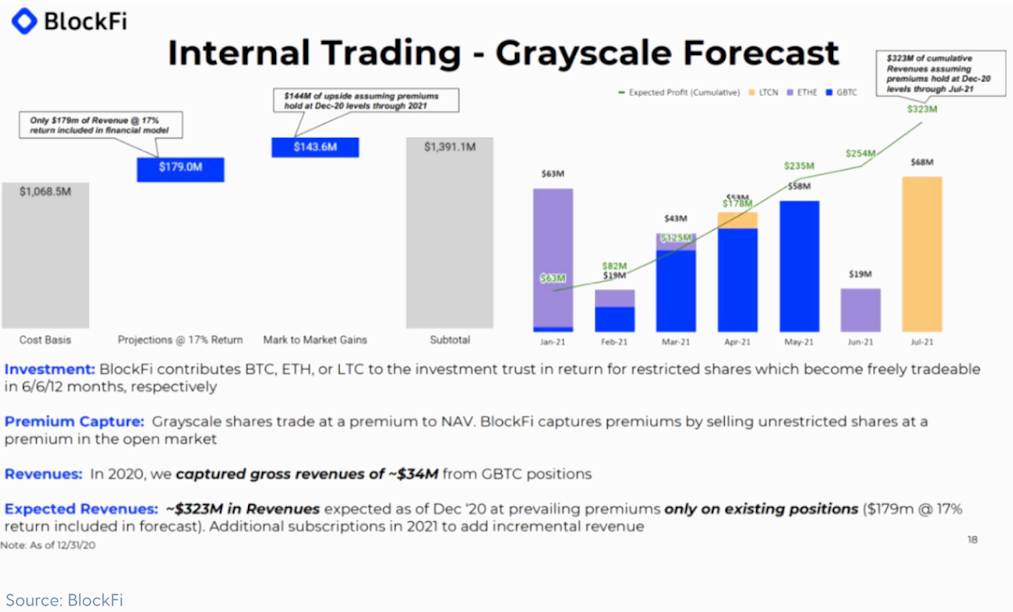

In many ways, much of BlockFi’s business model revolved around this one unsustainable Grayscale Trade. This was how BlockFi offered such high yields in its interest-bearing accounts. They would rehypothecate user funds into this GBTC premium trade and roll it over every 6 months. Since the premium was greater than the yield on its interest-bearing accounts, they could keep using this trade to fund their business.

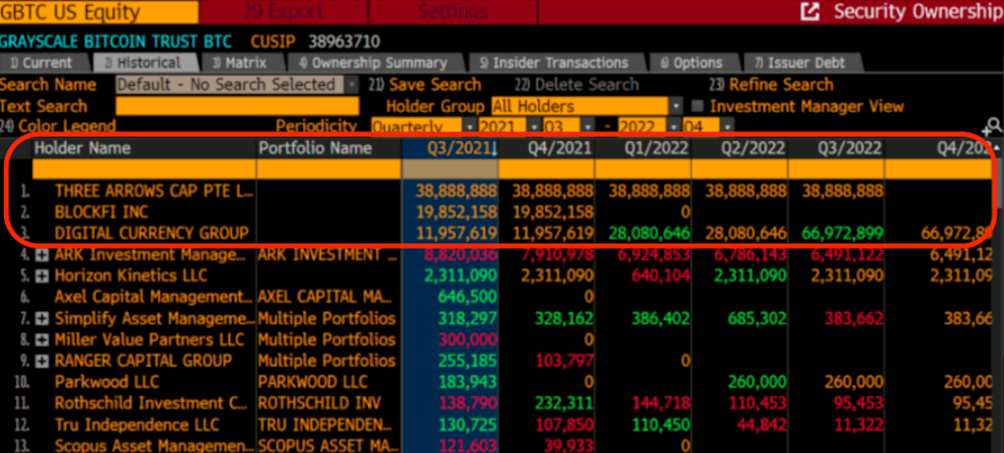

After consistently putting on this Grayscale Trade, Three Arrows Capital and BlockFi eventually became the two largest holders of GBTC shares, collectively owning 58,741,046 shares of GBTC as of Q4 2021.

To be clear, many other institutional investors were putting on the same trade, but BlockFi and Three Arrows Capital were the most well-known, and they were putting it on with size. As this trade became more popular, the price of GBTC and Bitcoin increased to the right.

This can be observed in the tripling of BTC holdings in GBTC from 2020 to 2021.

Things were going great for BlockFi and Three Arrows Capital as they rolled over this Grayscale Trade every 6 months. It was also going well for Genesis and DCG. Genesis was making a killing loaning out to these firms to put on the trade, and DCG was making more money than ever before from fees as GBTC’s AUM ballooned.

But the arbitrage trade wasn’t risk-free. It only worked if the GBTC premium was still there when your individual lock-up period ended. Without the premium, the whole money-making machine falls apart for everyone. A firm will actually lose money putting the trade on if there is no premium, especially if they borrowed to put on the trade in the first place, which a lot of these firms did. And that’s precisely what happened.

February 24th, 2021 — a date that will live in infamy.

This was the day the GBTC premium vanished, never to be seen again. Since that day in February, GBTC has been trading at a massive discount to NAV.

Suddenly, the darling trade of these hedge funds and lending firms was gone. What made matters worse is that these firms had to hold these illiquid GBTC positions due to the 6-month lockup period. All they could do was sit there and watch the GBTC discount widen.

So why did the premium disappear?

The GBTC premium disappeared for a variety of reasons. Here are two potential factors:

Increased competition in the market with the arrival of the ProShares Bitcoin Strategy ETF on the Toronto Stock Exchange and the Valkyrie Bitcoin Strategy future ETF on the Nasdaq in October 2021. Also, other smaller competing products with smaller management fees were launched, like the Osprey Bitcoin Trust and the Bitwise Crypto Index Fund. These new products attracted capital and investors away from GBTC, reducing the premium in the process.

As demand for GBTC fell and the premium was arbitraged away, the trade became less enticing from a risk standpoint, and the premium became negligible. It was not worth the risk of holding illiquid GBTC during the 6-month lockup period, especially if the premium was only a few percentage points. The marginal demand from the largest GBTC buyers (institutional investors) was no longer there, and the premium fell.

When the Grayscale Trade disappeared, these firms started to scramble to raise funds and search for yield in riskier endeavors. This was when things all started to fall apart behind the scenes.

As mentioned above, much of BlockFi’s lending model depended on their ability to rehypothecate user funds and perform the Grayscale Trade on the backend. BlockFi collected a premium above 15% for much of 2020 by performing this trade. They then turned around and offered retail investors 6-8% interest on their crypto holdings and then pocketed the spread.

It was well known that BlockFi was performing this Grayscale Trade. This was one of its primary revenue sources, and the company even mentioned the GBTC arbitrage trade in a leaked slide from a fundraising deck in 2021, shown below.

In February 2021, right before the GBTC premium disappeared, CoinDesk reported:

This boosted their GBTC shares to 36.1 million shares. Around this time, BlockFi was also planning to launch a competing BlockFi Bitcoin Trust so that they would not have to rely on GBTC to put on the trade.

This news started to cause an uproar across the cryptocurrency industry. People were not happy to find out that BlockFi was performing this GBTC arbitrage trade in the background, which led former CEO Zac Prince to respond with,

BlockFi’s position in GBTC “is substantially less than 20%” of total assets

Zac Prince

CEO of BlockFi

When asked about the GBTC arbitrage trade, BlockFi’s Chief Risk Officer, Rene van Kesteren, replied, "Locking up Bitcoin in Grayscale could theoretically pose a liquidity risk. But BlockFi discloses the arrangement to users and takes steps to defuse any danger." — March 4th, 2021

As the premium trade vanished and interest rates increased, BlockFi started to gradually reduce the interest rates offered on its interest-bearing products. BlockFi initially advertised 6.2% APY on its interest-bearing cryptocurrency products. By its last days in business, the yield offered on its Bitcoin interest-bearing product was only 2% APY.

When GBTC’s premium disappeared, BlockFi also raised $350 million in a Series D round, giving the company a valuation of $3 billion. One has to wonder if the loss of revenue from the GBTC premium trade played a role in the timing of this raise.

It was around this time that BlockFi made a rather large loan to a $10 billion cryptocurrency hedge fund with a sterling reputation, Three Arrows Capital (3AC). In a leaked investor call in June 2022, it was reported that BlockFi had loaned 3AC $1 billion dollars.

During the investor call, it was discovered that two-thirds of the billion-dollar loan to 3AC was collateralized by Bitcoin. The remaining third were in shares of GBTC, worth a total of ~$430 million at the time of liquidation.

According to the call, "BlockFi was able to easily liquidate its position in Bitcoin but ran into problems with the GBTC because the discount had reached lows last week of nearly 34%. As BlockFi attempted to liquidate its GBTC position, Pompliano explained, the price went down."

BlockFi’s liquidity issues with GBTC foreshadowed what was to come for lenders with large GBTC positions during a liquidity crisis.

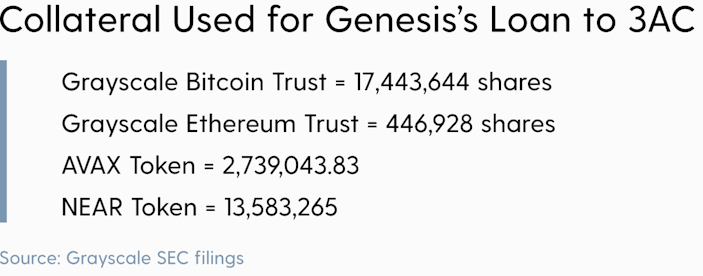

As the discount disappeared, Three Arrows Capital suddenly found itself in quite the pickle. It had put on a significant GBTC position with leverage provided by Genesis. 3AC now had to sell these shares at a discount to pay its debt obligations. With the GBTC share price and the broader cryptocurrency markets crashing, 3AC was effectively insolvent without the Grayscale Trade available to them.

From 3AC’s bankruptcy filings in July, we now know that Genesis loaned 3AC $2.3 billion dollars. This represented nearly 50% of Genesis’s entire loan book at the time! To make matters worse, the loans were undercollateralized with GBTC and other illiquid cryptocurrencies. The loans were collateralized with a Bitcoin IOU, an ether IOU, and two high beta centralized tokens, down an average of -88% year-to-date.

As the premium switched to a discount, 3AC could not afford to pay back its USD loan to Genesis and incurred large losses as the GBTC premium turned into a deeper and deeper discount.

It was around this time when 3AC began desperately searching for anything to fill the hole that was once filled by the GBTC premium trade to avoid its downfall. They began taking out USD loans from any crypto lender that would lend to them. BlockFi, Voyager, and Celsius all gave out loans, often collateralized by 3AC’s crypto and GBTC holdings, just like its Genesis loan.

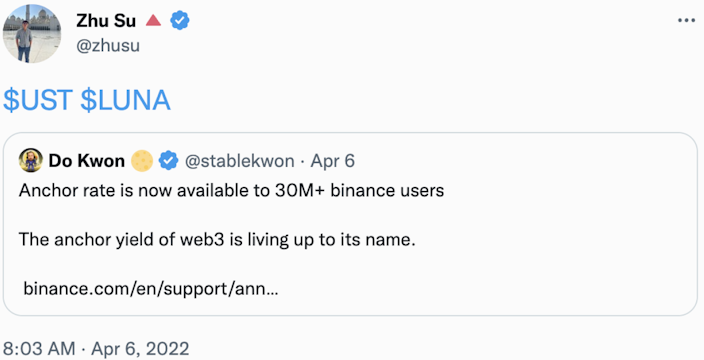

3AC then went searching for yield with the newly acquired funds, where they found it was a promising protocol called Anchor. The Anchor protocol was offering a 20% yield on the Terra stablecoin, which was being promoted by the now-wanted fugitive Do Kwon.

Here is Zhu Su, Co-Founder of Three Arrows Capital, tweeting about Terra Luna and Anchor about a month before its collapse.

Of course, we now all know how this ended up. Terra Luna crashed — wiping out ~$50 billion in value in a matter of days.

3AC had massive exposure to the Terra Luna collapse, likely partly because they were searching for yield to avoid bankruptcy and make up for the losses incurred by the GBTC premium flipping to a discount.

Terra Luna’s collapse led to 3AC’s implosion in the early summer of 2022, and this, in turn, took down many of the crypto lenders, too. All the counterparties took massive losses on their loans to 3AC, which ultimately contributed to their respective downfalls.

Genesis incurred a massive $1.2 billion dollar loss in 3AC, effectively making it insolvent. It turns out that the counterparty risk Barry Silbert had been warning about in his tweet from June 2021 was actually right under his nose the whole time.

This now leads us to Genesis, the largest crypto prime broker, which dished out a whopping $130.6 billion dollars worth of loan originations in 2021.

Genesis has been hit by a plethora of losses related to bad loans, fraudulent counterparties, and a general decline in the price of GBTC and cryptocurrencies in general.

First, Genesis presumably took a significant loss when Terra Luna collapsed after they swapped $1 billion worth of BTC for $1 billion worth of UST, which will probably go down as one of the worst transactions in history. This position has presumably been marked to zero after UST crashed.

The second event was the $1.2 billion dollar exposure to 3AC. This was the initial response after the 3AC collapse from now resigned CEO Michael Moro, with the “large counterparty” now known to be 3AC.

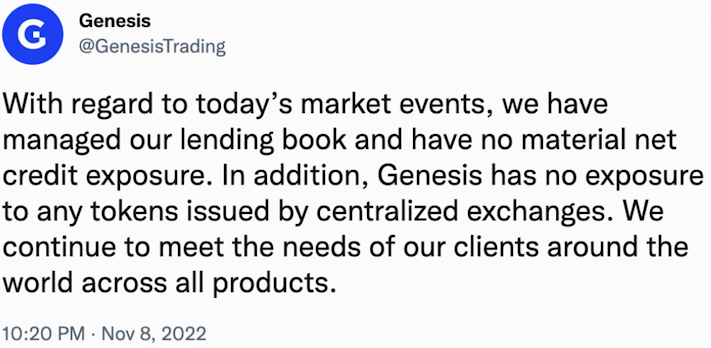

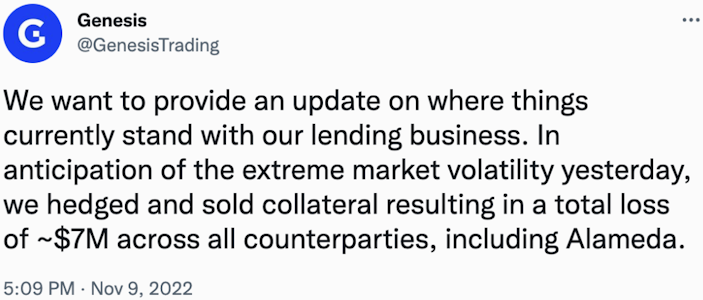

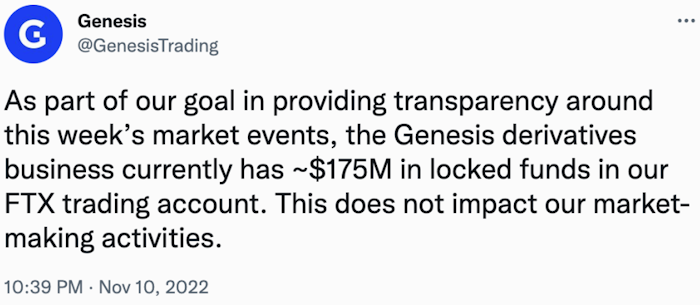

Lastly was the recent exposure to the FTX and Alameda Research Ponzi scheme. Here is Genesis' timeline regarding their exposure to FTX.

November 8th — Genesis denies exposure.

November 9th - Genesis says they have $7 million worth of losses.

November 10th — Genesis says they have $175 million trapped on FTX.

November 11th — Genesis received a $140 million equity infusion from their parent company, DCG, to help provide some breathing room.

November 16th — Genesis halts customer withdrawals and new loan originations, citing 3AC and FTX exposure.

November 17th — Reports surface that they are attempting to raise an emergency $1 billion.

November 21st — Genesis slashes its raise target in half and warns of potential bankruptcy.

Since then, it has been discovered that Genesis owes customers of crypto exchange Gemini $900 million dollars, as well as a second group of assorted creditors another $900 million dollars, for a total of $1.8 billion dollars, and that number is expected to grow. In addition, it has been reported that Genesis has hired restructuring lawyers to help find a way to prevent bankruptcy.

In a Genesis fundraising document leaked to the WSJ, we learned that Genesis attempted to raise emergency funds due to a “liquidity crunch due to certain illiquid assets on its balance sheet“…and…

“There is an ongoing run on deposits driven mainly by retail programs and partners of Genesis (i.e., Gemini Earn) and institutional clients testing liquidity”

Later, it was revealed that the “certain illiquid assets” on Genesis’s balance sheet comprised ~39 million shares of GBTC pledged as collateral from the 3AC loans and multiple loans to its parent company, DCG.

This leads us to the final boss of this whole labyrinth of leverage… DCG.

When 3AC blew a $1.2 billion dollar hole in Genesis’s books, Genesis was effectively insolvent. In the wake of the 3AC collapse it led to this tweet from former Genesis CEO Michael Moro:

It was later revealed that by “assuming certain liabilities, ” DCG took the bad 3AC loan on its books, took out a $1.1 billion dollar promissory note due June 2032 from Genesis, and proceeded to give the cash right back to Genesis for them to fill the hole in its books.

If this makes you raise your eyebrows a little bit, then you are not alone. This kind of intercompany loaning to keep the company afloat is suspect, to say the least.

Barry Silbert explained this loan in his letter to shareholders on November 22nd:

You may also recall there is a $1.1B promissory note that is due in June 2032. As we shared in our previous shareholder letter in August 2022, DCG stepped in and assumed certain liabilities from Genesis related to the Three Arrows Capital default. As stated in August, because these are now DCG liabilities, DCG is participating in the Three Arrows Capital liquidation proceedings on the Creditors' Committee and is pursuing all available remedies to recover assets for the benefit of creditors. Aside from the Genesis Global Capital intercompany loans due in May 2023 and the long-term promissory note, DC’s only debt is a $350M credit facility from a small group of lenders led by Eldridge.

On top of that questionable loan to bail out Genesis from the bad 3AC loan, DCG also took out another $575 million intercompany loan from Genesis due May 2023 to “fund investment opportunities and to repurchase DCG stock from non-employee shareholders.”

In recent days, there has been chatter about intercompany loans between Genesis Global Capital and DCG. For those unaware, in the ordinary course of business, DCG has borrowed money from Genesis Global Capital in the same vein as hundreds of crypto investment firms. These loans were always structured on an arm’s length basis and priced at prevailing market interest rates. DC currently has a liability to Genesis Global Capital of -$575 million, which is due in May 2023. These loans were used to fund investment opportunities and to repurchase DC stock from non-employee shareholders in secondary transactions previously highlighted in quarterly shareholder updates. And to this day, I’ve never sold a share of my DCG stock.

Barry Silbert

CEO of Digital Currency Group

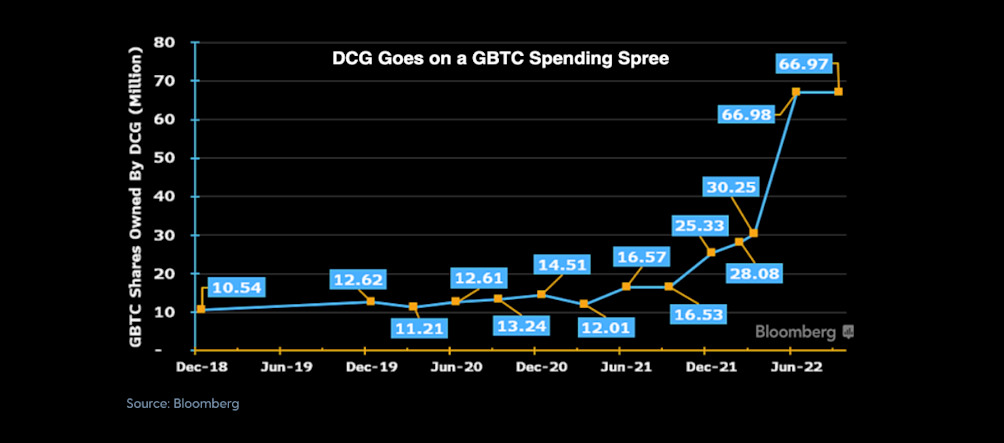

This $575 million dollar loan is most likely entirely deployed by now, as DCG has been purchasing GBTC shares in an attempt to stop the GBTC discount from widening more. The GBTC shares bought with this loan are likely down ~70% today.

DCG aggressively purchased shares last year to reduce the discount to attract and raise capital. DCG publicly announced a pledge to buy $1 billion worth of GBTC shares in November 2021. 2 weeks later, DCG raised $700 million dollars in an equity round at a $10 billion dollar valuation. The round was led by SoftBank, CapitalG, and Ribbit Capital.

Below is a chart that shows the amount of GBTC shares owned by DCG. Today, DCG owns about 10% of the total GBTC supply.

You can see below how BlockFi liquidated all of its GBTC holdings by Q1 2022, right as DCG was accumulating shares. DCG is now the largest shareholder of GBTC, with 66,972,899 shares.

From March 2021 to June 2022, DCG bought $772 million of GBTC shares at an average price of $40 dollars per share. With the GBTC price currently sitting at $8.98 today, that means DCG is down an average of -77.5% on those GBTC purchases (ouch).

The real problem here is liquidity.

Genesis needs liquidity now to fund its withdrawals and pay its creditors. Genesis has short-term obligations, and it appears a lot of its capital was deployed into illiquid long-term investments, like GBTC. It will go bankrupt if it does not get capital soon. It’s possible that Genesis has already begun selling GBTC shares to raise cash and make some depositors whole. This could be one reason why we have seen the GBTC discount has dropped to an all-time low of -50%.

DCG owes Genesis $1.7 billion and other creditors $350 million and has already exhausted its liquid capital by buying back GBTC shares and bailing out Genesis when it blew up from 3AC. Now, DCG is desperately trying to raise cash to control the fallout from the FTX fiasco and help Genesis and itself avoid bankruptcy.

As you can see, this is a total mess.

The questions are:

What options does DCG have?

What could this mean for GBTC holders?

What could this mean for the price of Bitcoin?

Although DCG finds itself in a tight spot, it does have several options available to them to avoid bankruptcy. Keep in mind that we are operating without all the information here.

Here are six potential avenues DCG can take:

This could provide a buffer for cash-strapped Genesis, but it would not be enough to fix the problem. They also are not incentivized to do this because it would widen the discount even more and likely cause their AUM to drop, reducing their fees, their primary source of revenue.

It’s likely we have already seen some of this selling as the GBTC discount has widened of late; however, DCG and Genesis cannot just sell their entire GBTC positions. GBTC is illiquid because there are legal restrictions concerning issuers of a security selling over-the-counter. This is called rule 144A. It is explained on the SEC’s website below,

“The number of equity securities you may sell during any three-month period cannot exceed the greater of 1% of the outstanding shares of the same class being sold, or if the class is listed on a stock exchange, the greater of 1% or the average reported weekly trading volume during the four weeks preceding the filing of a notice of sale on Form 144.”

Due to this rule, Genesis and DCG would be legally required to provide notice of the sale. They would only be able to sell ~7 million shares every quarter. For this reason, it would take time for these entities to unwind their GBTC positions.

All in all, selling its GBTC shares would only be a bandaid for a bullet wound. It would likely only widen the discount further and reduce DCG’s fee revenue, so this isn’t an ideal option for DCG to take.

The last time DCG raised funds, it was valued at $10 billion. This was near the top of the bull market when Bitcoin’s price was around $60,000. Now, they will need to try to raise a down round in a challenging environment with annual revenues down >50%.

But there is still value in DCG beyond Genesis. As mentioned above, Grayscale is a cash cow that brings in annual recurring revenue of ~$300 million at today’s Bitcoin prices. They can leverage those future cash flows to try to raise capital. DCG also holds an extensive venture portfolio, including assets like CoinDesk and Foundry. DCG can even raise funds from the 10% of the outstanding GBTC shares they own instead of selling them. Lastly, they have bankruptcy claims in 3AC, FTX, and Alameda Research that could fetch some value. Still, the details around those claims remain unknown.

If DCG can pull it off, it could raise funds to try to pay back the $1.7 billion it owes Genesis creditors by leveraging their assets. But even then, it’s hard to see how that would fill the hole.

DCG could also sell its assets, including its venture portfolio, to raise capital. One of the most valuable assets that it owns is CoinDesk. Semafor reports that people familiar with the situation state that buyers approached DCG to purchase CoinDesk at a price of $300 million. It is estimated that CoinDesk brings in about $50 million in annual revenue, mostly from its Consensus Conference.

They also could sell Grayscale to another asset manager to manage. Asset managers would need to seriously consider this offer, given the lucrative 2% management fee. This would not impact GBTC shareholders much either, which is a good thing, but it would certainly impact DCG. This would be selling their main revenue driver. It is estimated that DCG could sell Grayscale for ~$500 million to the right buyer. Yet, if DCG sold Grayscale, it would basically be kissing its business goodbye.

And still, this would likely not be enough to fill DCG’s hole.

Genesis could work with DCG to restructure its loans to give both parties more runway.

Right now, DCG owes Genesis $1.7 billion. It’s in everybody’s best interest if DCG can negotiate and strike a deal with Genesis creditors, allowing both parties to avoid bankruptcy.

If DCG can work out a resolution with Genesis creditors, perhaps they can survive to live another day. If DCG can’t come to a resolution, then Genesis will likely go into bankruptcy, and DCG will have to answer to its creditors in the bankruptcy courts.

DCG could raise money and inject capital into Genesis so that they can fund some of their depositor’s withdrawals. Or maybe DCG could negotiate with Genesis creditors to roll their debt into DCG warrants. This would give them a senior claim on the cash flow from GBTC. This could be enticing to Genesis creditors, given GBTC’s annual recurring revenues.

There are many different ways they may come to a deal, and I believe it is in the best interest of both parties to do so. If a deal was worked out, perhaps both DCG and Genesis could avoid bankruptcy. However, it’s hard to see how any investor could trust Genesis after all of this.

For GBTC shareholders — this would be a Goldilocks scenario.

If the SEC approves this, Reg M will allow GBTC shareholders to redeem their shares for the underlying assets at a 1:1 ratio. So, if Reg M relief was approved by the SEC, the GBTC discount would practically disappear overnight as it would allow Grayscale to create and redeem shares simultaneously and return the fund back to NAV.

The SEC would need to approve in-kind redemptions for shareholders to take custody of the underlying Bitcoin. This could pose challenges because a lot of GBTC shareholders hold the security in accounts that aren’t legally allowed to hold spot Bitcoin. However, shareholders could still redeem their shares for cash at NAV instead of the alternative of selling the shares at a 40% discount on the open market.

This would be a positive outcome for GBTC investors, and the SEC would do right by shareholders to approve this relief and allow in-kind redemptions to protect investors. I’m skeptical about whether the SEC will approve this because they have already denied Grayscale’s application to convert to an ETF this year, which would have given Grayscale the Reg M exemption.

By approving a Reg M exemption, the SEC would risk appearing supportive of the cryptocurrency industry in the wake of FTX’s collapse. Since they already rejected Grayscale’s application to convert GBTC into an ETF earlier this year, it’s hard to see them approving Reg M relief. At this point, it becomes a game of politics instead of a matter of protecting retail investors and GTC shareholders.

This is the nuclear option and appears highly unlikely, given that DCG would be killing its cash cow. By liquidating the trust, DCG would lose all that annual recurring revenue from the fee, essentially ending any hope for the business to continue.

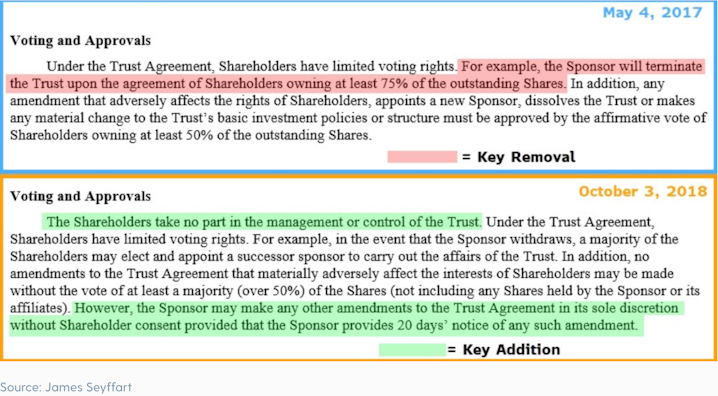

Shareholders of GBTC cannot vote to liquidate the trust after the 75% shareholder liquidation provision was amended in the GBTC charter back in 2018.

Today, the liquidation of the trust is at the sole discretion of the sponsor, and the incentive for them to voluntarily do this just doesn’t add up.

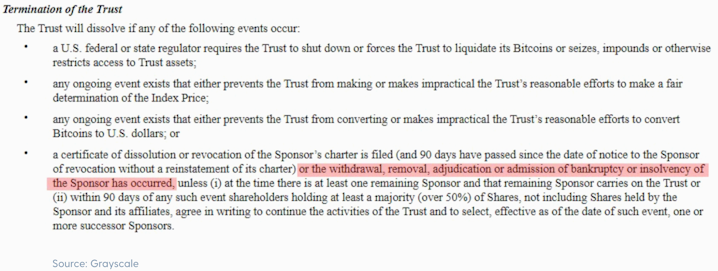

The one way that a liquidation of the trust can occur is in the event of a DCG bankruptcy or insolvency unless 50% of the shareholders vote to move the trust to a new sponsor instead.

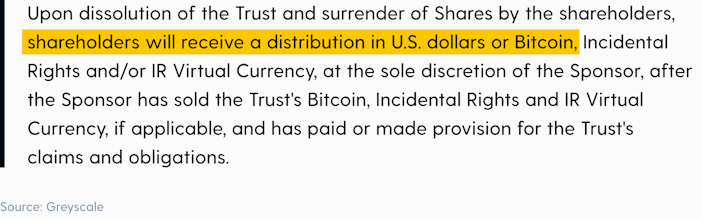

In the event of bankruptcy and subsequent liquidation of the trust, it remains unclear whether or not shareholders would be able to take in-kind redemptions of the underlying Bitcoin or if it would have to be distributed in dollars.

I’m not a lawyer, but the language makes it sound like shareholders would be able to redeem the underlying Bitcoin at the sponsor’s discretion, which is a potentially positive outcome.

If that is not the case, dollars would need to be distributed to GBTC shareholders. This means that DCG would need to sell all 635,235 Bitcoin on the open market. This would crash the price of Bitcoin, and there would likely be a lot of price slippage as the sponsor sold the Bitcoin. This would result in less value being returned back to GBTC shareholders and would tank the price of Bitcoin in the process. This would not be ideal.

All in all, a liquidation of the trust is a last-ditch option that DCG is unlikely to take voluntarily. In the event of DCG’s bankruptcy, there is language in the charter that makes it appear like in-kind bitcoin redemptions would be possible if the trust was liquidated.

The real risk that GBTC shareholders need to consider is whether the Bitcoin underlying the trust is secure and accounted for.

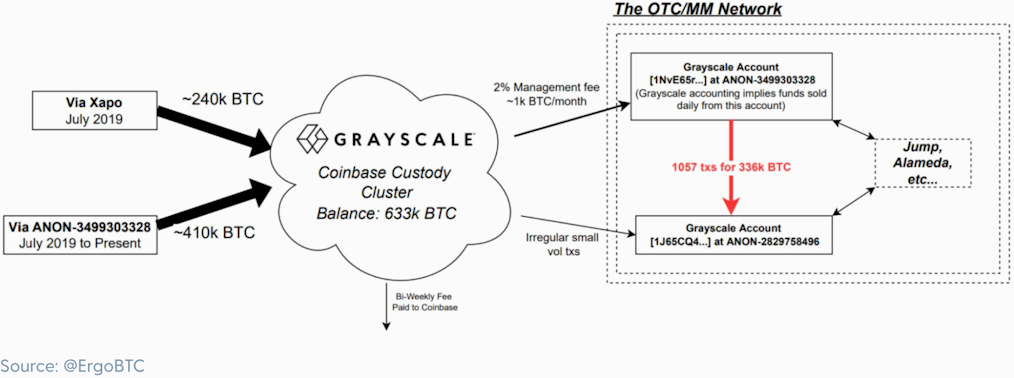

Coinbase is the qualified custodian for GBTC. They legally cannot rehypothecate or lend out the Bitcoin and have to keep the account segregated from other funds. Coinbase recently announced in a public statement that all of the Bitcoin underlying GBTC was accounted for.

Investors were unsatisfied that Coinbase didn’t show proof of this cryptographically, and I understand that concern. But, excluding the non-zero possibility that DCG, Grayscale, and Coinbase are running a fraudulent operation, I have no reason to believe that the Bitcoin is not there.

Coinbase is a regularly audited public company. GBTC is likely one of its largest clients for its Coinbase Custody product. If Coinbase somehow mismanaged the Bitcoin that underlies the largest Bitcoin fund in the world, no other entity would trust their custody solution ever again, especially now that other institutional-grade custody solutions like Fidelity and BNY Melon exist. It is in Coinbase’s best interest that the Bitcoin is there, and if they say it is, then I believe there is a 99.9% chance it is.

In case you are someone who understandably isn’t satisfied without on-chain confirmation, then here is Ergo’s findings, a respected on-chain analyst from OXT Research.

Ergo and his team tracked down all the Bitcoin on-chain that underlie the GBTC trust held at Coinbase, and all the Bitcoin were there.

Ergo’s findings should provide a sense of relief for GBTC holders. The Bitcoin underlying GBTC has been independently verified on-chain and is accounted for in Coinbase Custody.

In this piece, I attempted to lay out evidence that a lot of this crypto contagion began and is now culminating with DCG. It all revolved around the Grayscale Trade that was present due to GBTC’s structure as a closed-end trust. Once the GBTC premium trade disappeared, hedge funds and crypto lenders went further out on the risk curve in pursuit of yield rights as the Federal Reserve started increasing interest rates. It was a recipe for disaster. Risk happens fast, and so began a wave of bankruptcies that spread like wildfire throughout the entire broader crypto industry.

So, who is to blame for this complex web of leverage and speculation?

Sure, you can blame the crypto lenders for their shockingly poor risk management. You can blame the hedge funds and institutional investors for putting on risky trades with obscene amounts of leverage, too. You can also blame scammers and criminals like Do Kwon and Sam Bankman-Fried for running Ponzi schemes and frauds. You can blame DCG for providing the leverage for investors to put on this Grayscale Trade and letting them roll it over every 6 months, ripping off retail investors in the process. You can even blame the Federal Reserve for creating this easy money, yield-chasing environment that encouraged and allowed speculation to run rampant.

But to me… I think the one institution that could have actually prevented this from getting so out of hand, just by doing its job, is the SEC.

According to the SEC’s website, its mission is to “protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.”

I would say the SEC has failed its mission in its refusal to approve the conversion of GBTC into a spot Bitcoin ETF. I think the damage speaks for itself.

If the ETF conversion had been approved, then the premium trade would not have existed. If the premium trade would not have existed, these firms would not have grown to the size they had and taken on as much leverage as they did. A lot of this mess could have been avoided.

In my opinion, the SEC failed in its mission by not approving a spot in Bitcoin ETF, resulting in countless retail investors needlessly being harmed and losing their life savings in this crypto credit contagion.

ETFs are a safer, better investment structure for investors than a closed-end fund like GBTC because ETFs have no lockups, no premiums/discounts, lower fees, more transparency, and better tax treatment.

Although Grayscale had selfish motives for wanting an ETF (to gain market share and attract capital to its product), you have to give them some credit. Grayscale has been doing everything it can to convert GBTC into an ETF. They became the first SEC reporting company in 2020 and thus have to adhere to a higher level of disclosure and financial reporting than other companies in the space.

Despite this, the SEC rejected their ETF application this year and instead approved a CME Bitcoin Futures ETF. Grayscale is now suing the SEC for approving a futures ETF and not approving its spot ETF conversion.

In response, Grayscale started a comment submission portal on its website where investors can submit comments about the SEC’s rejection during the SEC’s 240-day review period.

Since June 19th, 11,609 comment letters have been submitted, many from GBTC shareholders. Grayscale writes, “99.96% of comment letters were submitted in support of the conversion.”

In the past, the SEC has denied dozens of similar spot ETF applications from other major players in the space, including Fidelity’s WisdomTree Bitcoin ETF and NYDIG’s Bitcoin ETF, mainly citing a lack of:

qualified custodian solutions

investor protections and market manipulation and fraud

The qualified custodian concern is unfounded in 2022. Several qualified custodians operate today, including Fidelity, BNY Melon, State Street, and Coinbase. This problem has been solved for years.

As for the spot Bitcoin market manipulation and fraud, how bad could it be if the SEC found it suitable enough to approve a CME Bitcoin futures ETF that’s supposed to track the underlying spot market?

Futures contracts are inherently more expensive to manage, don’t track the underlying spot price as well, and are more subject to price manipulation.

Fidelity performed a lead-lag analysis and submitted their findings to the SEC that empirically showed how the CME Bitcoin futures market leads price discovery in Bitcoin futures and spot markets.

Fidelity’s main takeaway from the analysis was,

“Our study’s finding that the CME Bitcoin futures market leads Bitcoin price discovery across Bitcoin futures and spot markets means that an actor trying to manipulate the ETP would be reasonably likely to have to trade in the CME Bitcoin futures market.”

Fidelity’s analysis shows that if a bad actor wanted to manipulate the price of Bitcoin, they would have better success if they used the futures market rather than the spot market, but yet, still no spot Bitcoin ETF approval from the SEC.

Even SEC Commissioner Hester M. Peirce is dumbfounded by the SEC’s continued rejection of a Bitcoin spot product,

"The Commission’s resistance to a spot Bitcoin ETP is becoming almost legendary.”

The reasons for this resistance to a spot product are difficult to understand apart from a recognition that the Commission has determined to subject anything related to bitcoin—and presumably other digital assets—to a more exacting standard than it applies to other products.

Commissioner Hester M. Peirce, June 2022

By rejecting spot Bitcoin ETF applications, approving Bitcoin futures ETFs, and allowing GBTC to persist as it’s currently structured, the SEC has failed to protect investors.

Lastly, regulators in many other countries, such as Canada, Australia, South Africa, and Europe, have all approved spot Bitcoin ETFs. These products have resulted in capital flight abroad as investors seek a better investment vehicle. The SEC’s failure to approve the conversion of GBTC into an ETF not only hurt investors but has also negatively impacted American competitiveness.

Ultimately, some of the blame for the wealth destruction we’ve seen across the broader cryptocurrency industry falls at the feet of the SEC for not allowing GBTC to be converted into a spot Bitcoin ETF. These regulators are in charge of protecting investors and creating fair and efficient markets; it’s about time it got back on its stated mission. For all of these reasons, it’s long past due for the SEC to approve a spot Bitcoin ETF.

If there are any lessons to be learned from this web of leverage and fraud, they are this: leverage and counterparty risk kill.

As Custodia’s CEO Caitlin Long famously said on a panel with Sam Bankman-Fried at the Bitcoin 2021 conference, “A fool and his leveraged Bitcoin are soon parted.”

All of these institutions tried to play fiat games on top of Bitcoin. Lenders tried to offer yield on a disinflationary asset and got REKT doing it. Investors tried to chase yield by leveraging up to their teeth, making riskier and riskier bets, and getting REKT doing it.

Swan’s Andy Edstrom said it best back in May,

Another big takeaway from this daisy chain of counterparty risk is “Not your keys, not your coins.”

What Celsius, Voyager, Genesis, FTX, and BlockFi should teach every investor is that there is no substitute for holding spot Bitcoin. When you hold GBTC, or Bitcoin, on an exchange or lending platform, you do not own Bitcoin. You own paper Bitcoin. You own a Bitcoin IOU. You are putting your trust in a counterparty, not an immutable ledger.

The beauty of Bitcoin is that if you take self-custody, you never have to trust another exchange, lender, custodian, or Bitcoin trust ever again. If you never want to be caught up in bankruptcy proceedings, become a victim of a fraudster, or have to read the fine print of a trust charter, then take ownership of your Bitcoin. You can avoid all of these counterparty risks forever by withdrawing your Bitcoin into your own possession. That is why we recommend buying spot Bitcoin and taking self-custody to all our Swan clients. If you want to avoid all of this nonsense, then that’s all you have to do.

It’s that simple.

Don’t trust, verify.

GBTC was the Genesis of the Crypto Credit Contagion

This Running the Numbers report was originally sent to Swan Private clients on December 9th, 2022. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Download this free PDF copy of Sam’s Running the Numbers and share the link with a friend!

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

The FTX Fiasco and the Fallout to Come

By Sam Callahan

Expect the fires from FTX to continue to burn and claim more victims along the way. If anything, this event has provided a tough lesson on why Bitcoin is different and why self-custody is vital.

The Great Miner Squeeze of 2022

By Sam Callahan

Bitcoin mining is truly a game of survival of the fittest, and right now, the creme is being separated from the crop. By the end of this squeeze, Bitcoin’s security layer will be more efficient than ever before.

Proof of Work vs. Proof of Stake

By Tomer Strolight

Proof of Work, at its heart, is the removal of trust from the system of money, and replacing it with something that can’t be faked: real work.