This Time is Different

No longer a niche commodity, Bitcoin now finds itself a prime fixation of the US Executive Branch.

Dante’s Inferno reserved the deepest parts of his allegorical Hell for oathbreakers and betrayers. In medieval times, these were the worst types of offenses due to the importance of loyalty and trustworthiness in maintaining order in a much more hostile world than our own today.

I don’t think I take too big a leap, especially with the likely audience of this essay, in saying the softest walled rooms of fictional Arkham Asylum should be reserved for the deniers of empirical and rational evidence of the value proposition Bitcoin provides to early adopters. I will repeat what has likely resonated in your minds and across your Bitcoin research dozens if not hundreds of times: “We are still early.”

Yet still, many people hold fast to platitudes, traditions, methodologies, and irrational protest of the most quintessential writing on the wall we have ever seen. In a very short timeframe, our traditional economy has had 18 months of neck-breaking interest rate increases, the largest nations in the world cutting themselves off from the dollar rails, multiple banks imploding, and annualized US interest expense has spiked and is on the verge of spiraling out of control.

Additionally, Bitcoin is going through very encouraging evidence that would lead one with very little research to suggest even better times ahead. These things include:

90% recovery from a recent bottom

The best-performing asset YTD

Continually growing hashrate that transcends price

Major institutions like Blackrock are public with their desire to see Bitcoin and public Bitcoin companies perform well

Fed pausing interest rates with a likely reduction in time for the halving

Most importantly, the imminent halving itself

These bullet points don’t even consider the true value of Bitcoin: trustless, immutable, transparent, permissionless, anti-theft, and digitally scarce. With the exception of hash power, they all focus on Price, the thing that pulled most of us on board in the first place. However, even with the evidence of analogous price performance in every epoch, there is a massive reservation from no-coiners to adopt before it reaches near all-time highs. It baffles me how few people there are who are willing to do research to break the mold of their worldview.

The first part of this series discussed three personas (2 Bitcoiners, 1 No-coiners) that all believe in the important characteristic value Bitcoin delivers, but their actions work against Bitcoin adoption. Here, I will discuss 1 Bitcoiner and 2 No-Coiners whose mindsets prevent themselves from realizing Bitcoins' revolutionary impact on an individual’s life.

Friend D, a Bitcoin idealist in culture, has extreme reservations about adopting the infrastructure made for Bitcoin. He thinks the dollar is doomed to lose its control and that Bitcoin is a perfect heir. He has a desire for anti-statist money to become the world standard so governments weaken their coercive edge over individuals. However, he admittedly does not want to learn to run a node, set up a hardware wallet, participate in mining, or open/close a lightning channel. He gives the reason that he is not an engineer and is too old and busy to learn these new tools. He feels comfortable to rely on others to maintain the network.

Most people’s most impactful interaction with Bitcoin is the collecting part (stacking sats). However, it is important to remember Bitcoin is a tool. This tool enables many trustless mechanisms. But this can only be accomplished if you use it as provided. We cannot expect a kitchen to cook or store our food natively. A kitchen reaches its potential when you populate it with products like a stove and refrigerator. And those things also increase their value to the user with additions like a broiler and ice maker, respectively.

Bitcoin is a sovereign individual system if enabled, but it can easily be captured by centralized forces. You are not required to self-custody Bitcoin. It’s as optional to self-custody as buying or using it in the first place.

So, could you rely on someone else’s node to enforce the rules of the network?

Could you use someone else’s Lightning channel?

Could someone else validate transactions and secure the network with miners?

Could someone else hold your private keys for you?

If the answer to these questions is all “yes,” your Bitcoin trust barometer is almost as high as if you kept all your savings in a local bank. You are paying for ease of responsibility at the cost of the risk to your entire stack of satoshis. Taking this a step further, if nearly all “Bitcoiners” thought like this, then Bitcoin is no greater than a meme coin and fits the narrative that most no-coiners think. We would then be void of “intrinsic value,” a “Ponzi scheme,” and “rat poison” to a civilized society.

Bitcoin is an opportunity that people just do not have in the traditional finance world. You are an administrator of your own monetary network. You get privileged rights to the inner workings of the most secure system in the world; that is also where you are storing your time-earned wealth. This is the furthest thing from a burden but rather a path of empowerment.

Spiderman’s Uncle Ben said, “With great power comes great responsibility.”

Just like common people learning to use the internet effectively in the 90s and early 2000s, we will step through processes that are analogous to nothing we have ever experienced. Teaching many old dogs new tricks is a part of the adoption journey and not an easy one. However, this evolution of human self-reliance is a major force involved in the death of the Dollar, where millions of people worldwide are actively preserving and participating in this network where there are no rulers.

Friend E is a No-coiner and has experienced firsthand what large corporations can do to small businesses to force families out of business. She makes the argument that Bitcoin does not solve predatory pricing, so what difference does it make if we have hard money or not? Her general disposition is that the government is here to protect people and small businesses. If the government were to lose its power of the economy, corporations would drive prices down until all their smaller competition is suffocated.

In a world of hard money, operating at a loss means opportunity cost. That is a profit you cannot see again. Profit (value creation) is the only way to survive.

While it’s a compelling narrative in stories to portray big business eating up the small businesses, realistically, $1M companies are not really recognized by $1B companies as legitimate competition. The UnderArmor clothing division is simply uninterested in Represent Ltd, a Southern California regional sports/culture brand (a Bitcoin company). Nike will compete with UnderArmor and vice versa. A big company lowering their prices to below profit margin is not feasible. It is not how monopolies are generally formed.

With economies of scale, big businesses have the privilege of operating closer to the break-even point because they expect to sell an enormous amount of inventory. Their prices are already relatively marginal to smaller competition. Dropping prices to suicidal values would cause significant losses on their income statement. An explanation of economic incentive is much more realistic as opposed to believing the government is working around the clock protecting small businesses.

In fact, monopolies or consortiums have still been formed despite the government’s presence. Judging by how wealthy politicians become once in office (Nancy Pelosi, Dan Crenshaw, Liz Warren), it is clear that they don’t really care if companies like Amazon, Microsoft/Google/Apple, NGC/Boeing/Lockheed, P&G/Pfizer/J&J can form monopolies or consortiums. Additionally, they buy politicians to limit fair competition in the marketplace by creating barriers to entry in their industries.

What Bitcoin does as a uniquely neutral money enables the true free market to take place. Can Apple lower their prices below profit to crush fictional start-up, “SerUlric Phones”?

Yea. But, messing with their bottom line risks losing economic power to Google. Does one risk vital market share against a direct competitor to bully a niche participant?

Generally, the answer is no. What about a hostile takeover?

Most hostile takeovers are enabled by banks, which are, in turn, sponsored by the government, enabling big businesses to buy out much smaller businesses with “no risk” to the acquirer. This is called “picking winners and losers,” but you are told this is capitalism.

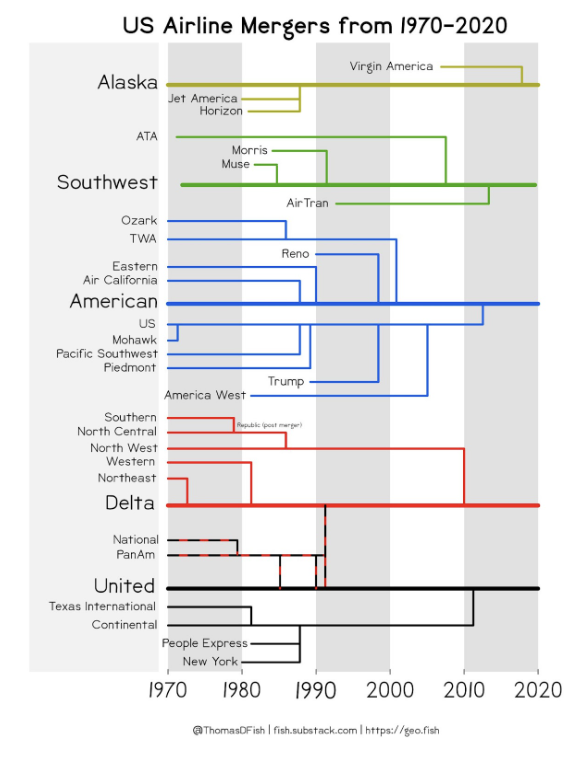

We saw the consolidation of larger banks into the largest banks at the beginning of 2023 and, referenced in Part 1 of this essay series. This year was not an anomaly but rather a continuation of the gradual reduction of competition in key industries like banking. But we should not forget how similar mergers have happened in the airline industry as well. Airlines (up to 2020)

Consumers in a fiat world are required to take on risk for every transaction they make: a house, a car, a new phone. With each purchase, you have a chance of buying a money pit, lemon, or brick. Big businesses with big lobbying groups don’t need to worry about that. They tend to have an infinite credit line with the government as long as they continue to pay the mafia boss. Look at Janet Yellen’s “speaking fees.”

When the government has power over where new money goes, monopolies form, consortiums form, and small businesses must compete with their market competition and the government. Individuals are simply fuel for their fires.

Bitcoin takes the monetary power away from the privileged. There are no loans out of thin air, bailouts, credit expansion, or privileged economic participants. If you want to operate at a loss, there is no free money to backstop those silly games. So, the only incentive is to create value better than the next person. The game theory of an attrition economy is pointless because people would rather survive than risk dying to kill someone. The big company now must risk complex economic formulas just to kill a competitor that would likely never catch up to them in the first place. This is irrational behavior, but Bitcoin forces/incentivizes/encourages rational action in the market because the rules are known and predictable.

The end result of prosperity through value creation is giving the consumer many quality choices. All we have had in our current system is an ever-decreasing number of choices for many industries. Notice all the banking collapses this year. Secretary of Treasury Yellen stated her preference for larger banks over medium ones, and the state recommends consolidating deposits at the largest banks. That does not sound like the government is protecting market competition. Rather, the powers that be are quickly doing away with it. This is the epitome of fascism: government intervention in the market for the benefit of selected enterprises. You should be outraged but not shocked. No one is greater than their incentives.

Friend F is another “No-coiner” mentally but still owns Bitcoin as a portion of her portfolio. However, she has outsourced her entire grasp on reality to media outputs that affirm her bias for a state-sponsored narrative. She thinks economics and finances are too complicated for a normal person to pursue knowledge. Therefore, she generally ignores those areas of knowledge even though she recognizes that her savings are dependent on someone’s financial decisions.

The evidence that systems are breaking down in front of her (social security, wages, prices, individual liberties) is happily pacified by escapism and platitudes from others that give her confirmation bias. The prospect of Bitcoin as anything more than a speculative investment vehicle is ridiculous to her because the media sources she consumes have not yet confirmed its legitimacy. Despite her acknowledgment that fiat is gradually debasing her purchasing power, her reluctant trust in the power of the government backing cannot be escaped. Even in 2023, the usage of years-old regurgitated mainstream platitudes spills from her mouth as she tries to rationalize the world that is falling apart because of the toxic money:

“The YoY is underwhelming.”

“I would 'invest, ' but it’s too volatile.”

“The black market uses it.

“But if the government bans it, then what?”

“It’s still ___% below its all-time high.”

“What if I cannot sell it for dollars on the exchange?”

“It’s bad for the environment.”

I do not intend to counter all of these points. These individual reactions resonate from a systemic, propagandized reaction to project resistance onto consumers against something that will make fiat obsolete. Because we have learned to hold the media in such high regard, their irrational defense of something that hurts its consumers does not register as an attack but as protection. Things that we would naturally see as a simple tool (money) for an end goal have been turned into a symbol of stability and nationalism.

How odd would it be if you were to turn on the TV and someone claimed that your smartphone has a half dozen things about it that were bad, including “used by criminals” and is particularly “harmful to nature.” Criminals use cars as well as houses, suitcases, and dollars. Any mineral mined to make a processor chip restructures the earth in some way. Why is the smartphone the focus?

Then you realize the voice behind the narrative has a monopoly on the entire push-button, flip phone supply chain. It is no wonder why the monopolist would create these stories, but instead, you would wonder why they have not done even more to convince the public of the fabricated dangers of leaving their market.

This is the chief reason for the FUD (fear, uncertainty, doubt) creation surrounding Bitcoin: dread of lost market share. And the propagator is none other than the most influential entity on the planet: the central bank-backed world governments. They are extremely fearful of losing the ability, privilege, and perceived right to manipulate from afar the money that they have in their hand. For the sake of their preservation, they use every tool at their disposal (news sources, private tech companies, local banks, celebrities) to subversively convince you that a decentralized, non-state, neutral money is actually poisonous to the existence of you and the world you reside in.

“Once an idea has taken hold of the brain, it’s almost impossible to eradicate.”

— Dom Cobb, Inception

The powers of this world understand how important it is to have sway over the mind. A convincing lie, half-truth, excuse, or distraction is enough to pacify the outrage of 80% of the population to the latent atrocities against humanity. The other 19.9% of people are on a journey at various stages to uncover the problems and develop solutions. The beauty of the Bitcoin Network is it’s a complex system but a simple concept: Bitcoin is hard money that very powerful people must pay an irrationally high price to forge, hack, or manipulate. The only rational thing to do is to participate normally or opt-out. What makes Bitcoin so resilient to nefarious action is realized through hours of investing the time to understand the protocol.

This decision is, of course, contradictory to what mainstream thought is about finances and economics. Common people are told to outsource that discipline to the experts. The experts have steered us wrong for decades; some would say purposefully, and some would say ignorantly. Whatever the case is, Bitcoin cannot do anything for you, Friend F, or anyone if they do not first seek knowledge.

Just like the Proof of Work consensus mechanism of the Network, there is no shortcut to clarity as to why Bitcoin fixes the money in the world. Some could claim the earliest Bitcoin adopters are lucky to a degree. However, the ones that persisted through any time frame that experienced a fiat value drawdown emanated resiliency and stoicism. These attributes could not be attained without clarity about what they possessed. And that clarity could not have been acquired without a basis of curiosity.

Remember, I mentioned that 19.9% of people are on a journey to uncover the problems. Some will uncover problems, and once they find it, they will try to rearrange it. They will flip it 180° and call the problem eradicated. Some will just get mad and throw complaints into the air, never to work for or support a better path. It is the “curious few” that found the problem, realized that the problem must be removed or neutralized, and replaced with something that people are incentivized to preserve and protect.

The three personas above and the three personas in my previous essay are not beyond hope. They are each on the verge of being powerful members of the most important network the world has seen. However, each of them needs a healthy dose of curiosity. They must be curious enough to identify and investigate the fiat problem, study to recognize the many detractors that lead to its growth, recognize the potential solution in Bitcoin, and most importantly, act on the newfound understanding.

As the reader of this essay, you will recognize these personas in your friends and family. Remember that these people are not lost but rather on the verge of a breakthrough, whether they are already Bitcoiners or not. Be the rational light in their lives that helps them move to greater individual sovereignty and Bitcoin maturity. They will never forget your impact on their lives.

Hold your IRA with the most trusted name in Bitcoin.

Ulric Pattillo is a Bitcoin Essayist with contributions on several platforms. He is a co-author of the Declaration of Monetary Independence which was featured at the Miami Bitcoin Conference in 2022 and 2023. Ulric has a Bachelors in Computer Engineering, a Masters in Business Administration, and works as a Digital Systems Architect. He has appeared on several Bitcoin podcasts including Simply Bitcoin, Pleb Underground, and The Bitcoin Source. Ulric is also the co-host of the Bitcoin Ballers Podcast. You can find his works consolidated on his website serulric.com.

News

More NewsThoughts on Bitcoin from the Swan team and friends.

By Jason Bassett

No longer a niche commodity, Bitcoin now finds itself a prime fixation of the US Executive Branch.

By Brett D. Guiley

The SAB 121 repeal mirrors the end of Glass-Steagall in 1999, which played a major role in the 2008 financial crisis. Bitcoiners should listen to history and be more cautionary about SAB 122.

By Ben Werkman and Lyn Alden

Bitcoin is the only digital asset that meets the necessary criteria for a sovereign reserve, given its decentralization, liquidity, security, and geopolitical significance.