This Time is Different

No longer a niche commodity, Bitcoin now finds itself a prime fixation of the US Executive Branch.

We shouldn’t delay forever until every possible feature is done.

No margin, no mission.

Satoshi’s quote is a reference to how product, and Bitcoin, is incrementally developed over time, and infers how multiple features and entire products are prioritized and released.

Like Bitcoin’s open-source community and consensus protocol, Swan’s Product Principles builds on these ideas and applies them in a private company context.

Sister Kraus’ quote comes from the nonprofit world, emphasizing the forever tension of mission and margin. We work for a mission — a change in the world — and need margin for the time and activities to make progress toward that mission.

It’s been nearly a year since I started at Swan, so I am taking time to share more about our product direction and approach.

From the first conversation, Cory’s guiding principle has been to “do what’s right for Bitcoin and Bitcoiners.” In addition, we also believe that “Bitcoin is for everyone.” These two principles are the foundations for product discussions, trade-offs, and decisions.

From a business and product approach, we link our mission of 10 million new Bitcoiners with margin from profitable services, so we can reach new Bitcoiners for the long-term.

Together, this means Swan products are where humans meet Bitcoin.

How does one become a Bitcoiner? How does one become part of the 10 million intransigent minority? The two elements are 1) understanding Bitcoin and 2) having a “meaningful” amount of savings in Bitcoin.

An important factor that drives Swan’s uniqueness is its strength and depth of Bitcoin education. The Swan team invests in and produces an incredible amount of original content that helps diverse audiences understand Bitcoin more deeply *and* share that information with others. Swan’s unique content is integrated into all of Swan’s product experiences.

What is a “meaningful” amount of savings in Bitcoin? On this point, Cory’s article identifies $2,500 as a numerical starting point, others use a percentage of net worth, but it’s important to note that this varies by person and over time. Thus, we work towards Bitcoiners setting individual goals, working hard to stack sats, and identify new ways to save Bitcoin.

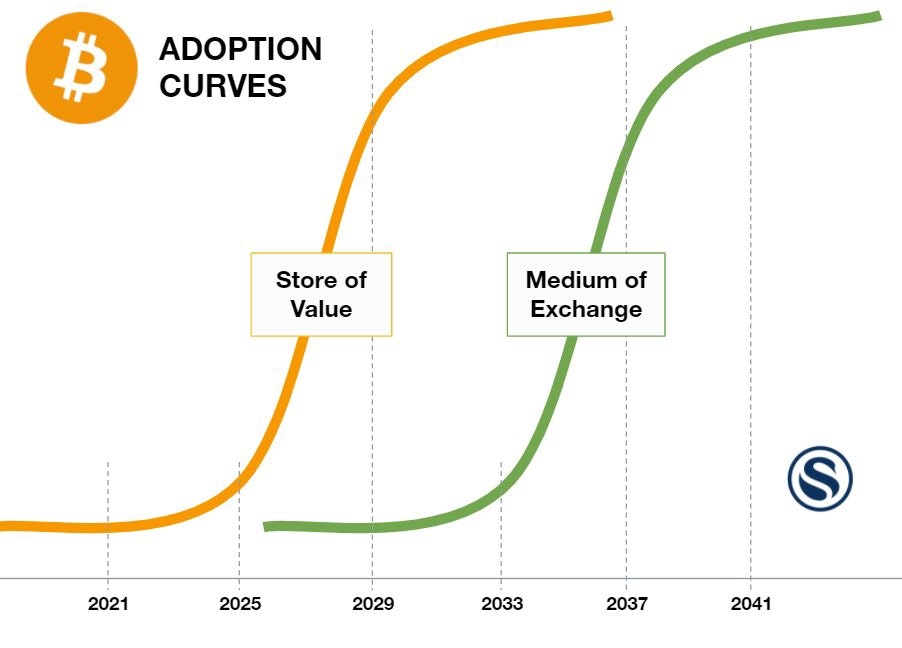

At Swan, we believe we are in the long arc of Bitcoin adoption. Today, we are still early in a Store of Value phase, while we see the first iterations of the Medium of Exchange phase emerging. In the short-term, we will continue to prioritize SoV products and services, while also building the infrastructure and initial services for Medium of Exchange scenarios. Building services in both categories provides Bitcoiners the Bitcoin financial services that are needed throughout their Bitcoin adoption journeys.

In our product work to bring our principles and mission to life, we use many of the tools and practices that others in software and services use. At Swan, we think about product as the intersection of User Experiences, Business Models, and Technology. We bring together various methodologies, frameworks, and processes where we think it will be helpful.

We approach User Experience in a broad sense. It includes frameworks like Jobs to be Done and various Service Design approaches to bring user design to life and analytics as a feedback loop to learn how products are being used. In Business Models, we may use a Lean Canvas or a Value Prop Design framework, and with Engineering we work organically in small teams, some of which adopt a Shape Up approach. Finally, we continue to learn from others in the industry, like GitLab, as we grow and evolve.

In the Ten Million Bitcoiners: The Intransigent Minority, Cory identified the most threatening attack vector left to Bitcoin is a concerted effort by the U.S. government to stamp out Bitcoin.

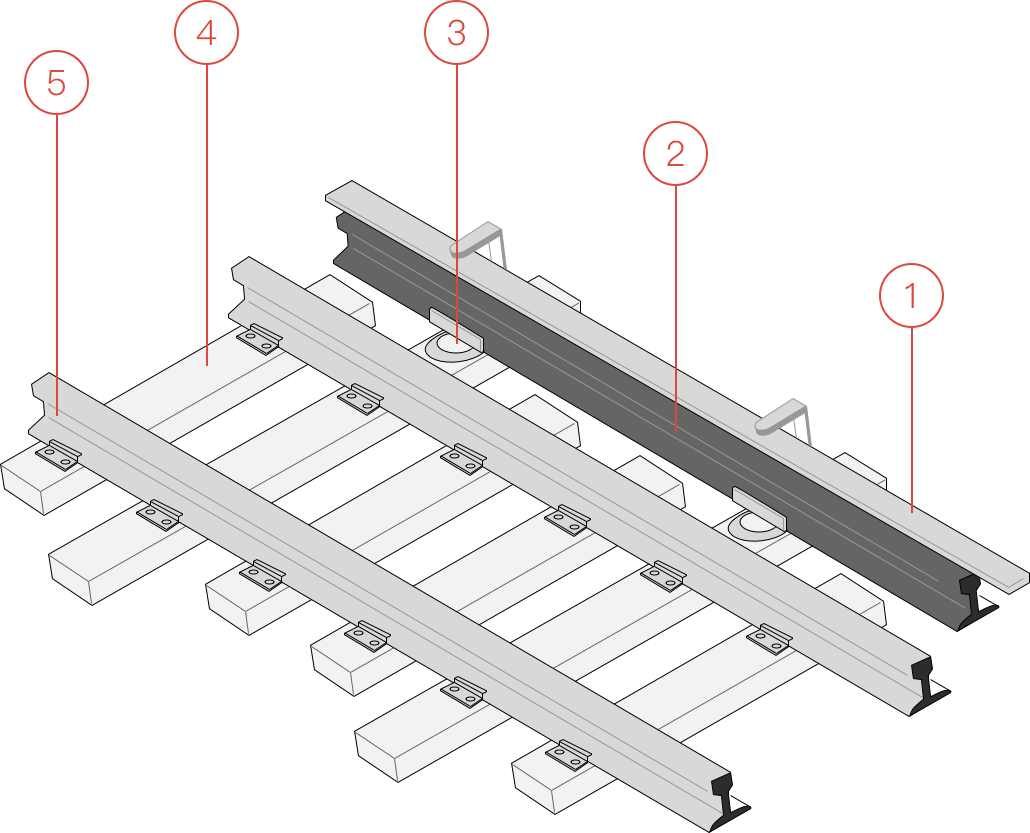

During the few years that I lived and worked in the Washington, DC area, I learned about the expression ‘the third rail’. In politics, it means something that is too dangerous or too charged to discuss without suffering politically. The expression originally comes from the electrified third rail in some train systems.

In politics, one third rail is retirement (and in fact, the term was likely popularized in DC in relation to Social Security).

Given our focus to connect humans with Bitcoin in more Store of Value scenarios, one incredible opportunity is to bring Bitcoin to more Americans’ retirement accounts. This is particularly true for Swan Bitcoin to combine our unique education, provide significant stacking opportunities, and proactively position Bitcoin against future threats.

By bringing access to Bitcoin in retirement accounts, we can proactively position Bitcoin into a ‘third rail.’ Within a short period of time and with focused adoption, Bitcoin in Americans’ retirement savings will become an insurmountable political issue for any current or future political leader.

We have allies on this front. Fidelity’s move to bring Bitcoin to 401k accounts is likely the single most significant development in recent time. This announcement from a large and established brand in retirement brings credibility and game theory to large retirement providers.

The Swan Individual Retirement Arrangement (IRA) approach is both similar and different. It’s similar in that it positions Bitcoin in a long-term savings account aligned to Bitcoin’s low time preference. However, even with Fidelity’s progress in bringing more Americans individual opportunities to gain exposure to Bitcoin through their 401k accounts, these accounts are still inherently limited to an employer’s decision of provider, and to the employer’s decision to enable a Bitcoin option. The Swan IRA has no such limitation. Every American can make their own individual retirement decisions for Bitcoin with a Swan IRA in a tax advantaged account.

Threats to Bitcoin will always be present. But each challenge it overcomes displays its resilience and builds more conviction in its long-term success. Bitcoin adoption grows from understanding and more ways to save. Bitcoin retirement adoption is likely the greatest defense for Bitcoin and a great long-term offense against inflation.

Buy automatically every day, week, or month, starting with as little as $10.

News

More NewsThoughts on Bitcoin from the Swan team and friends.

By Jason Bassett

No longer a niche commodity, Bitcoin now finds itself a prime fixation of the US Executive Branch.

By Brett D. Guiley

The SAB 121 repeal mirrors the end of Glass-Steagall in 1999, which played a major role in the 2008 financial crisis. Bitcoiners should listen to history and be more cautionary about SAB 122.

By Ben Werkman and Lyn Alden

Bitcoin is the only digital asset that meets the necessary criteria for a sovereign reserve, given its decentralization, liquidity, security, and geopolitical significance.

Audio narration